The Rise of the Family Office

To help us better understand the mindset of today’s family office, we worked closely with some local family offices to listen to their personal experiences and to understand their rationale behind establishing their businesses in Jersey as a leading international finance centre.

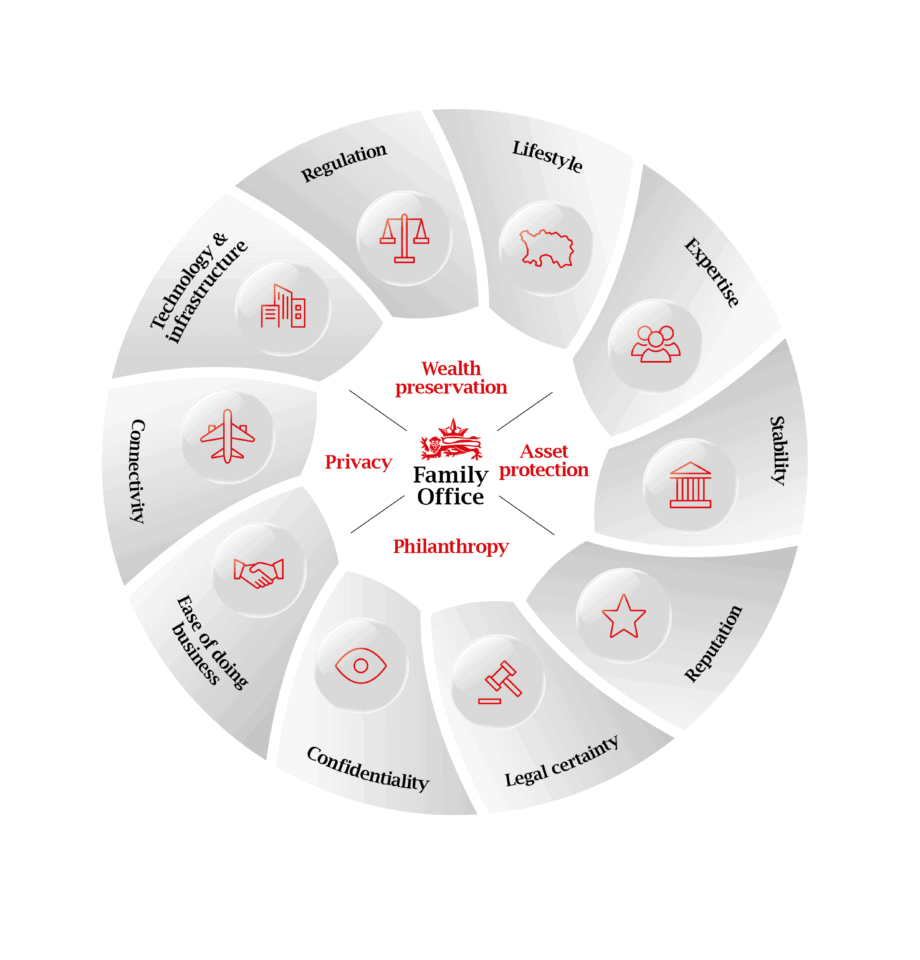

We recognise that every family office is unique, however, they share several common aspirations including:

- wealth preservation;

- asset protection;

- philanthropy; and

- privacy

Why Family Offices Choose Jersey

We understand the key drivers that make Jersey a destination of choice for family offices. With key aspirations and insights, we are able to support them in achieving their future wealth ambitions.

Jersey can support family offices to grow and protect their wealth, with a solid infrastructure, specialist advice and a wide range of products and services.

See our interactive family office wheel for detailed information on Jersey’s expertise, stability, reputation, connectivity and more.

Jersey Family Office Profiles

To respect the families’ aspiration for privacy, we do not expose their names. However, below is a brief summary of each family office to show the diverse range of family offices established in Jersey.

Family A is a prominent ultra-high net worth multi-generational family. The main family office was relocated to Jersey in 2018.

Family A’s single family office manages the family’s private wealth structures and undertakes philanthropic activities. In only a few months, Family A was able to recruit over five local people in Jersey who have the necessary expertise to run their family office.

The Jersey single family office is now seen as the main hub of the family’s multi-jurisdictional wealth and where their Global Head of Governance is based.

Family B set up their single family office in Jersey over 10 years ago. The family, who are mainly based in London, already had a relationship with Jersey service providers when they decided to set up a single family office in Jersey to manage the family’s private wealth.

Family B’s single family office consists of five local employees and manages the family’s multi-jurisdictional portfolio. Family B regularly visit the single family office and find the close proximity to London a great convenience.

Family C are an ultra-high net worth European family of multiple generations. The majority of Family C are located in London.

Family C set up a charitable foundation in 2008 to manage their philanthropic activities. Family C have family offices in four other locations across the world. The Principal of their philanthropic arm chose Jersey to set up a further family office solely for their philanthropic activities.

The philanthropic activities include both global and local initiatives. Some of the global projects include the marine environment, medical research, a suicide prevention helpline in the UK and social reform in prisons. The local projects include supporting Beresford Street Kitchen.

Family D are an ultra-high net worth family who set up their foundation in 2016. They set up an office in Jersey in 2017.

One of the purposes of the foundation is to undertake active strategic philanthropy. The underlying income generating businesses of the foundation are situated

worldwide.

Family E are a first generation ultra-high net worth family. The patriarch of Family E moved to Jersey with his family over 10 years ago. Family E chose Jersey due to lifestyle, the education options available and the ease of travelling to and from the UK.

Family E set up a private company in Jersey, which subsequently became regulated.

Working with the world

Allan Wood › Global Head of Business Development, Jersey Finance

email › / profile ›

Elliot Refson › Head of Funds, Jersey Finance

email › / profile ›

United Kingdom

For more information and advice on relocating family offices to Jersey, UK-based intermediaries can contact Robert Moore or Nicola Le Brocq. Both are based in the UK.

Robert Moore › Director – UK, Jersey Finance

email › / profile ›

Nicola Le Brocq › Director – Funds and Corporate, UK, Jersey Finance

email › / profile ›

Gulf Region

Gulf-based intermediaries wishing to enquire about relocating family offices to Jersey can contact Faizal Bhana or An Kelles for more information and advice. Faizal and An are both based in Dubai.

Faizal Bhana › Director – Middle East, Africa and India, Jersey Finance

email › / profile ›

An Kelles › Director – GCC, Jersey Finance

email › / profile ›

Africa

Intermediaries based in Africa wishing to enquire about relocating family offices to Jersey can contact Allan Wood, our Global Head of Business Development, Faizal Bhana looks after the Kenya and Nigeria markets, whereas Dr Rufaro Mucheka covers South Africa. Allan is based in Jersey, Faizal is based in Dubai and Rufaro is based in South Africa.

Allan Wood › Global Head of Business Development, Jersey Finance

email › / profile ›

Faizal Bhana › Director – Middle East, Africa and India, Jersey Finance

email › / profile ›

Dr Rufaro Nyakatawa › Business Development Consultant – Africa, Jersey Finance

email › / profile ›

Asia

Intermediaries based in Asia can contact Maria McDermott or Yiow Chong Tan for more information and advice on relocating family offices to Jersey.

Maria McDermott › Business Development Consultant – Asia, Jersey Finance

email › / profile ›

Yiow Chong Tan › Business Development Director – South East Asia

email › / profile ›

The Americas

US-based intermediaries wishing to enquire about relocating family offices to Jersey can contact Philip A. Pirecki for more information and advice. Philip is based in New York.

Philip A. Pirecki › Jersey Finance Lead in the Americas

email › / profile ›