In early 2019, Jersey Finance commissioned the Centre for Economics and Business Research (Cebr) to analyse finance sector productivity in Jersey.

Since then, we have worked with the financial services professionals on-Island and productivity thought leaders to produce a range of resources and materials.

All of these materials and resources are accessible from this page, and include:

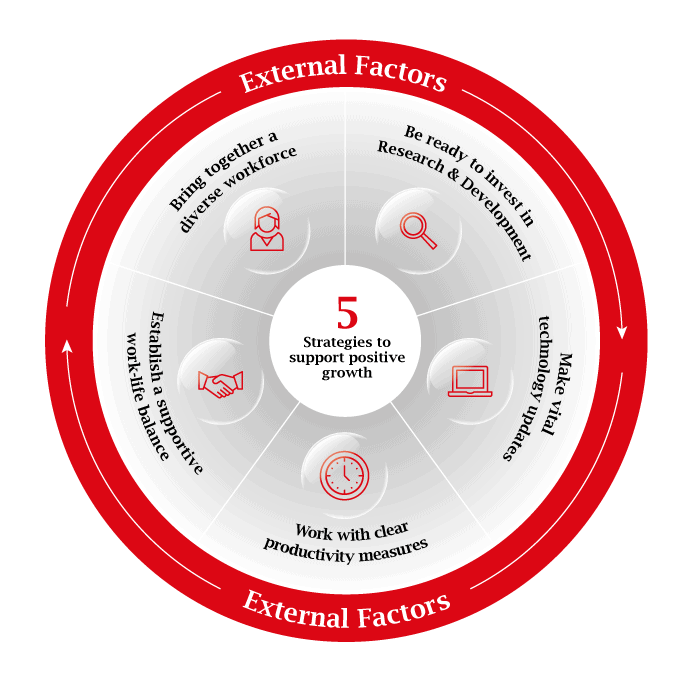

Including the external factors which affect productivity, what it takes to be a forward-thinking productivity leader and strategies to support positive growth.

A paper that explores a number of ways to measure productivity evidenced through case studies and insights from Jersey’s finance industry.

Link to the latest wellbeing news and case studies from Jersey’s finance industry.

An interactive map celebrating the cultural diversity of the Jersey Finance team.

Links to the Jersey Heard podcasts on productivity.

A short animated video of the five strategies to support positive growth identified in the Cebr research report.

Access PDFs of productivity publications produced by Jersey Finance and the Cebr research report.

Summary of research findings

A focus on productivity is vital for any business wanting to make the most of its resources, maintaining and increasing profits, and ensuring the future health of the company. The question of how to improve productivity is especially important for international finance centres such as Jersey that compete for business on a global level. As well as supporting firms’ efforts to remain competitive, higher productivity growth is also a desirable goal for the economy as a whole.

In early 2019, Jersey Finance commissioned the Centre for Economics and Business Research (Cebr) to analyse finance sector productivity in Jersey using official data and evidence from a survey of finance companies on the Island. Based on discussions with business leaders, Cebr’s report paints a clear picture of the positive steps being taken to improve businesses productivity – and what still needs to happen for underperforming firms to close the gap with productivity leaders.

A clear trend in the finance sector

Following the financial crisis of 2008-2009, many finance companies have seen slowing, or even negative, productivity growth for several years as the industry was required to adopt more stringent regulation and capital requirements.

The finance sector experiences productivity growth in two ways:

- firstly, by improving output per worker or hour worked through increased efficiency and technology improvements (what’s traditionally understood as productivity); and

- secondly, as a by-product of the financial intermediation services it provides to the rest of economy productivity driven by external forces). For example, when there’s greater demand in the economy for borrowing money, banking clients may decide to take out bigger loans, so a finance sector worker may only have to exert the same amount of effort to make more profit.

External factors affecting productivity

The headline productivity rate in financial services is typically heavily driven by external forces such as the level of regulation, the interest rate set by the central bank, and the stage the economy is in within its cycle. For example, in a recession, profits will be significantly affected by an unwillingness of potential borrowers to do business.

