Jersey Finance in partnership with Capital Economics, the respected independent research firm, has produced a report that looks at the economic, financial and fiscal linkages between Jersey and the European Union.

What is the relationship between Jersey and the EU and how does Jersey help facilitate long-term investment across borders? Find out more about the vital role the jurisdiction plays in generating growth in EU member states.

Facts and Figures

The Capital Economics report offers a comprehensive analysis of existing information, statistics and research with the results from a major qualitative and quantitative research exercise among a large representative sample of senior executives in Jersey. The report focusses on the relationship between Jersey and the European Union excluding the UK.

Video

IFCs and Transparency

Increased globalisation of capital, labour, business and tax is the context within which international finance centres (IFCs) like Jersey operate. They facilitate the effective functioning of global capital and labour markets.

- Jurisdictional neutrality – provides a location that is independent

- Administrative convenience – neutral location for administration

- Tax neutrality – assets can be pooled, grown and/ or distributed across borders without imposing any additional taxation

- Regulatory specialisation – resources can be concentrated on regulating specific types of financial sectors effectively

- Country risk mitigation – safe haven where assets can be kept protected from potential loss, damage or sequestration resulting from socio-political instability

Why Jersey?

- In the face of increased global regulation, Jersey has been at the forefront of international developments to improve transparency and clamp down on criminality, including tax evasion.

- With regards to anti-money laundering and financial crime, Jersey introduced its proceeds of crime legislation in 1999 which makes evasion of tax in other jurisdictions illegal.

- It is fully aligned with the standards required by the European Union 3rd Anti-Money Laundering Directive as well as being an active member of the Council of Europe’s Committee of Experts on the Evaluation of Anti-Money Laundering measures and the Financing of Terrorism.

- Jersey adheres to the Organization for Economic Cooperation and Development (OECD) Common Reporting Standard, the global standard in the automatic exchange of information. It was part of the ‘early adopters group’ which included 51 signatory countries at the outset. Jersey was also an early adopter of the United States FATCA model.

- Jersey has been at the forefront of collecting information on beneficial ownership of companies. The jurisdiction has maintained a central register of benefits ownership in a register for more than two decades.

Global endorsement for Jersey

The island’s position as one of the best regulated IFCs has been acknowledged by independent assessments from some of the world’s leading bodies and individual endorsements from political and industry figures:

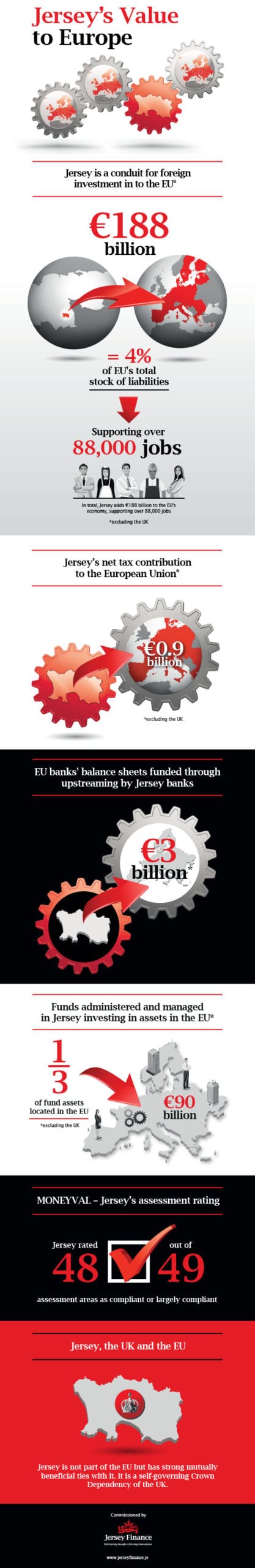

- Most recently MONEYVAL, the Council of Europe’s Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism reviewed certain aspects of Jersey’s institutional, legislative and regulatory framework to deter money laundering and the financing of terrorism through financial institutions. Of the 49 assessment areas, Jersey was rated compliant or largely compliant in 48 placing it in the top tier of jurisdictions assessed under those criteria.

- Pascal Saint-Amans, Director of the OECD Center for Tax Policy and Administration, highlighted the ‘tremendous job Jersey has done contributing to the international tax agenda’.

- January 2016 Pierre Moscovici EU Tax Commissioner described Jersey and Guernsey as ‘co-operative jurisdictions’ and welcomed their work on reporting standards and fighting profit-shifting”.

- The OECD Peer Review in 2013 stipulated that ‘Jersey authorities were fully committed to transparency and exchange of information for tax purposes’.

- In 2014, a study entitled ‘Global Shell Games’ involved researchers posing as fictitious consultants representing various risk profiles who via email, made solicitations for shell companies to over 4,000 corporate services providers across 180 countries. Jersey achieved 100% compliance in preventing their establishment.

- Rated by the International Monetary Fund in 2009 as one of the best global International Finance Centres.

