A further meeting of the OECD Inclusive Framework took place earlier today. A revised Statement on the components of Pillar One and Pillar Two has been published, together with an Implementation Plan. Jersey has joined the consensus on the OECD Statement, together with 135 other jurisdictions.

This Briefing Paper sets out the latest position on the OECD project and explains the developments since July.

Background to the Pillar One and Pillar Two work

The work on Pillars One and Two arose from the OECD’s Base Erosion and Profit Shifting (BEPS) initiative, and originally attempted to address the tax challenges arising from the digitalisation of the global economy. Over time, the focus of the work has shifted so that Pillar Two is now intended to create a global minimum effective tax rate for the profits of large groups of multilateral companies, and Pillar One is intended to ensure that the very largest groups pay tax in the jurisdictions in which their services or goods are used.

What’s New?

Some further clarification on the rules has been provided in the new Statement as follows:

Pillar Two

Common approach rules

- The Minimum Effective Rate will be 15%. This is an important change from the previous wording of “at least 15%”. It provides greater clarity and locks in the 15% rate.

- The scope for affected groups remains unchanged at €750m global turnover.

- Jurisdictions implementing Pillar 2 will be encouraged to bring the necessary Income Inclusion Rules into effect domestically by the beginning of 2023. The application of the Undertaxed Payment Rule will not begin before 2024.

Minimum standard rules

- The Subject to Tax Rule minimum rate on certain covered related party payments, the scope of which is still to be finalised, has now been set at 9%, which has changed from the 7.5-9% range set out in the July Statement.

Pillar One

- The percentage of profits to be reallocated to market jurisdictions under Amount A has now been set at 25% of residual profits above a 10% revenue threshold. The July Statement had considered an allocation in the range of 20-30%.

- Regulated financial services are to remain out of scope for Amount A.

- Mandatory dispute prevention and resolution procedures will apply to bring enhanced tax certainty.

- Participating Inclusive Framework jurisdictions will be encouraged to bring the necessary Amount A provisions into effect domestically by the beginning of 2023, which would see the first Amount A tax returns submitted in 2024.

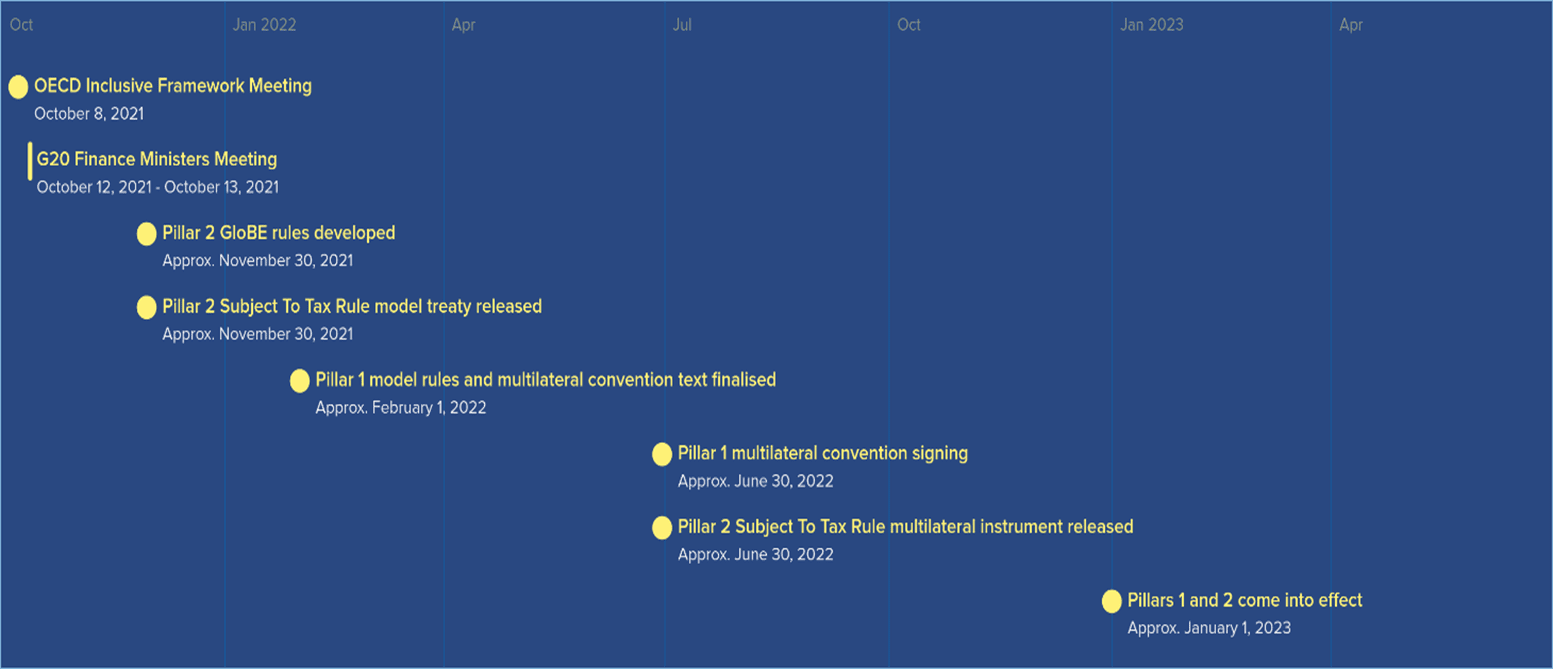

Much further work is still required to finalise the detailed rules, commentary and treaty instruments that will implement the agreed framework. Further information on the OECD’s ambitious timeline for this work is contained in the Implementation Plan and summarised below:

It is important to be clear on the nature of the consensus that the OECD Inclusive Framework has reached. Inclusive Framework members have agreed to a package of core components for the design of two new pillars of international taxation. These proposals are targeted and limited in scope, focussing on the world’s largest companies in the initial phase.

