What is Tax Neutrality?

Globalisation is no longer a new phenomenon, and shows no sign of slowing down. Individuals are increasingly international in mindset, the value of goods and services traded internationally continues to rise, and so do cross-border capital flows, as investors search for returns in a global marketplace. Despite this, many tax systems remain domestically focussed and do not adequately deal with cross-border trade and investment; double taxation remains a significant issue for individuals and businesses alike and this can result in inefficient economic decisions being made if the tax implications of a transaction have undue influence.

Global shifts in the wealth management landscape are prompting many investors to look for access to markets through well-regulated, reputable and long-established finance centres such as Jersey, which has been at the forefront of international finance for more than 60 years.

The concept of tax neutrality is simple: it is a tool that avoids imposing additional layers of tax on top of what investors and companies owe in their own jurisdictions in compliance with their domestic tax rules.

Being tax neutral is not the same as being a tax haven. A tax haven offers an environment with minimal transparency, a poor regulatory regime and little or no compliance with international standards on tax and transparency. A tax neutral jurisdiction, such as Jersey, supports cross border flows and positively impacts individuals and economies around the world.

How Does Tax Neutrality Work?

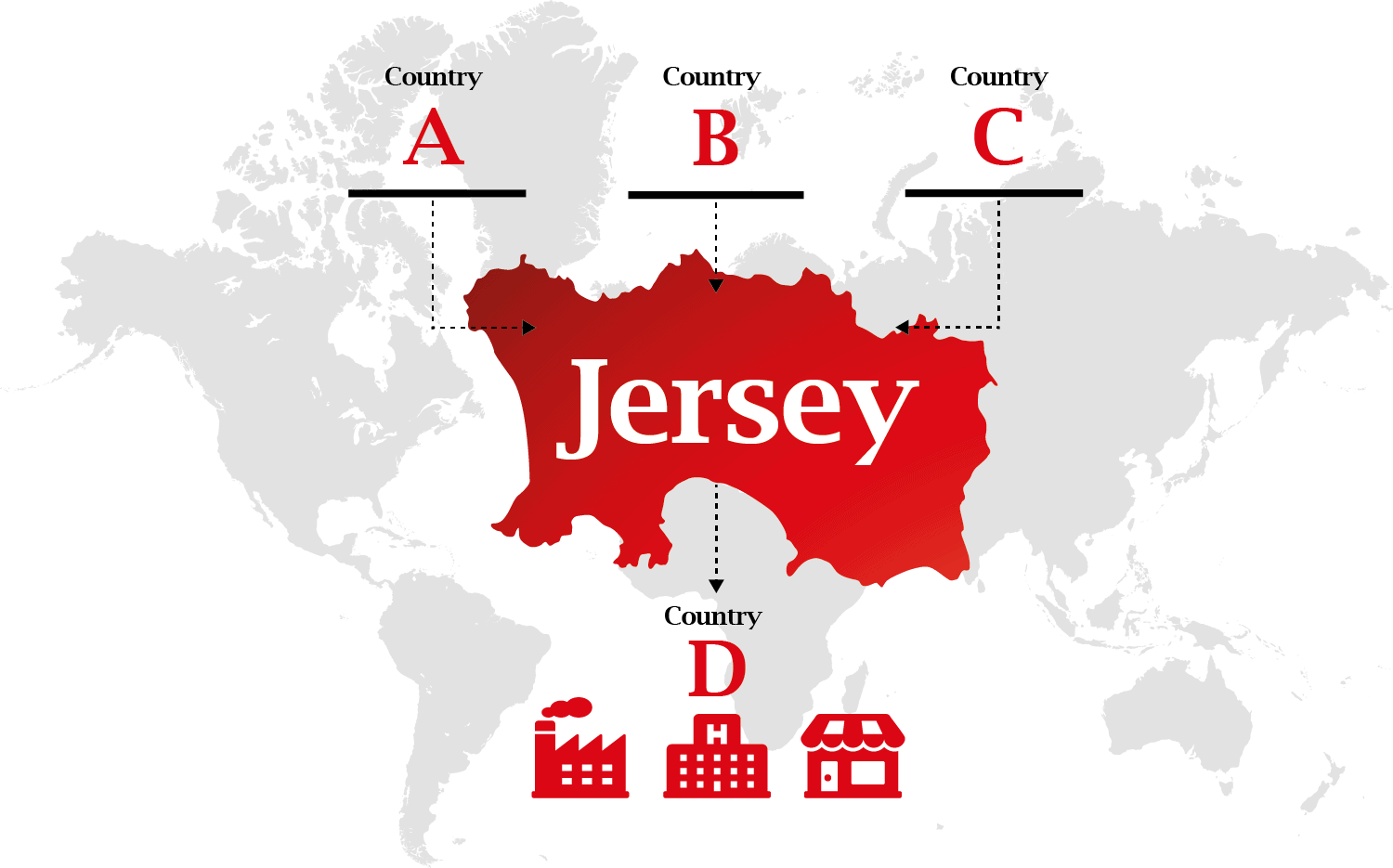

- Investors in Countries A, B and C send money to Jersey for investment

- This money sent by investors to Jersey is combined into an investment vehicle (e.g., a fund). The vehicle and the investors are not taxed in Jersey

- The money in Jersey is then used to invest in companies in Country D, such as shopping centres, factories and hospitals. When any money is returned to the investors, they are liable to tax in their home Countries of A, B and C on those returns.

