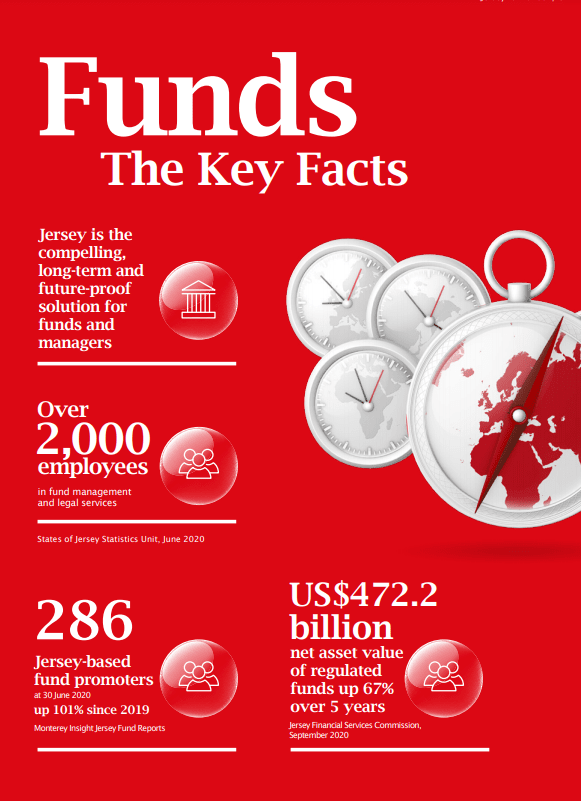

The funds industry is constantly evolving and Jersey’s fund administration firms and legal professionals are at the forefront of a range of emerging trends.Take alternative investments such as venture capital, private equity, real estate and hedge funds. Jersey has worked hard to develop expertise in these areas, as well as with funds in cutting-edge asset classes like mezzanine and infrastructure.

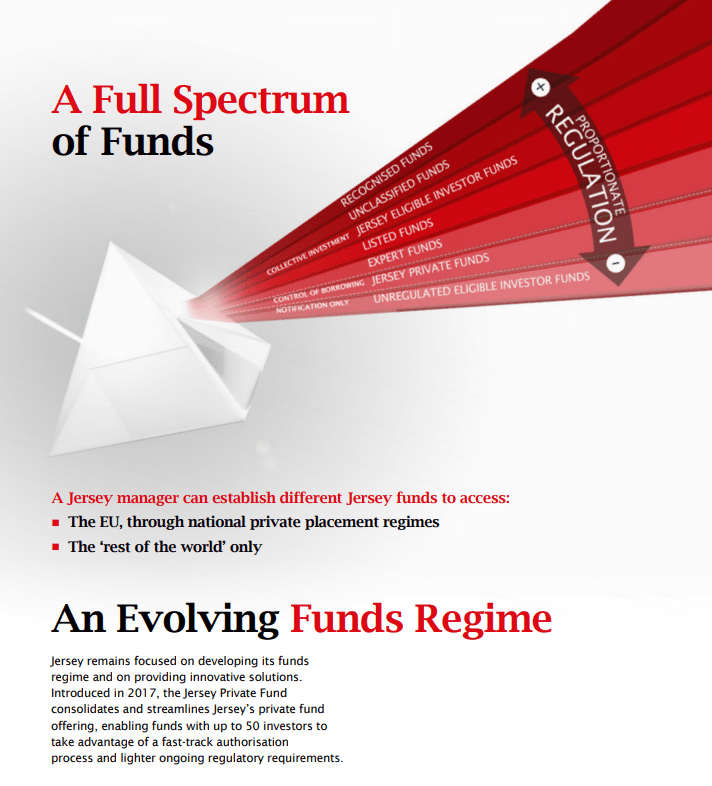

The international regulatory and legislative landscape is changing all the time too. Jersey’s funds regime reacts with agility, offering managers a full spectrum of regulatory options.

