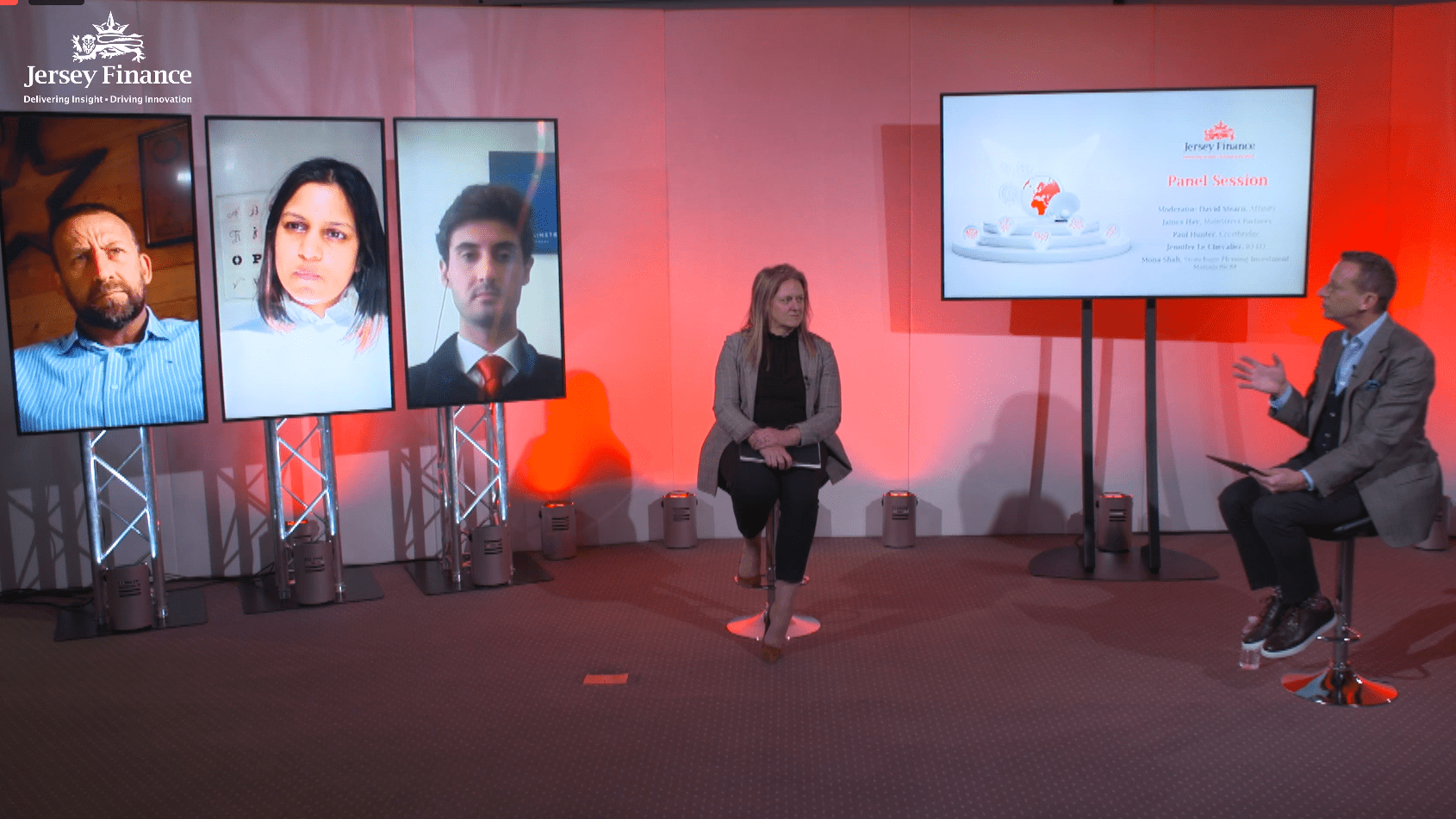

Exclusive to Jersey Finance Members, our inaugural event on 9 March brought together a panel of Jersey and UK experts to discuss ESG and NextGen, with a focus on wealth transfer.

Using the transcript from the event, here you will find the audience questions and answers answered by the panellists at the event.

Jersey Finance Members can view the event recording via Webinars on Demand.

Watch a few highlights and see what happened behind the scenes at our first ever Spotlight Private Wealth event.

Speakers and Panellists

Robert Moore › Director – UK, Jersey Finance

email › / profile ›

David Stearn CEO, Affinity

James Hay Investment Associate, MainStreet Partners

Mona Shah Director, Stonehage Fleming Investment Management

Jennifer Le Chavlier Head of Private Wealth, IQ-EQ

Paul Hunter Group Head of Family Office Services, Crestbridge

Quotes From the Audience Q&A

How would you as experts in your field simplify ESG to the older generation who sometimes just see it as ‘green’?