- Companies in Country D remain liable for tax in their home Country D.

Why Use a Tax Neutral Jurisdiction like Jersey?

Ease of doing business

The investor avoids double taxation by only paying tax where it is due in their home country. It reduces the administrative burden of investors who want to pool their funds.

This minimises the risk of either suffering tax twice or having to invest time and money in making claims for double tax relief. The ease of doing business in Jersey is a key attraction for funds and the tax-exempt institutional investors in those funds. This stems from factors such as: Jersey’s common law legislative structure; its proximity to the City of London giving access to funds from the UK and the rest of the world; a time zone that supports interaction between a range of markets (e.g. Asian, North American and UK); and Jersey’s long-established role as a third-country to the EU, with settled third-country access arrangements.

Stability

Jersey can provide a politically stable environment that provides investors with certainty that may not be available in Countries A, B and C. It also gives investors the ability to diversify their investment portfolios, which reduces risk. Jersey stands out for its stability, well-established legislature, expertise, quality of service and product offering for investors and guards its reputation as a world leading and well-regulated international finance centre with great care.

Making a difference to ordinary people

Jersey as a tax neutral jurisdiction helps institutional investors, such as pension funds, insurance companies and investment banks who invest on behalf of other people and who are exempt from tax, to access a broader range of funds, assets and countries.

A significant portion of the funds invested in Jersey comes from pension funds with at least 58 million pension fund members worldwide benefiting from pension funds investing in real estate through Jersey administered funds.

This gives them a better chance of stronger returns for their investors, without compromising their tax-exempt status. The ability to invest through Jersey investment vehicles therefore means that they can seek exposure to cross-border investments without the concern of suffering an unnecessary tax liability, thus maximising returns for future retirees (in the case of pension funds).

If an individual has a pension for example, this money, along with that of thousands of others could be pooled to buy units in an investment fund, which may be based in Jersey. If the fund’s investment portfolio includes shares in a company in India, then any profits attributable to those shares will already have been subject to tax in India. The individual investing into the company in India will also be liable to any tax arising on dividends (returns) paid from the company in India. However, the investment fund based in Jersey, which enabled this pooled investment, will not be subject to a second layer of tax.

Expertise

There is a wealth of talented and experienced professionals that may not be available in Countries A, B and C. Islanders working in our finance industry understand the wealth ambitions of millions of ordinary people and can help them with their retirement and financial planning needs. Built up over the past 60 years, there are more than 13,600 professionals working in the Island’s finance industry and almost 1,300 Jersey-based members of the Society of Trust and Estate Practitioners (STEP), clear evidence of the wealth of experience held by Jersey’s highly skilled financial services providers. Island lawyers also work closely with their counterparts in all of the world’s major centres, including New York, London, Tokyo and Hong Kong, to provide bespoke solutions.

Transparency

The majority of Jersey’s international activities focus on the pooling and deployment of assets that have already been taxed. As tax neutrality does not limit tax liabilities in other jurisdictions, it is not a form of, and does not facilitate, tax evasion – lack of transparency and poor regulation do. Jersey as a tax neutral jurisdiction does not support tax evasion, aggressive tax avoidance or unfair tax competition. It is a criminal offence to facilitate or engage in tax evasion in Jersey. It has been this way since 1999, three years before the UK enacted similar legislation. Jersey is also at the forefront of international standards designed to prevent tax evasion and money laundering

Jersey has been independently assessed by international organisations to have demonstrated a high level of compliance with them. Additionally, Jersey has been reviewed by the Code of Conduct Group for Business Taxation, which aims to identify and abolish harmful tax measures and was formally confirmed as a cooperative jurisdiction.

It has maintained a central register of the beneficial ownership of companies for more than two decades. In addition, Jersey regulates those who form and administer companies, trusts, funds partnerships and foundations. They are required by statute to maintain up-to-date and accurate information on the ownership of the vehicles they administer, with this information being available to international law enforcement and tax authorities on request.

Jersey as a tax neutral jurisdiction acts as a major conduit for international capital flows. A key foundation of the Island’s offering is the provision of a tax neutral environment for international business. This globally responsible tax model is simple and transparent and effectively facilitates the free flow of cross border capital.

Jersey is an award-winning international finance centre, which is perfectly placed to provide cross-border solutions to support the international investment ambitions of global investors. It has a robust, sophisticated and forward-thinking legal framework that enables it to lead the way in delivering international finance solutions. Our absolute focus continues to be on offering a stable, certain and attractive environment for supporting cross border investment in a well-regulated, transparent manner.