Lawyers work closely with counterparts in all of the world’s major centres, including London, the US, China, India and the GCC, to deliver structured products and specialist vehicles that meet a whole range of financial and investment objectives.

“For Jersey, the emphasis is undoubtedly on providing a premium, quality service and this is ensuring that the Island’s long-held reputation as a centre of substance and a service provider of excellence is standing it in good stead. In a global environment that remains challenging from a regulatory point of view, Jersey offers significant fund structuring opportunities through the right support and guidance.” Mike Byrne Chairman, Jersey Funds Association

The International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development (OECD) and the European Union (EU) have all endorsed Jersey as a top international finance centre.

A major report published by MONEYVAL underlines Jersey’s ability to combat financial crime through a sophisticated system of capturing ownership information about entities and structures in the jurisdiction.

Jersey is endorsed as a top international finance centre by…

Flexibility and Innovation

Able to cater to most investor needs, whether to establish a fund as a company, partnership or unit trust, Jersey funds can be open or closed-ended, providing significant flexibility.

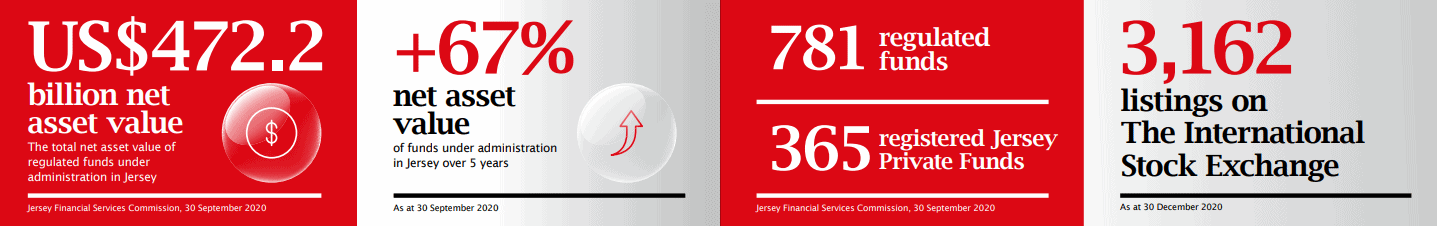

The Island makes a perfect base not only for fund raising, but for listing funds on international exchanges, from New York to Hong Kong and, of course, London, the Island’s close neighbour. The Channel Islands also have their own exchange, The International Stock Exchange (TISE), which provides a responsive listing facility for those looking to raise funds.

Jersey’s product laws have been enhanced with some truly innovative features, which serve to make its funds offering even more versatile. Meanwhile, the JFSC continues to develop its regulations to provide choice for investors and maintain the Island’s position at the forefront of fund services. The JFSC’s level of regulatory supervision is proportionate to the inherent risks of fund structures used, dependent on the number and type of investors to whom a fund is offered.

The Island also offers clients access to a wealth of expertise from Jersey service providers, including fund administrators, banks, custodians, depositories, to accountants, tax advisers and legal professionals, who have the knowledge and international connections to deliver perfectly tailored products and specialist vehicles, whatever the investment objectives.

A Compelling Alternative

Alternative investment funds, including private equity, hedge, real estate and infrastructure funds, are increasingly in demand on a global scale. They are particularly popular among the new wave of high net worth individuals and sovereign wealth funds emanating from emerging markets.

In the current climate, alternative fund managers are adopting global strategies and seeking to raise capital in growth markets around the world. Therefore, it is appealing to use a longestablished jurisdiction that has expertise in handling alternative funds business.

Jersey has carved a niche as a specialist centre in alternative funds, which now account for around 70% of the Island’s overall funds business.

