Jersey is no new arrival on the African scene and there is plenty of evidence of the close business ties that have been established over a number of decades, especially with private clients and intermediaries in Eastern and South Africa. There are a number of African banks with an operational presence in Jersey, including Standard Bank and Nedbank, and a long standing concentration of private client business; it is estimated that 9% of assets looked after in trusts in Jersey have arisen from African sources. Furthermore, Jersey has significant experience in advising clients across the African Continent on transactions with a wide ranging focus, from corporate work in the natural resources, mining and energy sectors, through to funds and infrastructure projects, as well as private wealth management.

Currently Jersey is a conduit for between 0.5 and 1.5% of all foreign investment into the continent, but the potential for the jurisdiction to have a more active role in supporting the growth of the African economy is clear, as a study recently commissioned by Jersey Finance confirmed.

Potential for prosperity

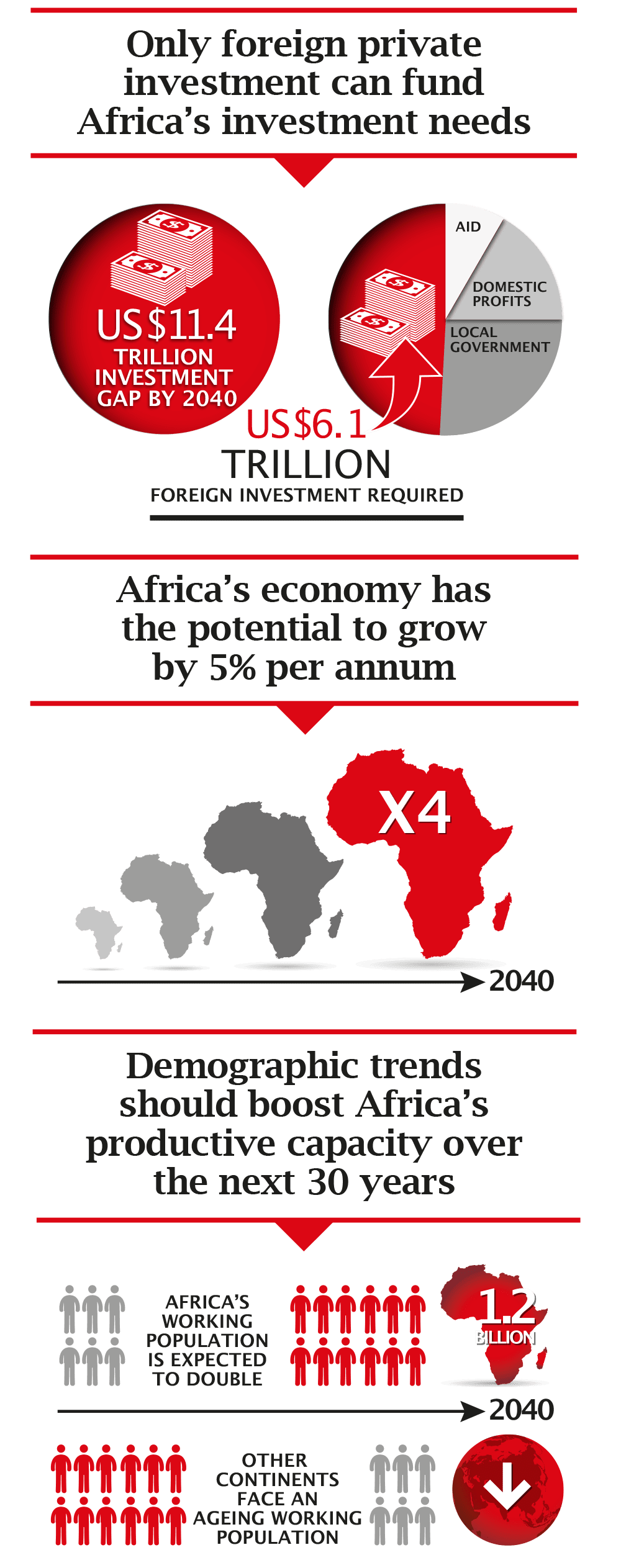

Independently researched and produced by Capital Economics, the study concluded that Africa has the opportunity to quadruple living standards by 2040, although in order to do so it will need to find $11.4 trillion in extra investment over that period. While other continents are saddled with ageing populations, Africa’s working age population is expected to double over the next 30 years, providing a demographic advantage and ideal conditions for the widespread growth of the African economy.

To fuel that growth, Africa would need a massive amount of investment funding for infrastructure development, foreign direct investment and for capital. Jersey, a conduit of international capital and an efficient capital allocator, is in a prime position to offer the expertise required in structuring and transaction-based business.

“Jersey has significant experience in advising clients across the African Continent on transactions with a wide ranging focus, from corporate work in the natural resources, mining and energy sectors, through to funds and infrastructure projects, as well as private wealth management”

Jersey’s value to Africa

Naturally, the features that international investors elsewhere find attractive about our financial services regime are the factors that African investors are also seeking. For example, our tax neutrality means that we can pool investments from all over the world to finance projects in Africa efficiently and cost effectively. Our robust legal framework and sound judiciary offer protection to investors who might be uncomfortable investing directly in African countries.

Jersey is a politically stable IFC of substance, with an AA+ credit rating from Standard & Poors, and its appeal is heightened because of the remarkably strong partnership that exists between Jersey based legal and finance professionals and financial institutions, intermediaries and advisers in the City of London. It’s a business bond that has evolved over many decades as Jersey has been established as a leading International Finance Centre for more than 50 years and has always had a close affinity with City of London professionals. It ensures effective access to London’s capital markets, a requirement of major companies in industries such as mining.

Jersey also benefits through its willingness to play an active role in international efforts to crack down on tax evasion and fiscal crime. In respect of information exchange, all Jersey corporate service providers are regulated and must hold detailed client records, and for trusts this information is held on the files of the licensed service provider, which is subject to rigorous inspection by the regulator. We have also been cited in a World Bank report as a model of good practice in capturing the details of beneficial ownership.

In addition Jersey’s authorities have sought to engage with the African Tax Administration Forum and other international bodies on ways in which it can assist developing countries to enhance their revenue raising capacity, while tackling issues of financial crime, including fiscal crime.

Ultimately, Jersey can offer a safe business environment while helping Africa fulfil its economic potential. In the following pages, some of our specialist practitioners highlight the expertise available, and the suite of legislative vehicles and listing capabilities that Jersey can offer the African investment community.

To read Capital Economics’ report ‘Jersey’s Value to Africa’, click here.