Capital Economics has produced a second edition of the ‘Jersey’s Value to Britain’ report (2014) which refreshes information on the economic, financial and fiscal linkages between Jersey and the United Kingdom, and to ascertain the extent to which the English Channel Island is a net benefit or cost to its neighbour’s output. Find out more about Jersey’s unique relationship with the UK and the significant impact it continues to make on the British economy.

Facts and Figures

This report combines existing information, statistics and research with the results from a major quantitative and qualitative research exercise among a large and representative sample of senior executives in Jersey’s financial and related businesses. This work goes further than any previous study and, importantly, provides a comprehensive review of the sources and uses of assets administered or managed by the island’s banks, funds and trustees. It also provides estimates of Jersey’s trade position.

Video

IFCs and Transparency

Increased globalization of capital, labour, business and tax is the context within international finance centres (IFCs) like Jersey operates. They facilitate the effective functioning of global capital and labour markets.

- Jurisdictional neutrality – provides a location that is independent

- Administrative convenience – neutral location for administration

- Tax neutrality – assets can be pooled, grown and/ or distributed across borders without imposing any additional taxation

- Regulatory specialisation – resources can be concentrated on regulating specific types of financial sectors effectively

- County risk mitigation – safe haven where assets can be kept protected from potential loss, damage or sequestration resulting from socio-political instability

Why Jersey?

- In the face of increased global regulation, Jersey has been at the forefront of international developments to improve transparency and clamp down on criminality, including tax evasion.

- With regards to anti-money laundering and financial crime, Jersey introduced its proceeds of crime legislation in 1999 which makes evasion of tax in other jurisdictions illegal.

- It is fully aligned with the standards required by the European Union 3rd Anti-Money Laundering Directive as well as being an active member of the Council of Europe’s Committee of Experts on the Evaluation of Anti-Money Laundering measures and the Finance of Terrorism.

- Jersey adheres to the Organization for Economic Cooperation and Development (OECD) Common Reporting Standard, the global standard in the automatic exchange of information. It was part of the ‘early adopters group’ which included 51 signatory countries at the outset. Jersey was also an early adopter of the United States FATCA model.

- Jersey has been at the forefront of collecting information on beneficial ownership of companies. The jurisdiction has maintained a central register of benefits ownership in a register for more than two decades.

Global endorsement for Jersey

The island’s position as one of the best regulated IFCs has been acknowledged by independent assessments from some of the world’s leading bodies and individual endorsements from political and industry figures:

- Most recently MONEYVAL, the Council of Europe’s Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism reviewed certain aspects of Jersey’s institutional, legislative and regulatory framework to deter money laundering and the financing of terrorism through financial institutions. Of the 49 assessment areas, Jersey was rated compliant or largely compliant in 48 placing it in the top tier of jurisdictions assessed under those criteria.

- Pascal Saint-Amans, Director of the OECD Center for Tax Policy and Administration, highlighted the” tremendous job Jersey has done contributing to the international tax agenda”. “

- January 2016 Pierre Moscovici EU Tax Commissioner described Jersey and Guernsey as “co-operative jurisdictions” and welcomed their work on reporting standards and fighting profit-shifting”

- The OECD Peer Review in 2013 stipulated that ‘Jersey authorities were fully committed to transparency and exchange of information for tax purposes’.

- In 2014, a study entitled ‘Global Shell Games’ involved researchers posing as fictitious consultants representing various risk profiles who via email, made solicitations for shell companies to over 4,000 corporate services providers across 180 countries. Jersey achieved 100% compliance in preventing their establishment.

- Rated by the International Monetary Fund in 2009 as one of the best global International Finance Centres

- Favourable assessment from the Foot Review in 2009 conducted by the UK government financial institutions

The island’s laws have the most thorough arrangements for the exchange of information with tax, police and enforcement agencies in other nations and these arrangements work efficiently and effectively in practice.

Jersey’s Value to Britain, Capital Economics – Report extracts

Trade, Jobs and Growth

The economy of Jersey has seen a great deal of change over the last century. While the mainstays of the island have historically been agriculture and tourism, the emergence of the financial services sector in the mid-twentieth century has outpaced the more traditional sectors to become the largest industry on the island in terms of output and employment.

Air links

The island’s airport served over 740,000 passenger arrivals in 2014, and is set to host just under 300 outbound flights per week in the 2016 peak season. Jersey’s air network is dominated by connections to the United Kingdom, and especially southern England.

Trade

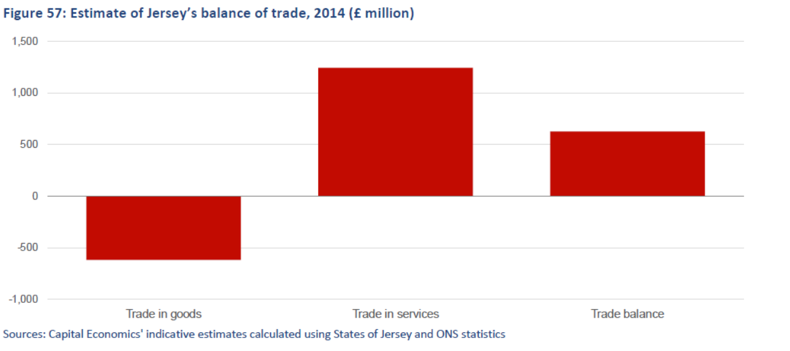

The report estimates that Jersey ran an overall trade surplus in the order of £0.6 billion in 2014. This has been calculated by comparing official estimates of the island’s gross value added with estimates of domestic consumption, business investment and government expenditure. The difference between these is the trade balance.

Jersey’s export performance compares favourably to the United Kingdom’s.

