Jersey’s deep financial services expertise, its respected regulatory framework and its robust legal system mean that our Island is a key location for pooling capital and for facilitating international trade and economic activity.

Value chains are the full range of activities that firms and workers undertake to bring products or services from conception to end use and beyond, performed within the same firm or divided among different firms and countries. Jersey plays an important role in the efficient functioning of these value chains and economies globally. Cebr’s research has quantified the specific contribution of Jersey’s financial services industry, through the metrics of GDP, employment and wages.

Log in now to view a summary of the key findings and to download Cebr’s full report.

The figures show that although Jersey is relatively small, the Island makes a very significant impact on the global economy.

Introduction

Jersey’s deep financial services expertise, its respected regulatory framework and its robust legal system mean that our Island is a key location for pooling capital and for facilitating international trade and economic activity.

Value chains are the full range of activities that firms and workers undertake to bring products or services from conception to end use and beyond, performed within the same firm or divided among different firms and countries. Jersey plays an important role in the efficient functioning of these value chains and economies globally. Cebr’s research has quantified the specific contribution of Jersey’s financial services industry, through the metrics of GDP, employment and wages.

The figures show that although Jersey is relatively small, the Island makes a very significant impact on the global economy.

You can find a summary of the key findings, including a short video, below. You can also download Cebr’s full report.

Key Findings

Jersey’s Global Contribution

Cebr’s research has revealed that on average each year, between 2017 and 2020, Jersey intermediated £1.4 tn of capital and this supported £170.3 bn of global economic output, 5.1 million jobs worldwide and £73.3 bn in associated wages. To give the GDP figure scale, in 2020, the direct GDP contribution of New Zealand was around £172 bn.

