Banks provide a safe place to store cash as well as other assets such as equities and bonds, or even precious metals and fine art.

They also provide essential services such as loans, mortgages, credit cards and are relied on to transfer money and assets from one person or company to another.

But how does it all work? What do all the different kind of banks do? And how do banks make their money? Read on to discover more.

Retail and Commercial Banks

Most people will have a relationship with a retail bank (sometimes called a high street, consumer or personal bank). They are the face of banking to the general public.

A commercial bank does much the same thing, but for companies from small local businesses to large international organisations. This can also be known as business or corporate banking.

Some banks offer both retail banking services and commercial banking services.

What services do they offer?

Retail banks give customers access to financial products, such as current and savings accounts, overdrafts, personal loans, mortgage loans, credit cards and foreign currency exchange services.

Commercial banks support businesses by providing access to a range of banking, credit and investment products, such as treasury deposits, foreign exchange transactions, lending and financing, and card services for retailers.

How do banks make money?

Both commercial and retail banks lend money at a higher rate than they borrow it. This allows them to balance those that save more with those who borrow more, which is vital for a healthy economy.

Another way banks earn a profit is by charging for products and services, such as mortgages, overdrafts, personal and commercial loans, bank guarantees, investments, and international payments.

Every time you use a credit card, the retailer will pay a small fee to the bank providing the transfer of funds. If you want to exchange currency or send money overseas, banks can charge a fee for that too.

Commercial and corporate customers often pay a regular fee to banks for transactions that go through their accounts, such as cash payments into their account and payments out of their accounts.

How do Jersey banks keep money safe?

Jersey’s regulators have established robust regulations to ensure that all financial services companies including banks are run properly and that customers are looked after and dealt with fairly.

It’s thanks to these robust banking regulations that the island didn’t have a single bank failure in the 2008 global financial crisis.

Additionally, the Jersey Bank Depositors Compensation Scheme (DCS) was established in 2009 to protect banking customers in the unlikely event that a bank fails.

Jersey is home to the Channel Islands Financial Ombudsman service, a joint body with Guernsey who has the primary role of resolving complaints about financial services provided in/or from the Channel Islands of Jersey, Guernsey, Alderney and Sark.

You can read more about this in our Put Simply guide to Retail and Commercial Banking.

Private Banking

Wealthy individuals can take advantage of a more personalised service offered by the private banking division of a retail bank, a dedicated private bank, or other financial institutions.

Why might someone want a private banking service?

The main advantage is a more personalised service. As a private banking client, you’re usually assigned a dedicated private banker – sometimes known as a relationship manager – who will help you with everyday tasks and liaise between different bank departments to help you with financial transactions. It’s like having a PA who’s focused solely on your finances.

Clients can also sometimes get better rates and terms and, if a private banker is involved in managing a client’s investments, they may be able to provide opportunities that aren’t available to the average investor, such as access to an exclusive hedge fund or a private equity partnership.

Who is eligible for private banking?

While retail banks offer a relationship manager as part of Premium or Premier banking services based on salaries or income, private banking tends to be reserved for high-net-worth individuals (HNWIs) with substantial amounts of cash to invest and other assets. The minimum requirement can vary, but most banks set a benchmark of at least £100,000 – and some only accept clients with more than £10 million to deposit or invest!

Is Wealth Management included?

Wealth management covers every aspect of a client’s financial affairs – from investing and inheritance tax to retirement planning and charitable giving. Private banking and wealth management can sometimes overlap when private banking clients are offered wealth management services by their bank. However, not all banks are involved in investing on behalf of their clients and there are wealth managers who can’t provide services such as opening accounts or lending money because they don’t have a banking licence.

Is Wealth Management the same as Asset Management?

You might hear the terms ‘wealth management’ and ‘asset management’ used interchangeably, but the roles of a wealth manager and an asset manager are different.

An asset manager is someone who makes investments in order to grow their client’s portfolio. They might work for an investment bank or an asset management company, or as an independent advisor. Taking account of their client’s financial goals and attitude towards risk, their aim is to maximise the returns on investments in products such as equity, real estate, commodities and mutual funds.

While an asset manager focuses solely on looking after a client’s investments, a wealth manager takes a broader approach that encompasses their entire financial situation. They can help with things like tax, cash flow, estate planning and other areas that an asset manager doesn’t cover.

You can read more in our Put Simply Private Wealth guides here.

Expat Banking

Expat banking is a bespoke banking service designed for expatriates (often shortened to expats) – people who are living or working in a country that is different to the country where they were born and raised or different to the country of their citizenship.

Why do expats need a dedicated banking service?

While a number of banks operate in many different countries, a customer may find that their home bank is not present in the country where they live or work, or that the products and services offered do not meet their specific needs as an expat. To meet this client demand, many banks have established centres of excellence in places such as Jersey where dedicated teams of people who understand international finance can serve the expat community.

What sort of specialist services do expats get?

