Using Jersey to navigate capital raising in Europe

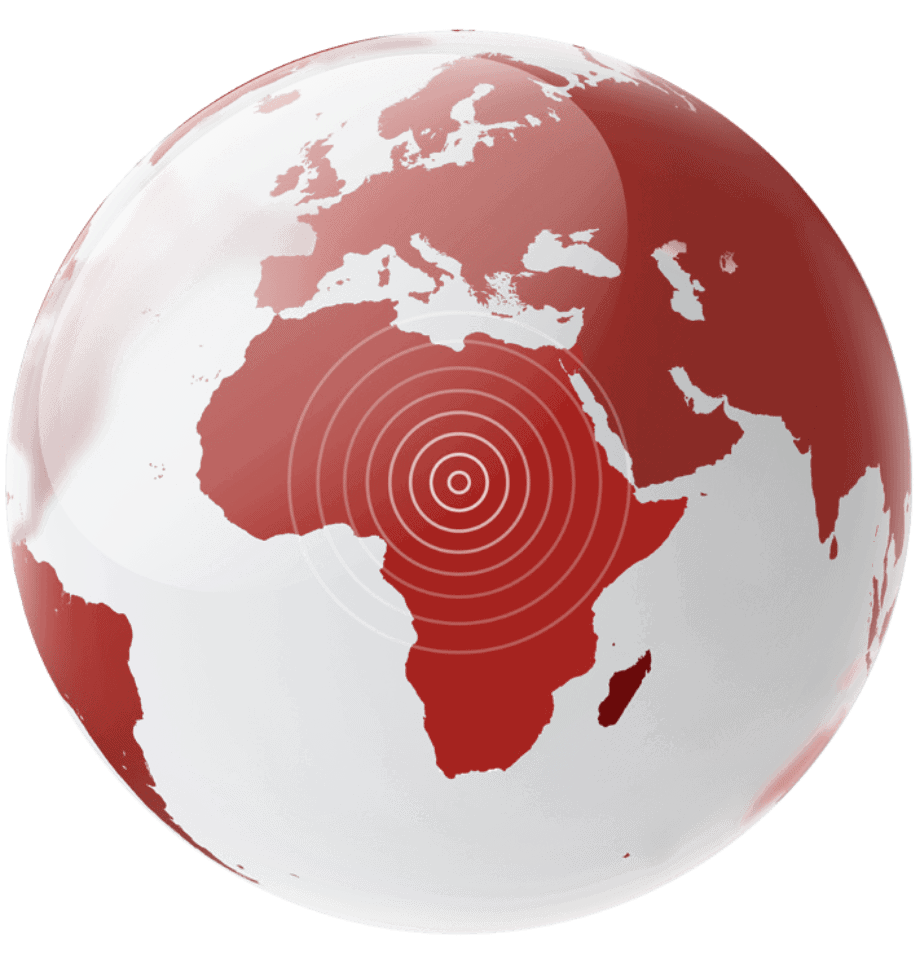

In recent years, European institutional investors have accumulated record amounts of investable capital which they have been slow to deploy given tighter yields and strong competition in traditional markets. The search for yields has resulted in an increasing appetite for foreign direct investment, and currently presents a large opportunity for African-based managers looking to fund raise. It is for these reasons that international managers choose Jersey as a domicile.

Whether you are raising capital for direct investment or seeking liquidity through a permanent capital vehicle as an exit strategy for your current investors, it is important that your fund or corporate vehicle addresses the regulatory and legislative requirements of Europe. It must also meet the substance, governance and operational risk requirements of the investors themselves.

With more than a thousand regulated collective investment funds and the largest number of FTSE 100 companies registered outside of the UK, Jersey is one of the world’s leading international finance centres (IFCs), a jurisdiction of choice for the European market and an approved investment jurisdiction for many high-net worth and institutional investors.

Acting as a bridge between capital raising in Europe and investment in Africa, Jersey’s support of regional gross domestic product (GDP) in Africa totalled £6 billion* (Jersey’s Contribution to Global Value Chains, Cebr 2021).

What sets Jersey apart?

| Finding the right structure for you | |||

| Unregulated Funds | An unregulated eligible investor fund may be open or closed-ended and only be offered to eligible investors, which includes professional or institutional investors or investors who make a minimum initial investment of US$1,000,000 (or its currency equivalent) | A simple filing of a notice with the JFSC | |

| Jersey Private Funds | Provides a new streamlined fast-track regulatory authorisation process for the establishment of funds marketed to 50 or fewer professional or eligible investors | A JPF must appoint a designated service provider that is registered in Jersey | Popular with new managers – low cost and minimal regulatory requirements |

| Eligible Investor Funds | A fund which is suitable for eligible investors (essentially professional or experienced investors) and which can be authorised on a fast-track basis provided it fulfils the criteria of the Jersey eligible investor fund | The fund company, general partner or trustee (as appropriate) must be established in Jersey and have at least two Jersey resident directors | |

| Expert Funds | A fast-track authorisation process is also available for the establishment of funds which target expert investors and includes institutional and sophisticated investors or any person investing at least US$100,000 (or its currency equivalent) | Expert funds are certified funds and must have at least two Jersey resident directors for the fund company, trustee (for unit trusts) or general partner (for limited partnerships) | |

| Listed Funds | Closed-ended corporate funds which are to be listed on a recognised stock exchange and can take advantage of a streamlined authorisation process | Listed funds are certified funds which must have at least two Jersey resident directors and a Jersey-based manager or administrator to monitor the fund | Useful for funds who wish to reach more than 50 investors |

| Unclassified Funds | Unclassified funds are funds that are offered to more than 50 investors or are listed and do not fall within the definition of a recognised fund or the simplified regulatory regimes for listed, expert or eligible investor funds. Unclassified funds are certified funds and are suitable structures for public offerings | Unclassified funds must have a Jersey-based manager and, for open-ended funds, a Jersey-based custodian | Allows investors to sell shares on the market, thereby establishing a permanent capital base for the fund |

| Recognised Funds | They are the most highly-regulated funds in Jersey | More suitable for retail investors | |

Whether you are looking to structure a corporate vehicle or an open or closed-ended fund, Jersey has a wide range of structuring options available.

Jersey Private Fund (JPF)

Jersey’s forward-thinking approach has ensured that the Island remains at the forefront of the funds sector, and in 2017 it introduced the Jersey Private Fund (JPF). The JPF offers a streamlined, effective and proportionate product for privately offered alternative investment funds.

As at 30 September 2023, there are 664 JPFs registered. The JPF offers a clear solution for private equity deal structuring in Africa.