For more information on funds, factsheets are available at www.jerseyfinance.je/publications

Jersey offers a range of benefits for alternative funds including:

- A tax-neutral environment to avoid double or triple taxation of funds and their investors

- Alternative fund providers of varying sizes and areas of specialisation

- A regulatory framework that has evolved specifically for alternative asset classes

- A range of regulatory regimes offering different levels of regulation depending on the investors’ needs

- Flexible fund structures allowing for innovative investment strategies and bespoke investor protection mechanisms

- Outstanding quality of life for those managers looking to relocate

- Infrastructure

A relatively new yet fast-growing asset class, infrastructure funds focus on large-scale, capital-intensive projects that are seen as stable, long-term investments for sophisticated investors. - Hedge funds

Jersey’s fund management community is expanding at an impressive rate with inward migration of hedge fund managers a key feature, complementing the Island’s well-established fund administration industry. Hedge fund manager figures now place Jersey in the top ten globally, with large players in the funds industry, such as Systematica, Brevan Howard and BlackRock, relocating here. - Private equity

Jersey has a long-established pool of expertise serving some of the world’s biggest private equity managers. This track record, together with the flexibility of the funds regime, and the futureproofed solutions it provides, makes Jersey a compelling choice. - Real estate

Jersey has been a prominent player in real estate services for many years and is the location of choice for many real estate structures and funds investing around the world. At 30 September 2017, there were 183 regulated collective investment funds being administered in Jersey investing in real estate, with a net asset value of $49.3bn.

A Substantial Offering

Thanks to its reputation for strong but appropriate regulation and a robust and stable legal framework, Jersey is home to some of the world’s largest fund administration providers.

Jersey’s funds industry attracts a large amount of money raised worldwide and is perfectly placed to pool investors’ monies and put this to work elsewhere. Jersey has proven itself to be popular among fundraisers in the US and the Far East, as well as to sovereign wealth from emerging markets.

Jersey is also a growing centre for major fund managers looking to relocate, not least because fund managers are putting substance at the heart of the decisions they make.

Its appeal as a jurisdiction of substance is evident not only through the presence of more than 280 fund promoters doing business on the Island (Source: Monterey Insight Fund Report 2020), but through the number of high-profile manager relocations in recent years. Foreign investors are also attracted to Jersey’s network of skilled and experienced service providers.

Jersey has an approachable, proactive regulator who can adapt to short timeframes, and an attractive and sustainable system of tax neutrality for funds business.

The presence of an experienced pool of fund director, administrator, depositary, audit and legal talent also adds to the attractiveness of the jurisdiction.

Changing regulation across the globe, including the 15-point action plan set out by the OECD as part of the Base Erosion and Profit Shifting (BEPS) agenda, is likely to result in further fundamental changes to international tax standards. This can provide Jersey with real opportunities as a substance jurisdiction, offering genuine asset management expertise.

Leading the Way

Jersey has a legal, tax and regulatory framework that adheres to all of the key international standards across its finance industry.

It remains one of the leading international finance centres, a position that has been acknowledged by independent assessments from some of the world’s leading bodies, including the OECD. Currently, Jersey managers, as they are based outside the EU, remain beyond the full compliance of the Alternative Investment Fund Managers Directive (AIFMD), yet they can still gain easy access to capital on the continent through EU Member States’ National Private Placement Regimes (NPPRs). Access via NPPRs may provide for lighter touch regulatory obligations, including in relation to leverage, capital requirements and remuneration rules.

Looking ahead, in an announcement relating to the extension of the funds passport to non-EU countries under AIFMD, the European Securities and Markets Authority (ESMA) recommended that Jersey should be included in the first wave of third countries whose managers can seek authorisation for a passport to market their alternative funds to professional investors throughout the EU.

Jersey is one of only five non-EU jurisdictions to be included in this, having been deemed by ESMA as having no significant obstacles at all in being able to apply the passport. This development promises to provide long-term access to EU capital, initially through NPPRs and, in time, via passporting.

The number of Jersey-based fund promoters has almost doubled over the past five years. There are more than 100 managers and 250 funds currently authorised by the Jersey Financial

Services Commission (JFSC) to market into Europe under AIFMD.