Debt investing has grown substantially over the last few years, while the domiciliation of debt structures has evolved. Jersey Finance, in partnership with IFI Global, organised a roundtable event in New York recently on ‘Investing in and Structuring Debt Instruments in 2022′.

Guests at the roundtable discussed the prospects for different types of debt instruments going forwards (with a particular focus on collateralised loan obligations) in potentially more challenging macro-economic circumstances, as well as their domiciliation trends.

In the following article, Simon Osborn, CEO of IFI Global, reflects on the discussion that took place at the roundtable.

Going into 2022 few would have forecast what happened over the first half of this year in the CLO market. 2021 was an extraordinarily strong year for structured debt, including for CLOs (collateralised loan obligations). But the economic outlook was very different back then. On top of today’s more challenging market environment there have also been significant changes in the structuring of these instruments, particularly with regard to their domiciliation, this year.

Given the changing market and structuring environment FSI hosted a roundtable on June 9 in New York with Jersey Finance to discuss what is going on in the world of CLOs.

Attending the roundtable were:

- Taylor Carman, Associate, Mintz, Levin, Cohn, Ferris, Glovsky & Popeo

- Guy Dominy, Director, Business Development – Americas, Maples

- Miles Edwards, General Counsel & CCO, Sanctuary Wealth

- Theodore Gillman, Managing Principal, Crito Capital

- Simon Osborn, CEO, IFI Global

- Michael Passmore, Head of Debt, Capital Markets & Corporates, IQ-EQ

- Chris Patton, Director, Head of Private Equity, Intertrust

- Philip Pirecki, Business development Lead, the Americas, Jersey Finance

- Elliot Refson, Head of Funds, Jersey Finance

- Kareem Robinson, Head of Capital Markets, Cayman, Ocorian

- Nina Varughese, Partner, Perkins Coie

Highlights

The impact of the macro environment on CLOs

Simon Osborn started the discussion with a macro-economic overview. He suggested that the Fed and other central banks have been well behind the curve with their recent interest rate rises. That is the chief cause of today’s inflation, it is not primarily due to the fallout from the war in Ukraine. Monetarists had warned that the growth of M1, M3 and M4 in late 2020 would cause double-digit inflation 18 months later. The Fed has embarked on a policy of aggressive interest rate tightening now, just when monetary growth in the US has begun to contract.

What does all this mean for the CLO market? Michael Passmore said that he expects that there will be a lot of volatility in the short term, but he also anticipates there to be a rebalance. ‘This is likely to happen across all markets, not just in debt. As central banks raise interest rates things will inevitably tighten up. The spreads on CLOs are going up. There will be a re-pricing in the market but in the long run I am optimistic. There will be a sell off, then it will come back.’

Kareem Robinson suggested that there is a lot of uncertainty on when deals will close for the time being. He had expected some of them to do that in the second quarter but that did not happen, in several cases. ‘Investor appetite to proceed just isn’t there at the moment. There is a lot of dry power but investors don’t want to spend it. Perception is reality: people see the bad economic news and so are holding back.’

Guy Dominy also suggested that investors are standing aside because of the macro environment. ‘They will come back in if the returns are right. At the moment spreads are increasing however the equity tranche of CLOs is still looking

fairly attractive for the time being, particularly if you are using leverage. CLOs should perform well in an inflationary environment as they are floating rate products.’

Theodore Gillman said that what is happening is about the price the credit, it is not really about the duration. ‘There is a repricing in the capital markets occurring as risk assets such as equities and high yield debt are being sold off. But we have not had a major repricing of long dated Treasuries. For the time being people do not want to take the risk; that is why deals with an equity like component are not going through. If we are back into a higher inflationary environment then people will gravitate more to equites and out of fixed income.’

Speaking as a lawyer who focuses on debt finance and restructuring Nina Varughese suggested that if economic stresses such as rising interest rates along with supply and labour shortages continue, then we may see default rates go up with more restructurings and bankruptcies. ‘These have already started in distressed small and mid-cap companies where lenders have less of an appetite to kick the can down the road and where these companies have no viable alternatives to refinancing their debt structures.’

CLO issuance

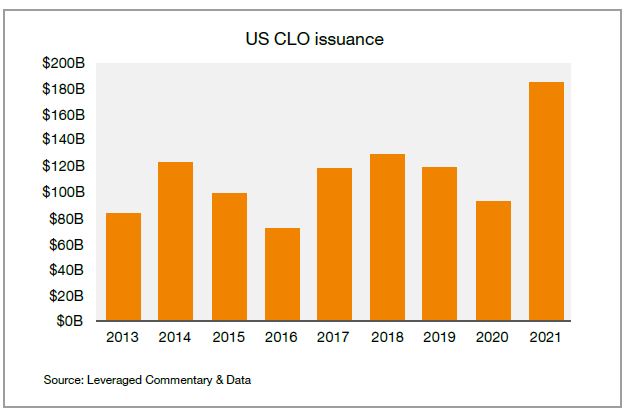

Despite the economic headwinds roundtable participants were confident that 2022 CLO issuance will be fine. Michael Passmore said that he expected it will slow over the next two quarters but that the overall numbers will be similar to what we have had in the past other than 2021’s record.

Guy Dominy made the point that US CLO issuance so far this year isn’t far behind 2021’s record. And in Europe it is actually slightly ahead of where it was last year. ‘Therefore, this current situation is probably only temporary; I think we will see an improvement later in the year.’

‘Everyone would agree last year was outlier and that this year will not be as prolific,’ said Kareem Robinson. ‘There will be nowhere near the same level of issuance as there was in 2021. Inflation is playing a high price, particularly from a cost perspective. The rising fees are difficult as rates are often fixed,’ he added.

CLO domiciliation

There is a significant change going on in the world of CLO domiciliation this year. Why this is happening was addressed in some detail at the roundtable. It is primarily the result of Cayman being put on the FATF’s ‘grey list’ in 2021 which led to the EU then placing this Caribbean jurisdiction on its own list of high-risk countries.

Philip Pirecki said that the European regulatory environment has made it difficult for investors to allocate to funds which are in blacklisted jurisdictions. ‘This is benefiting Jersey. So far for this year over 110 CLOs have moved from Cayman to Jersey. The expectation is that there will about 200 over the year as a whole.’

Guy Dominy added that Maples is seeing some of its CLO manager clients, with European investors, deciding to move all of their CLOs to Jersey from Cayman. They don’t want to risk their investors being caught by regulations or waste a lot of time or money doing the analysis.

Michael Passmore made the point that Cayman has been great for the US and for CLOs as well as other securitised products. When Cayman had its difficulties with the FATF service providers who were based there made the point that there are other jurisdictions, like Jersey, which are similar that we could use instead. But for the US market Cayman will continue to be a popular place to go to.

Kareem Robinson, who is based in Cayman, thinks that even when Cayman is removed from the EU’s blacklist managers with European investors will continue to incorporate in Jersey. It takes the risk away for them.

This article was first published in the June issue of IFI Global’s publication FSI.