Capital Administered

GDP Supported

Employment supported

Wages supported

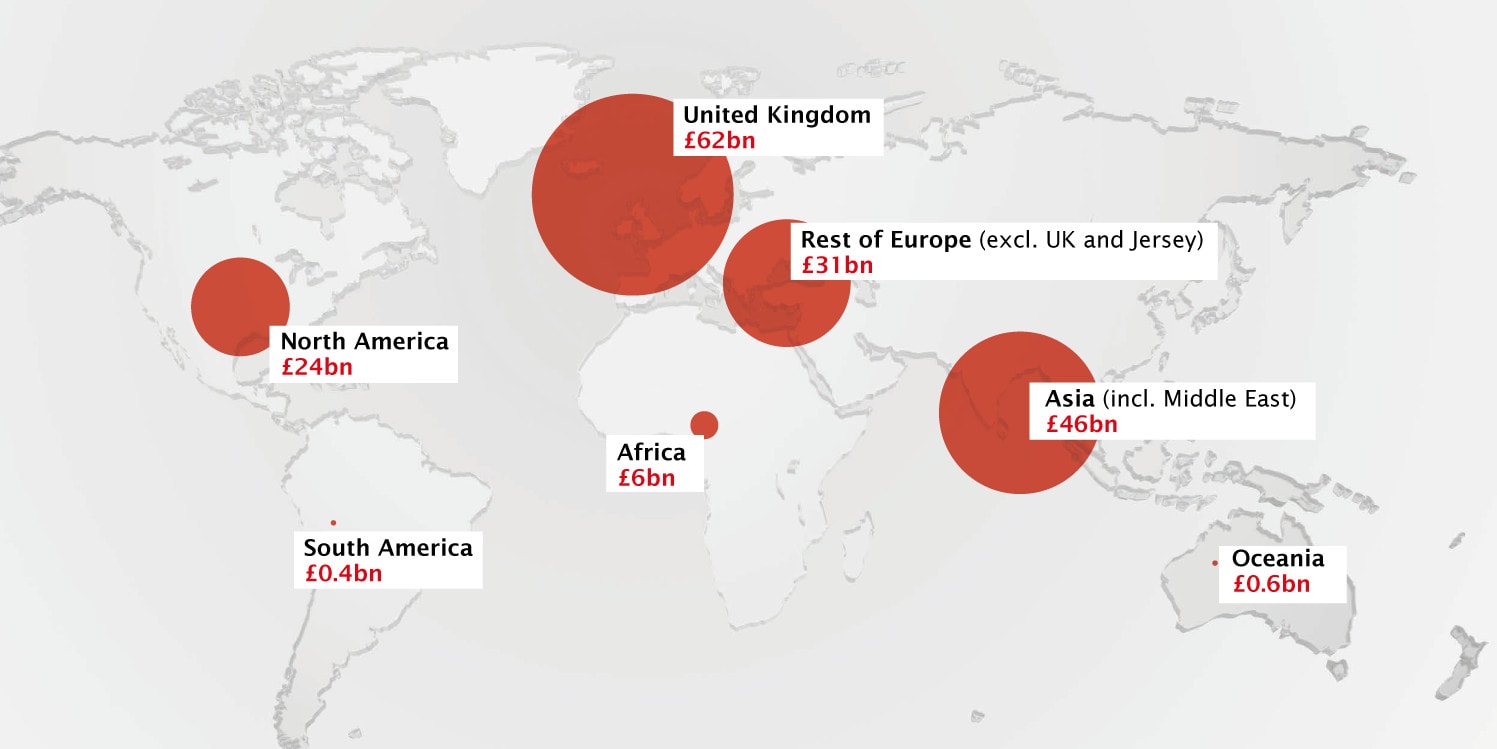

Jersey’s Support of Regional GDP

The United Kingdom was the most significant destination of capital across the period examined. The value chains that Jersey’s financial services sector supported contributed an annual average of £62 bn of UK GDP between 2017 and 2020, representing approximately 2.9% of total UK output. Europe was the most dominant continent, followed by Asia (inc. Middle East) and North America, Africa, then Oceania and South America.

