Infographics

The Europe Economics report draws on data analysis, literature reviews as well as surveys and interviews with Jersey administrators, fund managers and lawyers to understand the value that Jersey creates for global institutional and governmental investment portfolios.

An institutional investor could be a public or private pension funds, mutual fund, money managers, insurance companies, investment banks, sovereign wealth funds, endowment funds, hedge funds, and some hedge fund investors.

Tax Neutrality

One of the main reasons why tax-exempt institutional investors invest through vehicles based in Jersey is tax neutrality.

So what is tax neutrality?

The concept of tax neutrality is simple; that by not imposing additional layers of tax, decisions can be made on their economic merits alone.

Company A invests in Company B. Company B pays tax on its profits in its home jurisdiction. Company A then pays tax, in its home jurisdiction, on the distributions it receives from Company B.

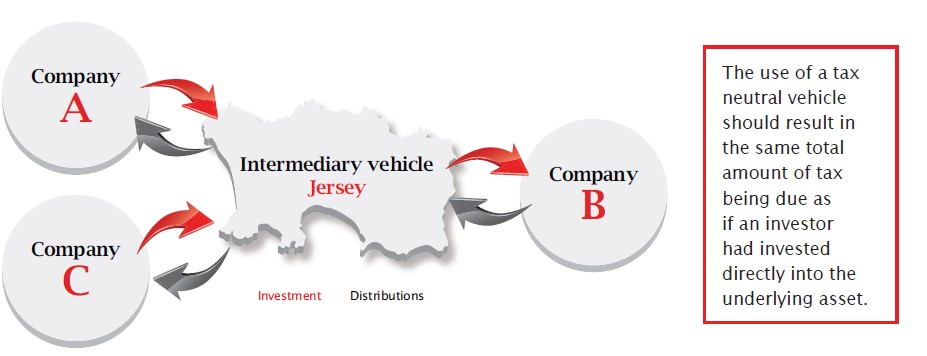

If Company A wanted to invest jointly with a partner, Company C, they may wish to pool their funds in an intermediary vehicle. This vehicle can reduce the administrative burden for all parties, provides an independent platform which treats each investor fairly and can be based in a stable jurisdiction to reduce country risk concerns.

In the above example, some jurisdictions would tax the intermediary vehicle, meaning the investment entity itself is no longer tax neutral, potentially putting the whole investment at risk.

A tax neutral jurisdiction such as Jersey would not tax the intermediary vehicle. Tax would continue to be paid by the ultimate investors (Company A and Company C) in their home jurisdiction, and also by the underlying investment (Company B) in its home jurisdiction. Therefore, the use of a tax neutral international finance centre (“IFC”) such as Jersey should result in no more or less tax being payable. This is a simplified example, as withholding taxes, double tax agreements and other matters would also be taken into account.

In this report, tax neutrality was seen a critical requirement for Jersey’s success. Tax neutrality is not tax evasion and it doesn’t make it easier to avoid paying tax either. Tax neutrality is, in fact, transparent and well-regulated, providing investors with the opportunity to use Jersey’s services without having to pay an additional layer of tax and is a clear and simple way of allowing vital capital between countries. It is also the responsibility of individuals and companies to pay any taxes they may owe in their home country.

So, to make sure the Jersey system isn’t being taken advantage of, it uses an independently-approved series of checks – one of the strictest in the world – to clarify where funds come from. Jersey has also signed 31 information sharing agreements with other countries, to help prevent multinationals from avoiding paying taxes due there.