Expat banks help customers manage their money and plan for the future, services differ depending on their circumstances such as:

Moving abroad

- International account opening so customers’ bank accounts are ready for when they arrive;

- Foreign currency exchange specialists to help reduce the impact of exchange rate movements;

- Wealth Managers to assist customers with their financial goals;

- Instant access and fixed term savings accounts in a number of different currencies;

- Specialist lending solutions including mortgages for expats looking to buy or re-mortgage in the UK while overseas.

Already living abroad:

- Bank accounts in major currencies such as Sterling, US Dollars and Euros;

- Relationship Managers to help expats manage their finances;

- 24/7 online, mobile and telephone banking;

- Instant access and fixed term savings accounts in a number of different currencies;

- Foreign currency exchange services for when customers need to move their money around the world;

- Services offering expert advice on minimising safety risks and providing emergency support abroad.

Financial interests abroad:

- Connections to expert support;

- Wealth Managers to help achieve financial goals;

- Foreign currency exchange specialists to help manage the impact of exchange rate fluctuations;

- Expat tax resources to support with tax commitments at home and abroad.

Is reporting transparent and in-line with international standards?

Yes. All expats are responsible for reporting their own income in any location where they have tax obligations.

There are laws and standards are commonly applicable to an expat bank and its customers, you can read more about these in our guide to to expatriate banking here.

Custodian and Depository Banks

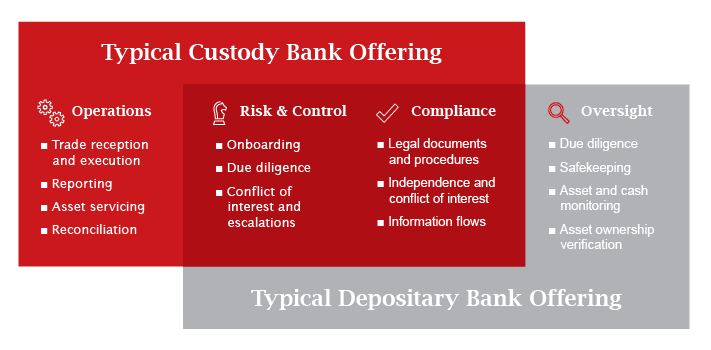

Custodian banks (also known as custodians) and depository banks are very different from retail and commercial banks.

They don’t provide standard banking services such as accounts, credit cards and loans. Instead, a custodian bank acts like a high-security warehouse where the financial assets of businesses and individuals are held, either physically or electronically, to prevent them from being lost or stolen.

A depositary bank is a specialist financial institution that facilitates investment in securities markets with the trading of items such as stocks and bonds.

What assets do custodian banks hold?

The assets held by custodian banks range from equities and bonds to precious metals, fine art and cash. As well as safeguarding these assets, custodian banks provide a number of related services including account administration and tax support, collecting dividends and interest payments, handling foreign exchange transfers, and settling transactions. They also distribute activity reports and information about annual general meetings and shareholder voting.

What do depository banks do?

A depositary bank’s services include monitoring cash flow, record keeping and overseeing fund operations such as valuations, risk analysis and investor subscription and redemption activity.

What is the difference between a custodian bank and a depositary bank?

The main differences are in the types of client they have, their responsibilities and their levels of liability. This diagram summarises the differences, or you can read more by downloading our Put Simply guide to Custodian and Depository Banks.

Why Jersey?

Jersey has been attracting deposits and investments from institutions and private clients across the world for decades and is a major financial centre for banking:

- Jersey is responsible for an estimated £400 billion of assets owned by private individuals and families from around the world.

- There are 24 bank branches and subsidiaries located in Jersey – and they include nearly half of the top 25 banks in the world, measured by the level of their capital.

- With an AA-credit rating from Standard & Poor’s, Jersey is one of the world’s preferred banking partners.

- Jersey represents an extension of the City of London for corporate treasurers, institutional bankers and treasury specialists, fund promoters, brokers and other corporate financiers.

So, why have these banks chosen to have a presence in Jersey?

We’re independent

As we’re politically and financially independent from the UK, Jersey can afford to be flexible and support specialist business areas. For example, Jersey’s banking sector has provided services to support the fast-growing alternative investment funds industry, in particular the real estate, private equity, and hedge fund markets.

We’re well regulated

The regulation of Jersey’s banking sector has received an AA- credit rating from Standard & Poor’s meaning that an independent assessor thinks that the banking sector is safe.

The island’s superior regulatory environment has also been recognised by some of the world’s leading bodies, including the Organisation for Economic Co-operation and Development (OECD), the Group of International Finance Centre Supervisors and International Monetary Fund (IMF).

We’re experts

The banks in Jersey are supported by seven of the nine major offshore law firms, and seven of the ten largest accountancy firms have a permanent base in Jersey. They provide legal, audit, tax and advisory services.

Of course, all these companies need employees. We have more than 3,000 legal and accounting professionals supporting Jersey-based financial service providers, local and global firms and individual clients.

As a result, Jersey has an expert, highly-skilled workforce.