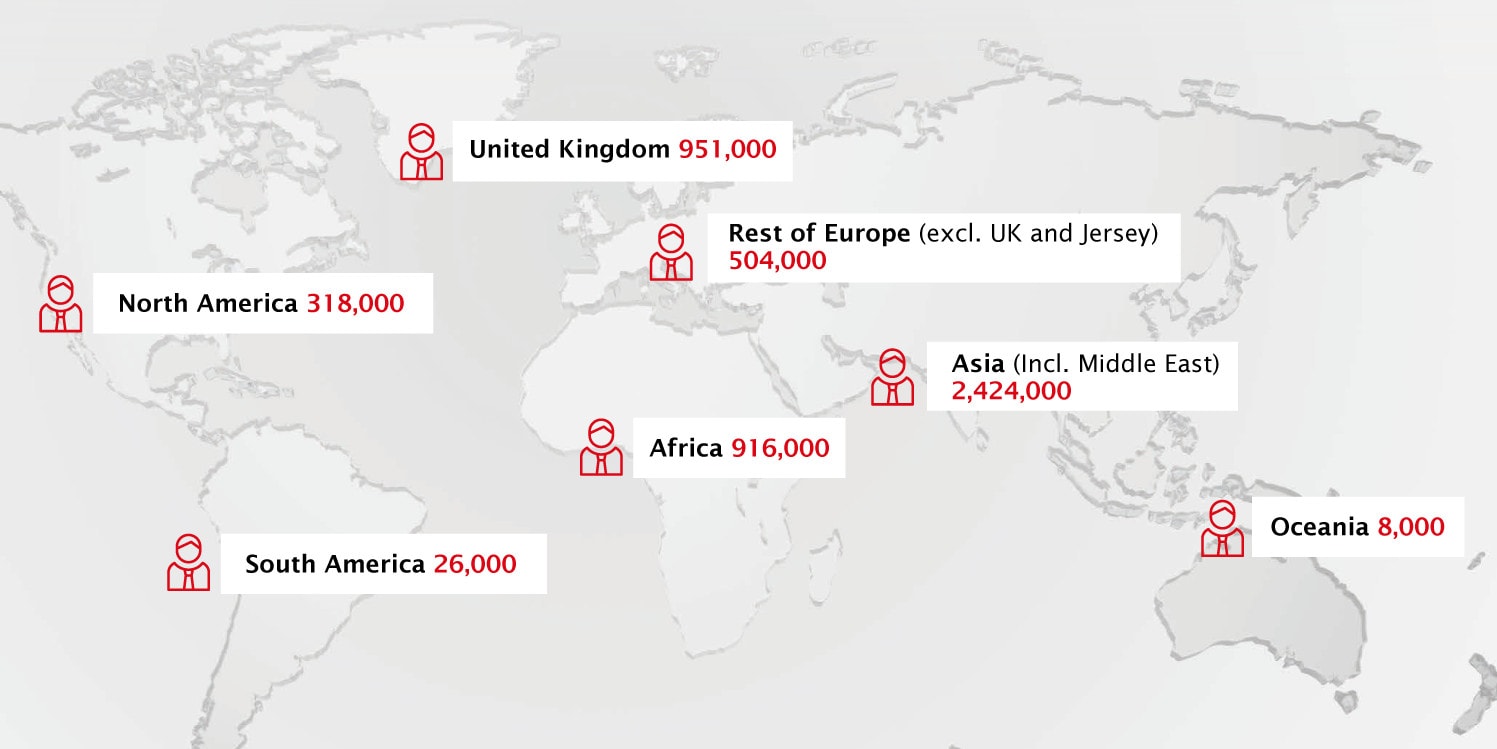

On average annually, between 2017 and 2020, capital intermediated in Jersey supported 5.1m jobs worldwide and £73.3 bn in associated wages.

For every job in Jersey’s financial services sector, the value chains facilitated supported an additional 380 jobs globally.

Jersey’s Support of Regional Employment

Cebr estimated the number of jobs supported within each region by Jersey’s role as a conduit for capital flows. The following illustration shows the number of jobs supported on average each year during the period examined (2017-2020).

Finance Sector Analysis

Key Sectors

Cebr examined three of Jersey’s key finance sectors – Funds, Banking and Trusts and Asset Holding Vehicles (AHVs) – to assess their impact on economic activity.

Funds

Cebr found that on average annually during the period examined (2017-2020), Jersey’s funds sector supported a scale of economic activity in line with the total GDP of Bahrain in 2020.

of capital serviced by the sector, supporting...

of global GDP via GVCs

Jersey is a global leader in the funds sector. Just under 90% of the market is in specialist, or alternative, asset classes – notably venture capital and private equity, but also in real estate, hedge, infrastructure and derivative funds.

While the headline figures above are annual averages for the period 2017 to 2020, in the most recent year examined, 2020, a total of £282.1 bn of capital was serviced by Jersey’s funds sector. More than 30% (£85.7 bn) originated from Asia and the Middle East, with North America second at £77.5 bn. Asia was the most significant destination for the capital – as well as being the fastest-growing region over the four years surveyed – with £109.7 bn allocated there in 2020, demonstrating its continuing attractiveness.

85.4% of the total global output supported by the funds sector came from Asia, the Middle East, the UK and the rest of Europe. The United Kingdom’s absolute level of economic output supported by Jersey’s funds sector was similar to North America’s, but the relative share of its total GDP was almost eleven times higher.

Cebr defined the scope of Jersey’s fund sector as regulated funds that are both domiciled and administered in Jersey, so the associated impacts of the sector were appropriately attributed to the Island, as some non-domiciled funds do not carry out all functions of their activity in Jersey.

Banking

Cebr found that on average annually during the period examined (2017-2020), Jersey’s banking sector supported a scale of economic activity in line with the total GDP of Iceland in 2020.

of assets administered by the sector, supporting...

of global GDP via GVCs

Jersey’s banking sector has been providing services to institutions and private clients globally for decades and includes retail and commercial banks, private banks, expatriate banking, and custodian and depository banks.

In 2020, £143.3 bn of assets were administered. The primary funding source is deposits (the majority of these are customer deposits, with bank deposits constituting the rest). Senior debt issued, and all other liabilities and equity, are the remaining sources. Europe (including the UK and Jersey) accounted for 80% of the funding and 90% of the sector’s allocation during the period examined. Assets allocated to Asia nearly tripled, while those to Africa nearly doubled. The UK remained dominant, representing £98.2 bn in assets in 2020, 68% of the total.

Jersey is a significant contributor to UK GDP growth, and a vital FDI facilitator and wealth creator. Jersey banks are crucial in providing funding for their parents’ operations in the City of London, with more than £80 bn of balance sheet funding provided through intra-group transfers. 87% of the total global GDP supported by Jersey’s banking sector came from the UK and the rest of Europe, highlighting the strength of the interlinkages between the regions and Jersey’s banking sector.

Trusts & Asset Holding Vehicles

Cebr found that on average annually during the period examined (2017-2020), Jersey’s trusts and Asset Holding Vehicles (AHVs) sector supported a scale of economic activity in line with the GDP of Hungary in 2020.

of capital administered by the sector, supporting...

of global GDP via GVCs

Private wealth management is the third major sector of Jersey’s financial services industry. Structures such as trusts and foundations allow both private and corporate clients to manage, protect and grow their assets. The sector is by far the largest in terms of assets administered.

The figure for assets under management here was £1.14 tn in 2020. Across the period examined, around 40% was financial assets (split between shares and other financial assets), with another 40% property and land. Of the remainder, the majority was cash (16%).

Jersey’s Trust Law has been key to the Island’s reputation as an attractive destination. Of the assets held in Jersey trusts and other vehicles, 70% was settled by individuals resident in Europe, including the UK and Jersey. The remaining 30% was primarily settled by clients in Asia, including the Middle East, or North America. There has been a noticeable increase in trust business attributable to Asia and the Middle East.

Of the £126 bn global GDP supported by this sector, 80% was generated by Europe and Asia, including the Middle East. £45.5 bn of the global GDP figure was generated by the UK specifically. Asia and the Middle East’s absolute level of economic output support was more than that of the rest of Europe’s, but its relative share was lower.

*Annual averages 2017 – 2020

Jersey’s Financial Ecosystem

During the course of Cebr’s research, the on-island availability of world-class professional and legal services was the most highlighted factor in what makes Jersey an attractive jurisdiction to do business.

The Island’s ancillary services underpin Jersey’s annual administration of nearly one and a half trillion pounds sterling of capital. All other industries within Jersey’s financial ecosystem require these firms to provide services. While the funds, banking, and trust and other AHV sectors in Jersey are key in directly facilitating Jersey’s role within global value chains, their activity is enabled by the professional services network on the Island.

Cebr’s research highlighted that the contribution of this network to GVCs is not in the direct intermediation of the capital, but that these organisations play a key role in Jersey’s ecosystem by creating an environment in which the finance sectors that are directly involved in intermediating capital can do so more effectively. For well-established firms and new companies looking to grow, access to the full range of business services enables the efficient operation of all business functions.

Jersey’s professional and legal services providers make a clear economic contribution through their facilitation of the main finance sectors, the key drivers of Jersey’s contribution to global value chains.

About the Research

In 2020, we commissioned the Centre for Economics and Business Research (Cebr), one of the UK’s leading economic consultancies, to explore Jersey’s contribution to global value chains. Cebr carried out its research in 2021, with assistance and data provision from Jersey’s financial services firms, namely banks, funds and trust companies.

Organisations were surveyed to identify where Jersey’s administered capital originated over a four-year period between 2017 and 2020, as well as its end geographic allocation. This research was complemented by data from the Jersey Financial Services Commission, Statistics Jersey, Jersey Finance and other sources. Jersey Finance would like to thank all those who contributed to this important project.

About Global Value Chains

Value chains are the full range of activities that firms and workers undertake to bring products or services from conception to end use and beyond, performed within the same firm or divided among different firms and countries.

Global value chains highlight the shifting patterns of trade and production, and the increasing interconnectedness of the global economy. Technological transformations have accelerated the trend, as well as an increasing specialisation by different locations in the production and exporting of certain goods and services.

Jersey facilitates the flow of capital and investment globally. Financial services are integral to the range of business functions in supply chains across all global value chains, including research and development and procurement. Access to capital is critical throughout the lifecycles of businesses, from early-stage seed capital to Series C or D funding, and beyond in some cases.

Jersey plays an important role in the efficient functioning of interconnected value chains and economies globally. Cebr’s research quantifies the specific contribution of Jersey’s financial services industry, through the metrics of GDP, employment, and wages.

Ask the Author

We interviewed Owen Good, Lead Author at Cebr, for his thoughts on the project.

Q: What do the headline numbers tell us about Jersey’s contribution to the global economy?

A: The figures show that, although Jersey’s GDP is relatively small compared to many nations, it makes a very significant impact on the global economy. Nearly one and a half trillion pounds in assets are administered by firms on the Island, and these assets are used to support economies around the world, through supporting more efficient capital allocation. Also, the figures show how the macroeconomic impact of the £170.3 bn of global GDP that Jersey supports sustains employment across the globe. And they demonstrate just how effective Jersey’s financial sector is. For every job in Jersey’s financial services sector, the value chains facilitated support an additional 380 jobs globally.

Q: What has been the impact of the COVID-19 pandemic?

A: Despite the global economic turmoil resulting from the COVID-19 pandemic, the impact on Jersey’s role in supporting global value chains has been limited. In fact, the total assets under management of Jersey-administered funds increased by £24.9 bn – that’s just under 10% – between 2019 and 2020, while the total value of capital intermediated in Jersey banks increased by £9.6 bn. Additionally, the estimated value of assets held in Jersey trusts increased by £15.4 bn.

Q: How is Jersey able to add value?

A: Jersey’s tax neutrality is a factor when it comes to ensuring capital is pooled efficiently and allocated around the world so it has the maximum impact, but the non-tax based advantages are also significant. In our interviews with Jersey Finance Member firms, one of the most frequently highlighted factors in making Jersey an attractive jurisdiction to do business was the on-island availability of world-class supporting professional and legal services. So, while the funds, banking and private wealth management sectors in Jersey are key in facilitating Jersey’s role within GVCs, these firms can only carry out the work they do efficiently and effectively thanks to the ancillary professional services network on the Island.

These positive spillovers associated with agglomeration are a rich topic within economic theory; the responses provided by interviewees in Jersey provided strong support that this benefit is realised within Jersey’s finance industry.

Another benefit is Jersey’s regulatory and legal infrastructure. The quality of financial regulation in Jersey was often cited as a major draw for businesses on the Island. One particular feature is that there has been an open dialogue between the firms and the regulator. The collaborative approach has meant that legislative changes, such as the economic substance rulings, are well communicated to businesses, promoting stability for Jersey.

Jersey’s legal framework also supports the Island’s finance industry. Jersey is a world leader in the trust and private wealth sector and the evidence collected suggests that the quality of Jersey’s courts and legal system is a key contributor to the quality of the overall service that can be provided by Jersey trust and private wealth companies.

Q: What are Jersey’s prospects for the future?

A: Our research suggests that Jersey’s robust contribution to global value chains looks set to continue. Total capital intermediated in Jersey is set to expand by just under 50% in the years between 2020 and 2030, surpassing the £2 tn level. The expansion will be driven by the expected strong economic performance across Asia, and in particular in those markets with which Jersey has existing strong financial-sector links. Indeed, in the central forecast, the value of the capital intermediated in Jersey flowing to the region will roughly double between 2020 and 2030, increasing from £291 bn in 2020, to £610 bn.

North America is another region set to grow significantly as a market for Jersey’s capital allocation, with the value of capital intermediated in Jersey set to rise by just over 50% from £200 bn in 2020 to £300 bn by 2030. Meanwhile, growth in the UK market is expected to be more moderate, at 24%, between 2020 and 2030. Despite this more tempered rate of expansion, the UK will still be the greatest source of Jersey’s capital allocation by 2030, with an estimated £656 bn supported.

Read Cebr’s full report, including more analysis and details on methodology

Podcast

Work

Downloads

Please log in to view this content OR create an account/create a login

You must login to the Jersey Finance website to access this area. If you do not have a login, please create one.

Help

To create a login, click here

Or please press the back button on your browser to return to the last page to try again or return to the homepage.

To reset your password please click here.