Why Jersey for investors

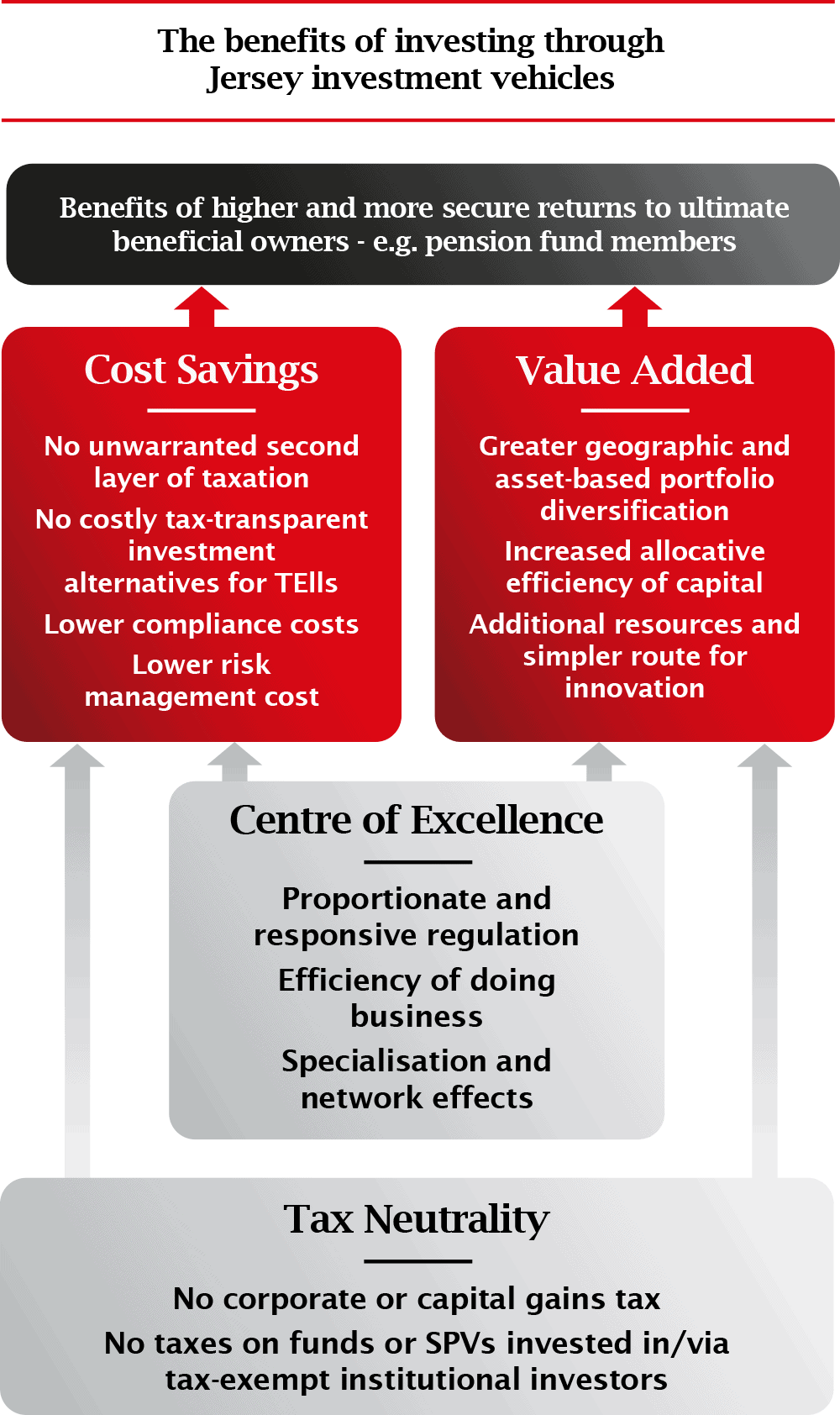

Tax neutrality is particularly important to tax-exempt institutional investors but is by no means sufficient to attract investors to Jersey. Investors are using Jersey for other reasons which help set the jurisdiction apart as a leading international finance centre.

Jersey’s regulatory environment is very important and is seen by contributors of this report as a primary non-tax related advantage of Jersey to institutional investors. Jersey has a good reputation because of this assurance. Its flexible and responsive approach to regulation reduces costs to investors and enables greater innovation, while increasing the ease of doing business. What’s more, its flexibility regarding EU regulation avoids unnecessary costs to institutional investors.

Below are the significant benefits to tax-exempt institutional investors in investing in or via funds and corporate structures established and/or administered in Jersey.

- Ease of doing business – including lower service and risk management costs

- Upholding of tax exempt status – cost efficiencies from not having to replicate tax neutrality status

- Portfolio diversification – diversification across assets and geographic locations with associated higher returns/ lower risk

Case Study

Re-development of Battersea power station

The Battersea site along London’s riverside was bought for £400m by a three-member consortium from Malaysia, which has said it believes the whole development will be worth £8bn by the time it is fully completed in around 2025. The joint venture deal for the project was signed on July 4, 2012 in Jersey and led to the formation of Battersea Project Holding Company Limited as the holding company.

Battersea power station was previously left abandoned for three decades. Several developers have tried and failed to restore the Grade II-listed 1930s landmark, which is the largest brick structure in Europe. The planning consent for the development of the area of the Battersea power station has provision for 3,500 homes and 1.7m sq ft of offices, as well as for hotel and shops. It will also provide London with two new Underground stations, extensions from the Northern line. One of the confirmed tenants would be Apple, which is set to open its UK headquarters in 2021. The rest of the original building will be filled with retail, leisure and apartments, leaving more than 700,000 sq ft of offices planned in the additional constructions.

The developers claim that the overall economic impact assessment of the scheme on the wider UK economy totals nearly £20bn. By the time it is completed around 2025, the once derelict site will house 25,000 people and will have created more than 20,000 jobs – including 2,685 full-time construction jobs and 17,238 full-time roles once the site is operational.[1]

The two biggest investors in the project are Sime Darby, one of the world’s largest operators of palm oil plantations, and SP Setia, a large Malaysian property developer. The third investor is a Jersey-incorporated subsidiary of Malaysia’s Employees’ Provident Fund (EPF).

The EPF traces its origins to a pension fund started in 1951 and is now the sixth-largest pension fund in the world with more than 13 million members and Rm537bn ($169bn) in assets under management. Its growth has been promoted by Malaysian government rules that require 11 per cent of all employees’ salaries be channelled into a state pension scheme while a further 13 per cent is paid in by the employer. The EPF invests in a broad range of assets and can also be directly involved in financing national infrastructure projects to provide highways, airports, etc. to the Malaysian public.

The scale of assets under management has encouraged the EPF to turn to international markets in search of higher returns. The EPF has a significant stake in the London commercial property market, helping make Malaysia the sector’s second-largest overseas investor.[2] In addition to the EPF’s investment in the Battersea redevelopment, the pension fund, together with two other investors, has bought into Britain’s second-largest private healthcare provider Spire Hospitals as part of its diversification strategy. This business operates 12 hospitals. [3]

[1] See The Telegraph

[2] See The FT

[3] See IPE Real Assets

Download Reports

Please log in to view this content OR create an account/create a login

You must login to the Jersey Finance website to access this area. If you do not have a login, please create one.

Help

To create a login, click here

Or please press the back button on your browser to return to the last page to try again or return to the homepage.

To reset your password please click here.