Over the years, Jersey Finance has built up an extensive global network through its business development team, which we can now leverage to promote our funds message into new markets.

In December 2019, we piloted this concept in South Africa, where Elliot Refson, our Director of Funds, and Allan Wood, our Global Head of Business Development, utilised their extensive network of contacts to arrange a series of events and networking activity. This included:

- a bespoke networking lunch for 32 asset managers;

- a Jersey Finance Funds Masterclass event with more than 60 funds specialists and managers;

- a speaking slot to more than 150 professionals at an Invest Africa event on the periphery of SuperReturn Africa; and

- a large number of targeted individual meetings with key intermediaries.

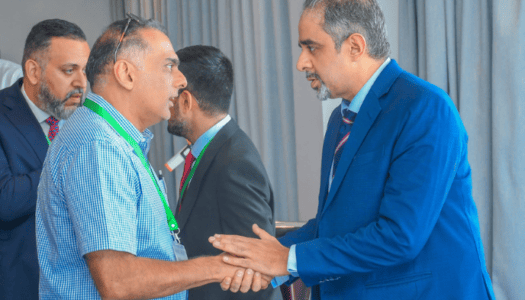

In February, we followed this activity up with another South Africa trip, which included an additional week of gatekeeper meetings and Jersey Finance hosting the opening drinks reception at the South African Private Equity and Venture Capital Association (SAVCA) Conference, with more than 200 professionals attending. The level of engagement and interest in our offering was incredibly high, and you can view some photos from this event below.

As a result of this activity, we are able to point to two multi-billion dollar fund managers (one private equity and one hedge), as well as several smaller opportunities in the alternatives and asset management space, with who we are actively engaged with in terms of them using Jersey as a jurisdiction in lieu of Mauritius and Luxembourg.

We are in no doubt that there is a huge opportunity for funds in South Africa and that the recent blacklisting of Mauritius by the FATF, as well as the blacklisting of Cayman by the EU, will further enhance this opportunity. We are now looking forward to taking this concept to our other key markets.