What activities of an environmental nature should be added to the sound business practice policy?

What should we/Jersey do in response to the EU Sustainability Finance Disclosure Regulation (SFDR), i.e., in terms of regulation, what do you think Jersey are doing or should be doing in response to SFDR?

Read James' full response

Regarding companies that currently rate highly from an ESG perspective, versus those that still have a way to go. How do you balance your portfolio? What balance do you try to pitch?

Mona Shah: “Great question. Particularly because there has been so much interest and this wall of assets flowing towards the whole ESG space, that we do sometimes have concerns about valuations for particular companies- particularly those that score highest or the most impactful”. Read more

Do the panel feel it is also vital that not to only look at sustainable investments, but also to get your own house in order to ensure you are doing what you preach?

“Like many in our industry, we are very committed to this and we want to have those conversations with clients as well. We encourage them. We’ve had quite a few new clients come to us recently and ask ‘what do you do? We need to understand what you’re doing in this area’. And it is becoming a very common ask”.

“We feel passionate that we have got to walk the walk and talk the talk, otherwise we are just not going to be believable. So, everything from pushing forward diversity policies to doing environmental audits of our office”.

“IQ-EQ Is not only influenced by our clients, but also by our staff who are multigenerational and they demand that we, as an organisation, change and adapt to adopt an ESG philosophy is all that we do and deliver”.

“Diversity of input is so important, especially to this area, so we have tried to go out and find people from diverse backgrounds”.

Other questions

Not all questions submitted at the event were answered on the day. Below you will find written responses to the unanswered questions submitted on the day. You can also download a PDF version of the full audience Q&As.

Q: With the recent launch of a 2030 Vision for sustainable finance in Jersey, what early measures would accelerate the journey towards raising Jersey’s profile and stand out from its competitors?

James Hay: There are a number of quick wins can that Jersey can take to accelerate sustainable finance in the island but these short-term measures need to keep long-term goals in mind. In Europe, regulators have brought in a radical new regime with certain goals top of the agenda such as redirecting capital towards sustainability, eliminating greenwashing and harmonising rules across the bloc.

Jersey can stand out and build its profile for sustainable finance by focusing more on the client relationship benefits of improving disclosure and providing an enabling environment for financial professionals to become the trusted ESG advisors of their clients.

Harmonised disclosure rules are very useful for product comparison and shining a light on adverse sustainability impacts but they may distract from having meaningful conversations with clients about their sustainable investment preferences and integrating their values into portfolios in a clear and comprehensive way. If that’s the end goal for advisors then Jersey should prioritise the context in which its professional services sector operates.

Q. What would be your advice for preparing the next generation to engage with philanthropy?

Paul Hunter: It is clear that the next generation is increasingly motivated to engage with philanthropy. In our business, we continue to emphasise the importance of maintaining a dialogue across the generations in the families we work with. We encourage families to discuss their goals and priorities, including philanthropic matters which are important to them. The next generation is perhaps more vocal about wishing to engage in the ESG space; but it is not an area exclusive to that generation and by encouraging families to continue to speak about what is meaningful to them, the generations may find more areas of agreement than they may have first thought.

In addition to recommending families maintain a dialogue with each other, we would also recommend the next generation seek advice from experts about the philanthropic causes they are interested in. It is beneficial to receive advice from people who have knowledge about entities who carry out philanthropic work and who can provide important details about the entities’ activities, governance and strategy so that the next generation invest in and connect with entities that best serve the philanthropic causes they wish to support.

In our team, we are increasingly educating ourselves so that we have meaningful conversations with our clients, including the next generation, and we act in a collaborative way with external advisors so that we are all well informed and engaged in this important sphere.

David Stearn: When preparing the next generation to engage with philanthropy, the family should assess the causes and values important to all of them and include the next generation in this conversation. This will give a sense of involvement and responsibility allowing participation and giving a sense of purpose for those involved. This must also include measuring outcomes required for philanthropic giving to ensure the intended outcome is achieved by those in receipt of the donation.

Q. Which senior leaders oversee your ESG policy – the CEO? The portfolio managers? In other words, is ESG truly a priority for your firm?

David Stearn: Within Affinity Private Wealth, ESG is dealt with at the most senior level of the organisation. It is a strategic priority dealt with at the top board level which, amongst other things, has resulted in a change to our articles to reflect our business is responsible to our stakeholders and not just shareholders. The stakeholders include clients, staff, the environment, our community and of course, as a ‘for profit’ organisation, our shareholders.