Welcome to the First for Funds Newsletter

Welcome to our funds newsletter, First for Funds, which provides news, views and updates on Jersey’s funds sector.

At a Glance:

New business development director for funds appointed

New research: Jersey for Alternative Lenders: A Bright Future

LLC legislation gets the green light

Finance industry figures reveal an upbeat picture for first half of 2018

Funds thrive using Private Placement

Mid-year figures show appeal of the Jersey Private Fund

Jersey Finance welcomes provisions for CIVs investing in UK property

CEO blog: The African FDI Opportunity

Latest funds factsheets

New appointment Business Development Director for funds

We are delighted to announce the appointment of Elliot Refson to the role of Business Development Director – Funds.

Elliot took up the role earlier this month and will have responsibility for driving the strategy and promotion of fund relocations and inward investment.

To contact Elliot, please click here.

Latest research Jersey for Alternative Lenders: A Bright Future

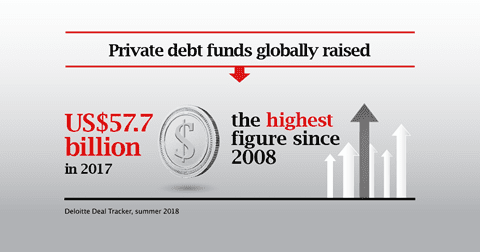

In 2017, more than US$57 billion was raised by private debt funds – a nine year high. This report – Jersey for Alternative Lenders: A Bright Future’ – looks at why an increasing number of borrowers are choosing alternative lenders, even if the banks can offer them cheaper solutions, and how jurisdictions like Jersey are ready to support this growth.

New legislation LLCs get the green light

Legislation in Jersey, that will enable the establishment of Limited Liability Companies (LLCs) and has the potential to significantly enhance pan-Atlantic business with the US, has been given the green light. Work is now underway to complete the regulatory framework and make LLCs available for use.

Latest industry figures Upbeat picture revealed by latest stats

Latest figures on the size of the finance industry in Jersey show the value of the funds sector is at a record high.

Future-proof fund regime Funds Thrive Using Private Placement

National Private Placement Regimes (NPPRs) are proving an increasingly popular means of marketing into Europe and, as such, the Jersey Funds Association has published four case studies to demonstrate how they’re being successfully used.

Jersey Private Fund JPF showing strong appeal

Mid-year figures from Jersey’s regulator show the Jersey Private Fund structure (JPF), launched last year, is continuing to show strong appeal across the alternative asset classes.

UK tax update Provisions for CIVs investing in UK property welcomed

Jersey Finance has welcomed the release of the Technical Note, and associated clauses within the draft Finance (No. 3) Bill, setting out the Capital Gains Tax (CGT) treatment for non-resident collective investment vehicles (CIVs) investing in UK property.

CEO blog The African FDI Opportunity

Our CEO, Geoff Cook, has looked at the opportunity for foreign direct investment into Africa in conjunction with a number of events in the region that Jersey Finance has taken part in.

New promotional material Funds Factsheets

The following factsheets, which offer clarity on our funds offering, are now available on our website: