A clear choice

Jersey is proud to be a leading funds jurisdiction. With alternative investment funds in high demand globally, particularly among institutional and pension fund investors, Jersey is a specialist centre and works with some of the world’s biggest private equity managers. In fact, we have more than 60 years of experience in structuring, managing and administering funds. It’s this track record, together with the flexibility of our funds regime and the future-proofed solutions we provide, that makes us a clear choice.

Private equity and venture capital funds business up 249%

Some private equity promoters using Jersey:

The turbulent global economic and political environment of recent years hasn’t hampered our forward-thinking private equity sector.

It’s continued to flourish with the launch of significant new funds investing in high profile portfolio companies.

Arm Holdings, Deliveroo, Facebook, Flipkart Limited, GenSight Biologics, Guardant Health, Impact Biomedicines, Improbable

Worlds, Klarna, NVIDIA Corporation, Revolut, Skrill, Skype, Slack, Spotify, Wealthfront, Onfido

What sets Jersey apart?

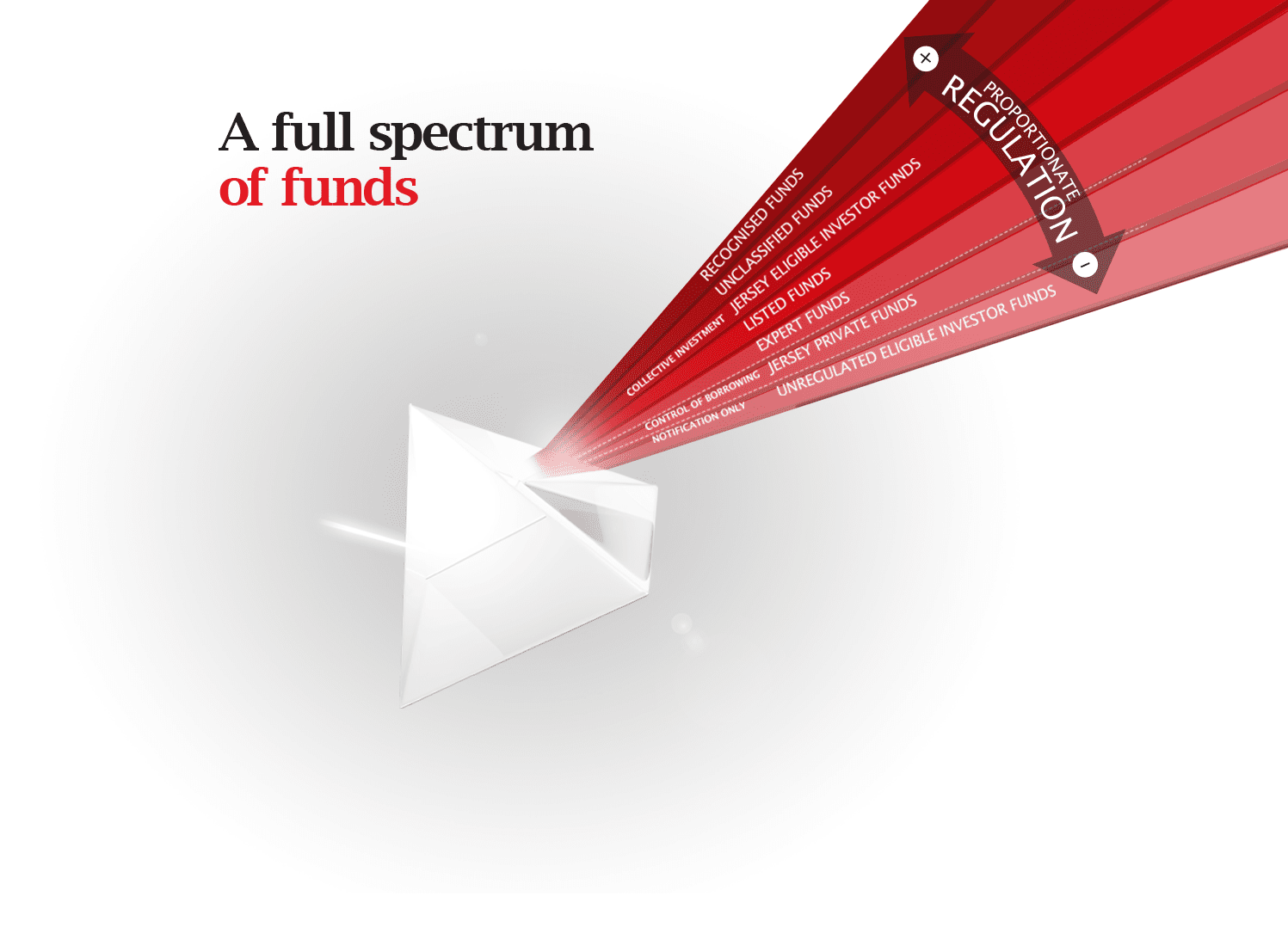

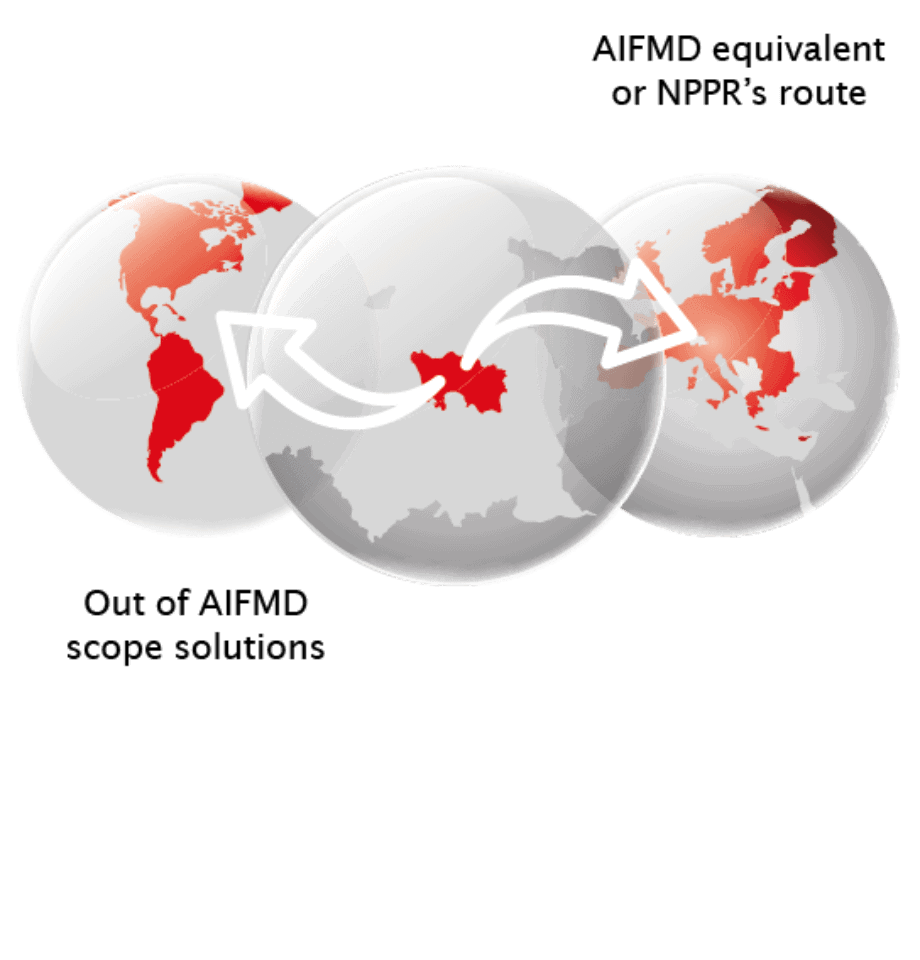

Jersey has a fully flexible funds regime and, unlike other jurisdictions, offers easy and cost-effective marketing within the EU through NPPRs. As Jersey is not a member state, it is not subject to the scope of the AIFMD when targeting investors outside the EU.