As agreed:

- Pillar One of the package would create new profit allocation rules for the world’s largest global multinational enterprises (MNEs)[1], expected to be around 100 groups, excluding extractives and regulated financial services. For that small, targeted group of MNEs, certain of their profits would be re-allocated to market jurisdictions; and

- Pillar Two would introduce a new framework of taxation whereby companies that are in scope would pay a Minimum Effective Rate of taxation (MER) of 15%, calculated in a specific way according to the Pillar Two rules and on a country-by-country basis.

Pillar Two – some further detail

The design detail of Pillar Two is somewhat more developed than Pillar One, although a range of technical details remain to be worked out. Pillar Two will itself contain two separate components:

- The Global Anti-Base Erosion (GloBE) rules – this rule would effectively top up the tax of a MNE on a country-by-country basis, to an agreed Minimum Rate. The level of the Minimum Rate agreed in the Statement is 15%. However, it will take some more months of negotiation and discussion to settle on the specific technical rules that must be followed and the instruments for implementation.

Rule order is very important. The GloBE rules will primarily be applied as a top up tax at the Ultimate Parent Company level through the Income Inclusion Rule (IIR). However, an alternative Undertaxed Payments Rule (UTPR) may be applied to Constituent Entities (being subsidiaries of the Ultimate Parent Company) to the extent that low taxed income of those subsidiaries is not subject to tax under the IIR.

The GloBE rules will apply to MNEs with a consolidated global turnover at or above €750m. While the Statement contains a provision that countries will be free to apply the IIR to MNEs headquartered in their country even if they do not meet the threshold, it is expected that the IIR will remain a regime that applies only to the largest MNEs.

- In addition to the GloBE top up tax, Pillar Two also contains a rule affecting Double Taxation Agreements, called the Subject to Tax Rule. This rule will allow developing jurisdictions from which payments are made under a Double Taxation Agreement to impose limited source taxation on certain related party payments which would otherwise be subject to tax below a minimum rate.

Importantly for Jersey, the proposals recognise that funds generally should not be in scope. It is likely that investment funds that are Ultimate Parent Entities of an MNE Group or any holding vehicles used by such entities, organisations or funds will not be subject to the Pillar 2 GloBE rules. Our expectation is that the final GloBE rules will also contain a form of participation exemption for dividends, other than for portfolio shareholding.

The work of the Government of Jersey to date

The Government of Jersey has participated fully at every stage of these discussions, to represent the interests of the Island, its economy and its international finance centre. Officials from across Government departments will continue to prioritise this work in the important months that lie ahead and continue to coordinate with Guernsey and the Isle of Man. As a member of the Inclusive Framework on BEPS, Jersey continues to play a full and active role in the OECD discussions to develop proposals for international tax reform.

Next steps in the OECD process

The agreement from this OECD Inclusive Framework meeting will be sent forward for political endorsement to the G20 meeting of Finance Ministers on 12-13 October.

Assuming this endorsement is given, the G20 Leaders’ Summit scheduled for 30-31 October will also formally endorse the framework.

Wider Comment

The Government of Jersey has always maintained that international tax standards should be developed on a global basis by organisations such as the OECD, rather than on a regional basis, as this helps protect the principle of maintaining a level playing field among tax jurisdictions globally. This is critical to ensuring that the interests of developing countries and small jurisdictions are balanced with those of larger and developed countries.

Jersey’s corporate tax system has been carefully designed to meet the Island’s ongoing fiscal needs and to align with international standards. This means that Jersey’s corporate tax system is designed to support the requirements of a geographically small economy that is open and attractive to global investment.

Jersey has always been clear that it is no different to any other jurisdiction in seeking to design its tax system to suit its needs and to provide maximum opportunity to support jobs and growth. For smaller jurisdictions, like Jersey, this can mean the use of a competitive tax policy as a legitimate lever to compensate for the real advantages enjoyed by larger jurisdictions in terms of scale, location and resources.

Jersey’s tax policy is based on the principle of tax neutrality combined with the application of strong rules on economic substance and transparency, which have been approved by the OECD and the EU. Our tax and regulatory regime has been subject to recent external and independent assessments, and these have proven that we meet all the requirements of international policymakers on the implementation of global tax standards.

Jersey is well placed to continue to adapt to international tax standards, and we will continue to engage in a proactive way with the OECD, EU and global bodies to combat aggressive tax avoidance and profit shifting. Our focus continues to be on adding value to the global economy by offering a stable, certain and attractive environment for supporting the growth of cross-border investment in a well-regulated and transparent manner.

[1] With a global turnover in excess of €20bn and profitability in excess of 10%

Please log in to view this content OR create an account/create a login

Your company must hold Jersey Finance membership and you must have an individual account to be able to access this area. If you have an account, please login, otherwise please click here to create one.

Help

To create a login, click here

Or please press the back button on your browser to return to the last page to try again or return to the homepage.

To reset your password please click here.