- Favourable assessment from the Foot Review in 2009 conducted by the UK government financial institutions.

The island’s laws have the most thorough arrangements for the exchange of information with tax, police and enforcement agencies in other nations and these arrangements work efficiently and effectively in practice.

Jersey’s Value to Europe, Capital Economics – Report extracts

Trade, Jobs and Growth

Jersey facilitates the flow of vital investment into the EU which in turn stimulates economic investment and supports jobs and incomes.

The €200 billion of accumulated investment in the EU mediated through Jersey is helping support roughly 96,000 jobs across the continent, with €188 billion of this invested or settled by individuals or businesses resident outside the bloc. This foreign investment is supporting around 88,000 jobs.

Jersey also facilitates a flow of capital out of the European Union, and for the bloc as a whole excluding the UK, the net impact is a small outward flow. It could be argued that any outflow is a loss of jobs to these European economies.

Capital flows out of an area should not be viewed as negative. European investors may want to invest beyond the continent’s borders in order to diversify and reduce risks in their portfolios and to seek more profitable opportunities and higher returns. In this way, outflows reflect well-functioning and efficient capital markets which are better at matching investors with potential investments. And of course European Union countries benefit from these foreign investments as profits and interest are returned to the original investors.

Moreover, it should be no surprise that the EU, a mature and well developed economy, is the net investor into the rest of the world. This includes developing nations with greater appetite for capital.

The report estimates that Jersey catalyses tax revenues in the order of €1 billion a year based on net additional foreign investments into the EU or €1.9 billion based on gross foreign investment. If it includes total investment into the EU facilitated by Jersey these tax revenues could be in the order of €2 billion per annum.

On balance, given that no more than €0.1billion per annum of taxes are currently avoided or evaded and that tax generated by economic activity stimulated in member states (other than the UK) and facilitated by investment mediated through Jersey is in the order of €1.0 billion per annum, Jersey yields a net fiscal benefit to the EU governments of around €0.9 billion per annum.

Jersey’s Value to Europe, Capital Economics – Report extracts

Tax Neutrality

Globalisation is no longer a phenomenon, but although it is familiar to us all, this does not mean it is slowing down. Individuals are increasingly footloose, the value of goods and services traded internationally continues to rise, and so do cross-border capital flows as investors search for returns in a global marketplace.

Despite this, many tax systems remain domestically focused and do not adequately deal with cross-border trade and investment; double taxation remains a significant issue for individuals and businesses alike and this can result in inefficient economic decisions being made if the tax implications of a transaction have undue influence.

Jersey is a major conduit for international capital flows and a key foundation of the Island’s offering is the provision of a tax neutral environment for international business. The concept of tax neutrality is simple; that by not imposing additional layers of tax, decisions can be made on their economic merits alone.

However, tax neutrality is also widely misunderstood and misrepresented, with certain corners erroneously linking it to tax evasion.

We consider here in more detail how tax neutral jurisdictions, such as Jersey, operate

FDI

Foreign Direct Investment (FDI) is often described as either foreign direct investment or foreign portfolio investment.

It is cross-border investment by one entity in an economy with the objective of obtaining a lasting interest in the enterprise and plays an important role in providing cheap financing for companies and is active in primary and secondary financial markets for assets, contributing to a greater level and wider variety of economic investment:

- Broader credit base: Foreign investment allows individuals and institutions access to a broader credit base by enabling them to access capital in foreign countries.

- Supports innovation: Foreign investment allows borrowers in the recipient country to finance a wider range of investments thereby supporting innovation and entrepreneurship

- Facilitates longer term investment: Greater foreign institutional ownership fosters long-term investment in tangible, intangible and human capital.

Jersey vehicles help to facilitate this longer term investment as it is a centre for asset-holding vehicles to accumulate long term returns as opposed to engaging in speculative activities associated with short term trading markets.

Jersey facilitates the flow of vital financial investment into the EU which stimulates economic investment and supports jobs and incomes.

The €200 billion of accumulated investment in the European Union mediated through Jersey is helping to support roughly 96,000 jobs across the continent. Of this, €188 billion has been invested or settled by individuals or businesses resident outside the bloc; this foreign investment is supporting around 88,000 jobs

Jersey also facilitates a flow of capital out of the European Union – and, for the bloc as a whole, the net impact is a small outward flow.

European investors may want to invest beyond the continent’s borders – in order to diversify and reduce risks in their portfolios, and to seek more profitable opportunities and higher returns. In this way, outflows reflect well-functioning and efficient capital markets, which are better matching investors with potential investments. And, of course, European Union countries benefit from these foreign investments as profits and interest are returned to the original investors.

Jersey’s Value to Europe, Capital Economics – Report extracts

Downloads

Please log in to view this content OR create an account/create a login

You must login to the Jersey Finance website to access this area. If you do not have a login, please create one.

Help

To create a login, click here

Or please press the back button on your browser to return to the last page to try again or return to the homepage.

To reset your password please click here.