Therefore, it must be acknowledged that efforts by companies to make their operations as efficient as possible will not necessarily show in statistics if external forces are offsetting these efforts.

Focussed on Jersey firms

While the external factors will influence the productivity in Jersey, there are also other drivers specific to the Island and similar jurisdictions.

Innovation and education

Jersey’s Fiscal Policy Panel has highlighted a lack of innovation as a possible cause of weak productivity growth. The education levels of the Island’s workforce may suffer as a result of limited access to educational institutions. The lack of local universities and research institutions as well as Jersey’s industrial structure mean that the jurisdiction’s domestic knowledge assets are limited.

Regulation

As with many other regions where the finance sector is prevalent, regulation is likely to have had a significant effect on productivity in Jersey since the financial crisis. In reaction to regulation introduced and enforced after the financial crisis, financial institutions increased non-revenue generating compliance roles that, while essential, lowered the average output per worker at the business.

Technology

Having up-to-date technology is vital for increasing the productivity of businesses in Jersey’s finance sector and ensuring firms remain competitive.

what it takes to be a forward-thinking leader

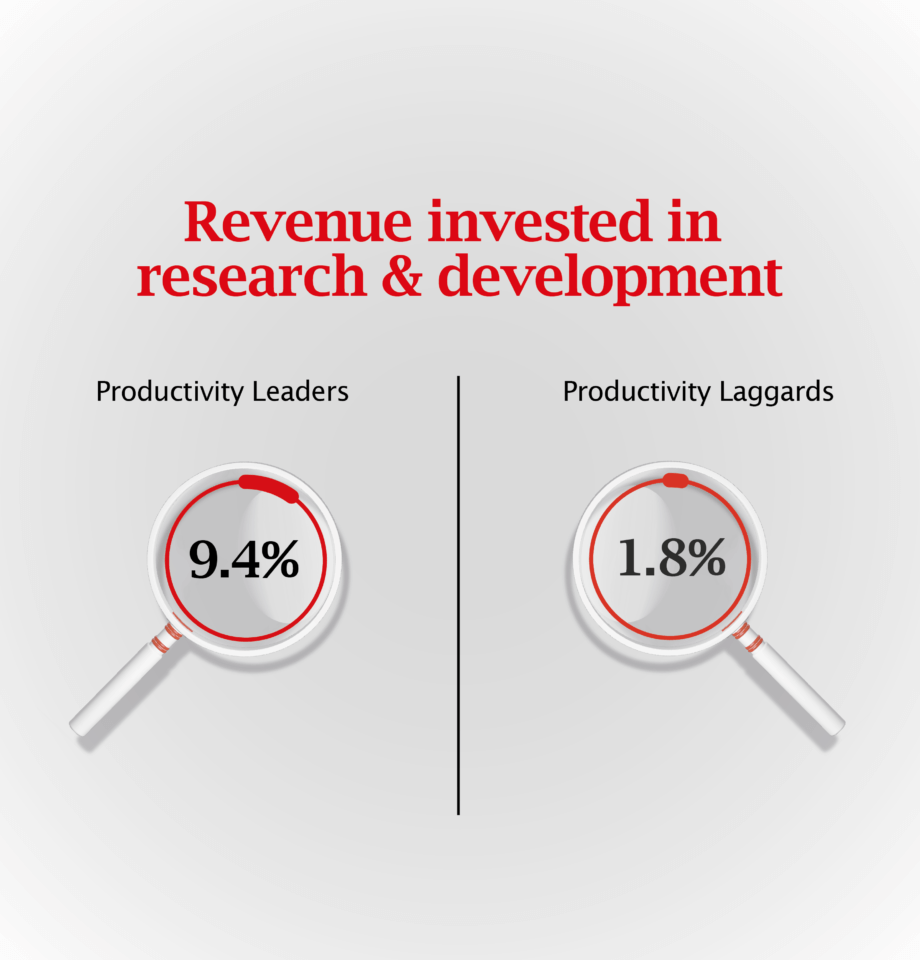

A survey of Jersey Finance members reveals that, on average, productivity leaders invested 9.4% of revenue in research and development (R&D) over the past three financial years, while productivity laggards (businesses with lower productivity) only invested 1.8%.