The total value of exported goods and services is equivalent to 64% of the island’s total gross value added; for the United Kingdom, the comparable statistic is around 28%.

Although running a trade surplus overall, the report estimates that, for 2014, Jersey was a net importer of goods to the value of £600 million. Given the lack of freight capacity to anywhere other than the United Kingdom, almost all of these imports will have been shipped in from the south coast of England or by air from British airports.

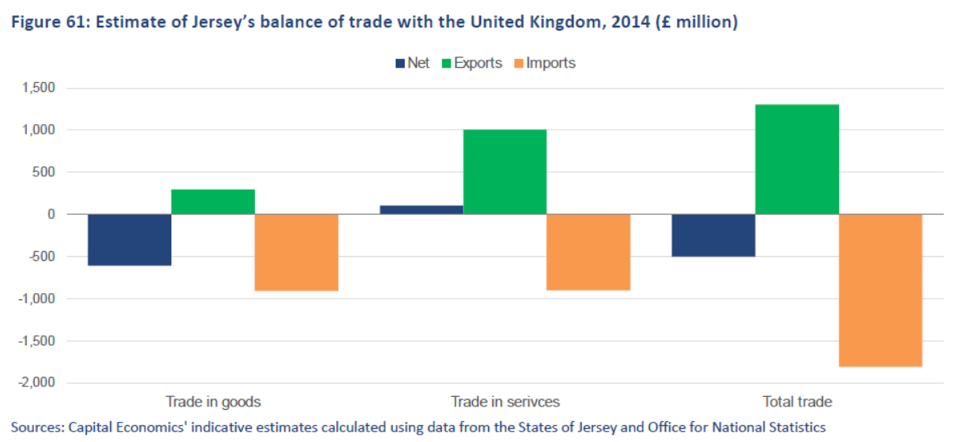

The report estimates that the island imported in the region of £1.8 billion of goods and services from Great Britain and Northern Ireland in 2014, which was £0.5 billion more than it exported to there.

An estimated 36% of exports by such businesses are destined for the United Kingdom, while the remaining £1 billion are exports to outside the sterling zone.

Jobs

Jersey provides an estimated overall gross benefit to the United Kingdom economy to the order of 700,000 jobs and £39 billion per annum of economic activity based on all net investment to the United Kingdom.

Accounting for the impact of trade, business mediated through Jersey, foreign investment, tax generated, and netting out the possible losses from tax leakage and the provision of defence, Jersey provides an estimated net benefit to the United Kingdom economy to the order of 250,000 jobs and £14 billion per annum of economic activity.

Jersey’s Value to Britain, Capital Economics – Report extracts

Tax Neutrality

Globalisation is no longer a phenomenon, but although it is familiar to us all, this does not mean it is slowing down. Individuals are increasingly footloose, the value of goods and services traded internationally continues to rise, and so do cross-border capital flows as investors search for returns in a global marketplace.

Despite this, many tax systems remain domestically focussed and do not adequately deal with cross-border trade and investment; double taxation remains a significant issue for individuals and businesses alike and this can result in inefficient economic decisions being made if the tax implications of a transaction have undue influence.

Jersey is a major conduit for international capital flows and a key foundation of the Island’s offering is the provision of a tax neutral environment for international business. The concept of tax neutrality is simple; that by not imposing additional layers of tax, decisions can be made on their economic merits alone.

However, tax neutrality is also widely misunderstood and misrepresented, with certain corners erroneously linking it to tax evasion.

We consider here in more detail how tax neutral jurisdictions, such as Jersey, operate.

Liquidity into the UK

Jersey’s banks largely service the needs of the expatriate ‘mass affluent’ and internationally footloose high net worth individuals, as well as associated corporate and institutional clients. They attract deposits and funding from across the globe. Almost one quarter of the island’s £150 billion of banking funds come from deposits and other instruments ultimately provided by customers from beyond Europe, while two-fifths arise from the United Kingdom.

There is, though, little lending business conducted from the island. Instead, the banks upstream the bulk of funds to their parent companies, which are typically in London. The majority of funding collected by banks in Jersey is up-streamed to their parents’ operations, which are primarily in the United Kingdom, whose banking sector is bolstered by almost £90 billion of funding received this way. This is equivalent to 1.5% of its total balance sheet while supporting around 5,000 jobs.

What are the benefits to the UK?

The up-streaming of deposits from Jersey to the United Kingdom has broader economic importance as it provides important liquidity to the British economy.

The up-streaming model brings real economic benefits, both through the extra liquidity it provides and through the revenue it generates from intermediation. Moreover, in recent years, the ability of the part-nationalised banks to secure funding through Jersey has eased the burden on British taxpayers. Jersey bank assets are of high quality, cheap and stable which makes them highly attractive sources of funding for British banks. The last eight years of accommodative monetary policy has distorted the relative attractiveness of these deposits as liquidity in general has been easy to come by. However, the decision by the United States Federal Reserve to raise interest rates in December 2015 for the first time since 2006 has paved the way for further gradual monetary tightening over the years to come. As interest rates rise, general liquidity will be harder, and more expensive, to access, making Jersey money even more desirable.

To demonstrate the materiality of the scale of the contribution made by Jersey’s up-streaming to British bank’s liquidity, the report analyses how British banks could raise the equivalent level of funds. It estimates that to raise the same level of funds in the retail market for example, British banks would need to raise rates on sight deposits from their current low of 0.7 per cent to between five and seven per cent.

Jersey’s Value to Britain, Capital Economics – Report extracts

Downloads

Please log in to view this content OR create an account/create a login

You must login to the Jersey Finance website to access this area. If you do not have a login, please create one.

Help

To create a login, click here

Or please press the back button on your browser to return to the last page to try again or return to the homepage.

To reset your password please click here.