On average, productivity leaders invest £796,000 per year in capital (equating to £15,000 per full-time employee), of which £317,000 is on technology. Meanwhile, laggards invest £405,000 per year on average (£6,000 per employee), of which £270,000 is on technology.

This differs from R&D investment because capital expenditure can be purchased ‘off the shelf’ while R&D expenditure is on the development of specific new products or processes.

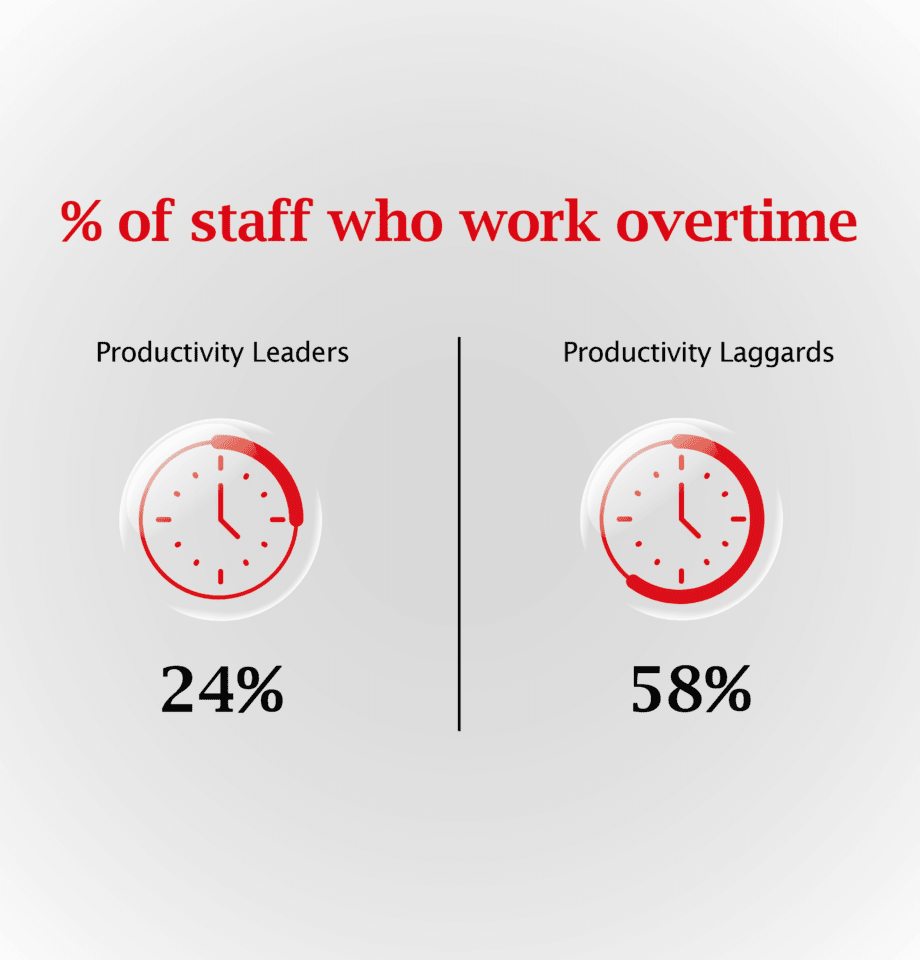

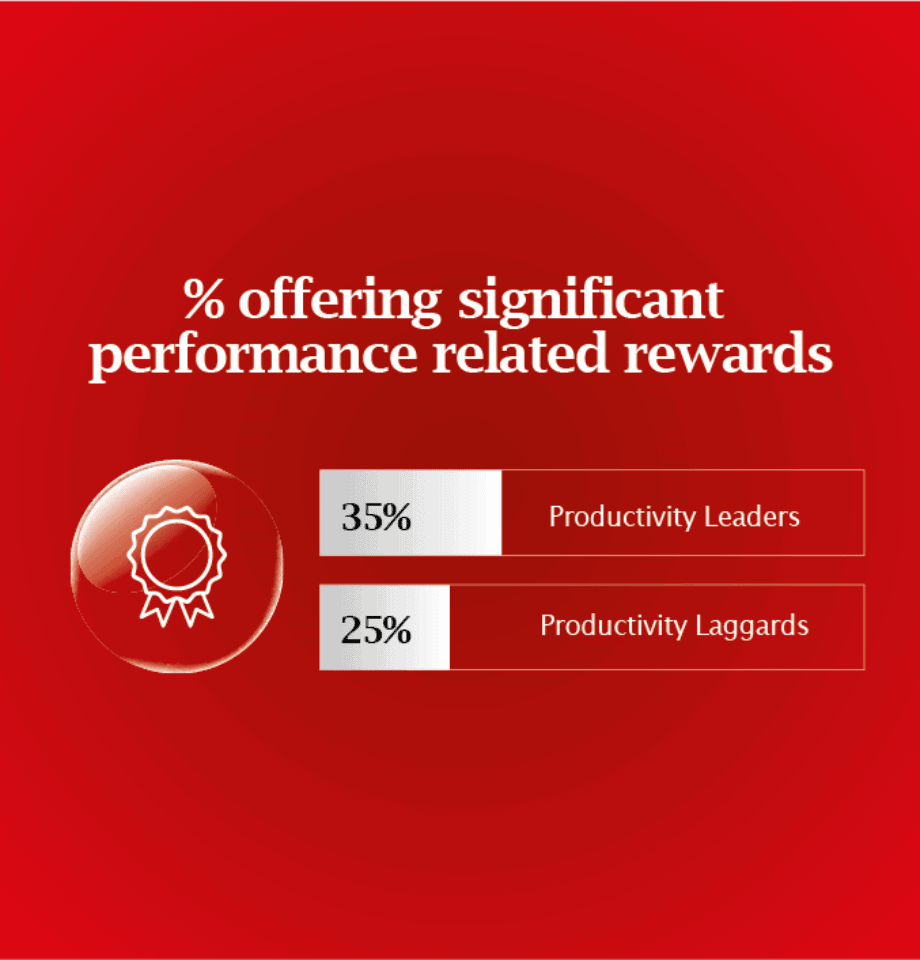

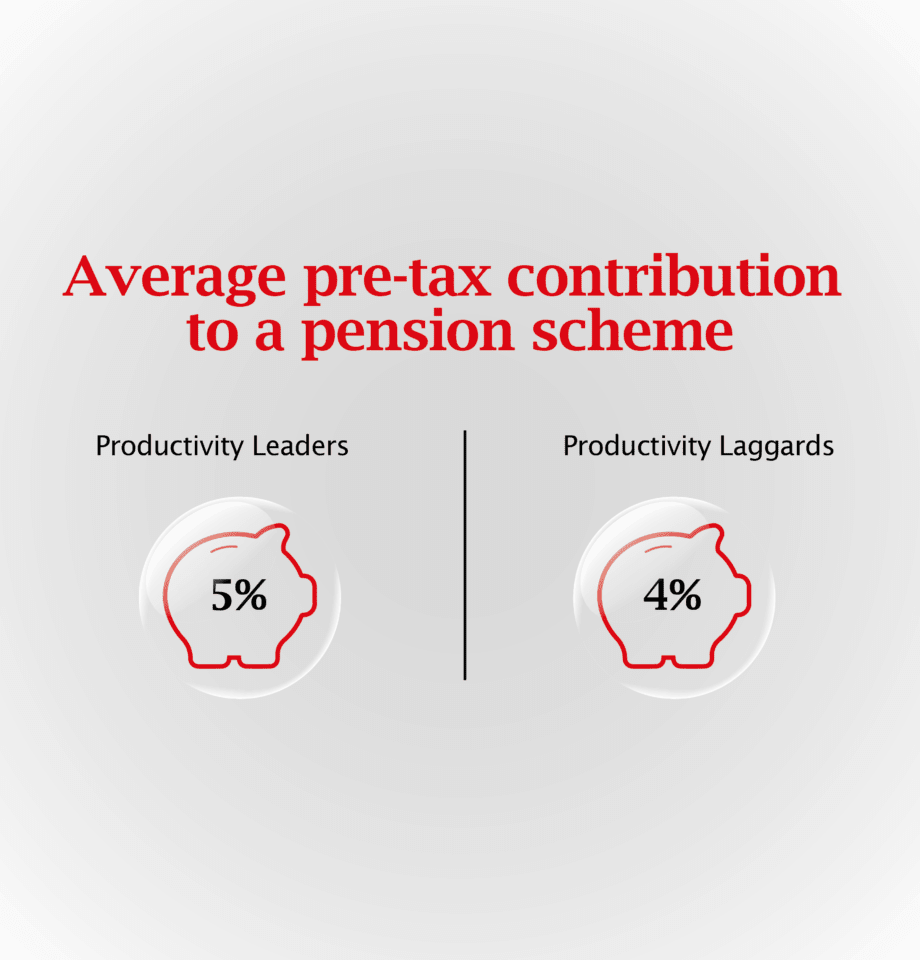

The survey of Jersey Finance members revealed that productivity laggards are much more likely to say that their employees often have to work late into the evening or over the weekend. It also found that productivity leaders are more likely than laggards to offer significant performance-related rewards and contribute a higher percentage of pre-tax income to workplace pension schemes.

One possible explanation for why recruitment efforts aren’t correlated with productivity could be the limited population of the Island. This is likely to result in a fairly small spread of skills among the pool of labour in Jersey’s finance sector, compared to a finance centre with a larger population such as London. Therefore, when financial services companies are recruiting in Jersey, the relatively homogeneous talent pool means that a different level of recruitment effort doesn’t have a huge influence on the skill set of the person hired.

five strategies to support positive growth

Although every company is different, the majority of businesses can benefit from the above strategies. Overall, productivity should be a key concern for any business wanting to make the most of its resources, increase profits, and ensure the long-term health of the company. Many finance companies are in a position where they have seen slowing, or even experiencing negative productivity growth for several years. In order to reverse this trend, a conscious effort is required.

Useful resources

Our work with the Centre for Economics and Business Research (Cebr) to analyse finance sector productivity in Jersey revealed that working with clear productivity measures can lead to positive business growth.

This thought leadership paper explores a number of ways to measure productivity evidenced in case studies and insights from Jersey’s finance industry.

Read more

In early 2019, Jersey Finance commissioned the Centre for Economics and Business Research (Cebr) to analyse finance sector productivity in Jersey using official data and evidence from a survey of finance companies on the Island.

Read moreOur 2019 Cebr research showed that organisations who establish a better work-life balance see stronger levels of productivity. This can deliver mutual benefits to people, organisations, economies and communities. Discover the latest wellbeing news and case studies from our Members and partners on Jersey.

At Jersey Finance, we value diversity. For us this means that we respect people with different ideas, strengths, interests and cultural backgrounds to drive our success, fostering a positive work environment to encourage healthy debate. In celebration of the United Nation’s World Day for Cultural Diversity in 2020, some of our staff team contributed to a Cultural Diversity Map showcasing our many and diverse cultural experiences.

View MapPodcasts

One year on from the launch of our commissioned research project with the Centre for Economics and Business Research (Cebr), our strategic projects manager and fintech lead, Adam Brown speaks with economist and Cebr CEO, Nina Skero, about how the current economic landscape has and will affect productivity worldwide, and on Jersey.

Listen Now

Kate Wright, Co-Founder of The Diversity Network, and Karolina Pilcher of Jersey Finance deliver insight into diversity and inclusion on Jersey, as well as useful advice and examples on how business can be more inclusive.

Listen Now