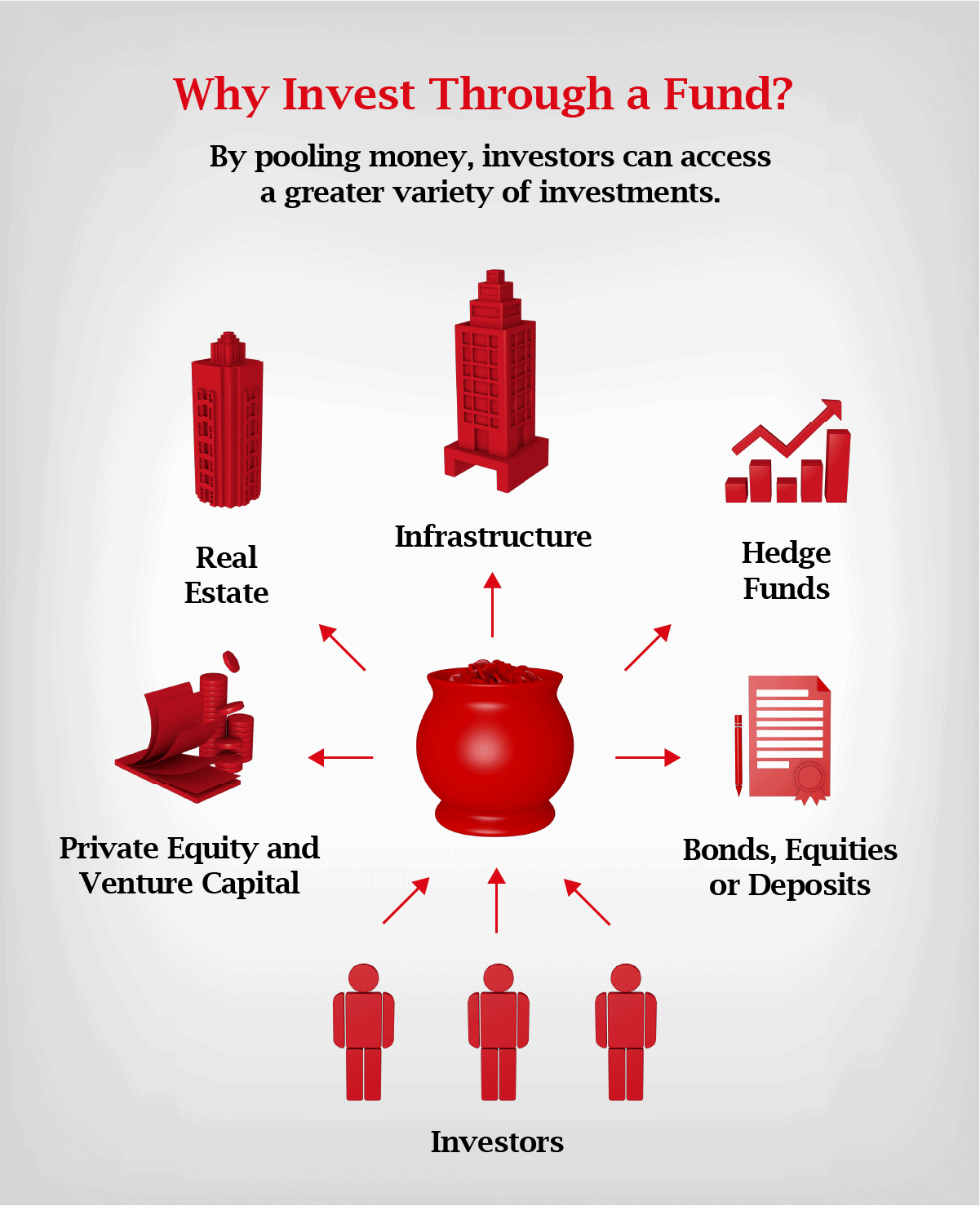

Investment funds bring together multiple investors who invest their money together.

By pooling money, investors can access a greater number and variety of assets, or assets of a higher value.

Jersey offers a wide range of investment vehicles and fund regulatory options to provide funds and fund managers the right structure and is a centre of excellence for alternative investment funds.

Investing in a fund

Here, we’ve explained some of the basics about funds and investing using a fund.

Why invest in a fund?

Putting your money in to a fund can give you the chance for better returns than in a deposit account or by investing money by yourself.

Investors in investment funds ‘pool’ their money, that is, they invest it together as one large amount. Investors own a proportion of the entire value of the fund – they do not own the fund’s assets directly.

Through investment professionals and because of the larger ‘pooled’ amount of money available for investment, investors will have access to markets and investment products which might otherwise not be accessible.

The benefits of this can be enormous with investors hoping to gain back the capital they invested and/or receive a dividend or share of the profits made by the investment fund at fairly regular intervals.

Who can invest in a fund?

It depends on the qualification of the fund. Funds that are available to individuals are called retail funds. Some funds are only available to professional investors such as institutional and/or sophisticated investors.

How do you invest in a fund?

Most banks, investment firms, trust companies and financial planning firms offer a variety of online fund platforms which you can invest in.

Asset types

Jersey specialises in ‘alternative investment’ funds. They are known as ‘alternative’ compared to more conventional funds that invest in bonds, equities and cash.

Let’s take a look at the types of assets alternative investment funds may invest in.

Real Estate

Jersey is one of the best-known jurisdictions for structuring real estate funds. Jersey funds hold portfolios of real estate assets situated across the world, from UK student accommodation and iconic landmark buildings, to European shopping centres and Asian office complexes.

Private Equity

Private equity is an alternative investment asset class. It typically refers to investment by either funds or individuals into private companies. Private equity funds may also be involved in the buyouts of public companies.

Venture

Venture capital funds typically invest in young or entrepreneurial companies. An example of such a fund is one which is structured as a private equity fund that focusses on Chinese and Indian companies in the technology and digital space. Another example is a venture fund which invests in the digital gaming sector.

Infrastructure

Infrastructure funds are as they sound; they offer investment opportunities into infrastructure projects such as roads, airports and rail facilities. Infrastructure funds are usually structured as limited partnerships and look very similar to private equity funds, although they are also much larger because the size of the projects they invest in are often enormous. One such fund is a pan-European infrastructure fund which invests in motorways in Germany, ports in the Netherlands and airports in the UK.

Debt

Debt funds generate returns from their investors’ money by investing in bonds or deposits of various kinds, such as treasury bills, corporate bonds, government securities and other debt securities in return for a fixed rate of income. A bond is like a certificate of deposit that is issued by the borrower to the lender. These terms basically mean that they lend money and earn interest on the money they have lent.

Hedge Funds

A hedge fund is an investment fund that pools capital from sophisticated or institutional investors and invests in a variety of assets, often with complicated portfolio-construction and risk management techniques. They often focus on liquid investments – an investment which can easily be converted to cash – that can be sold easily and are usually open-ended, meaning that shares can be bought or sold at regular intervals.

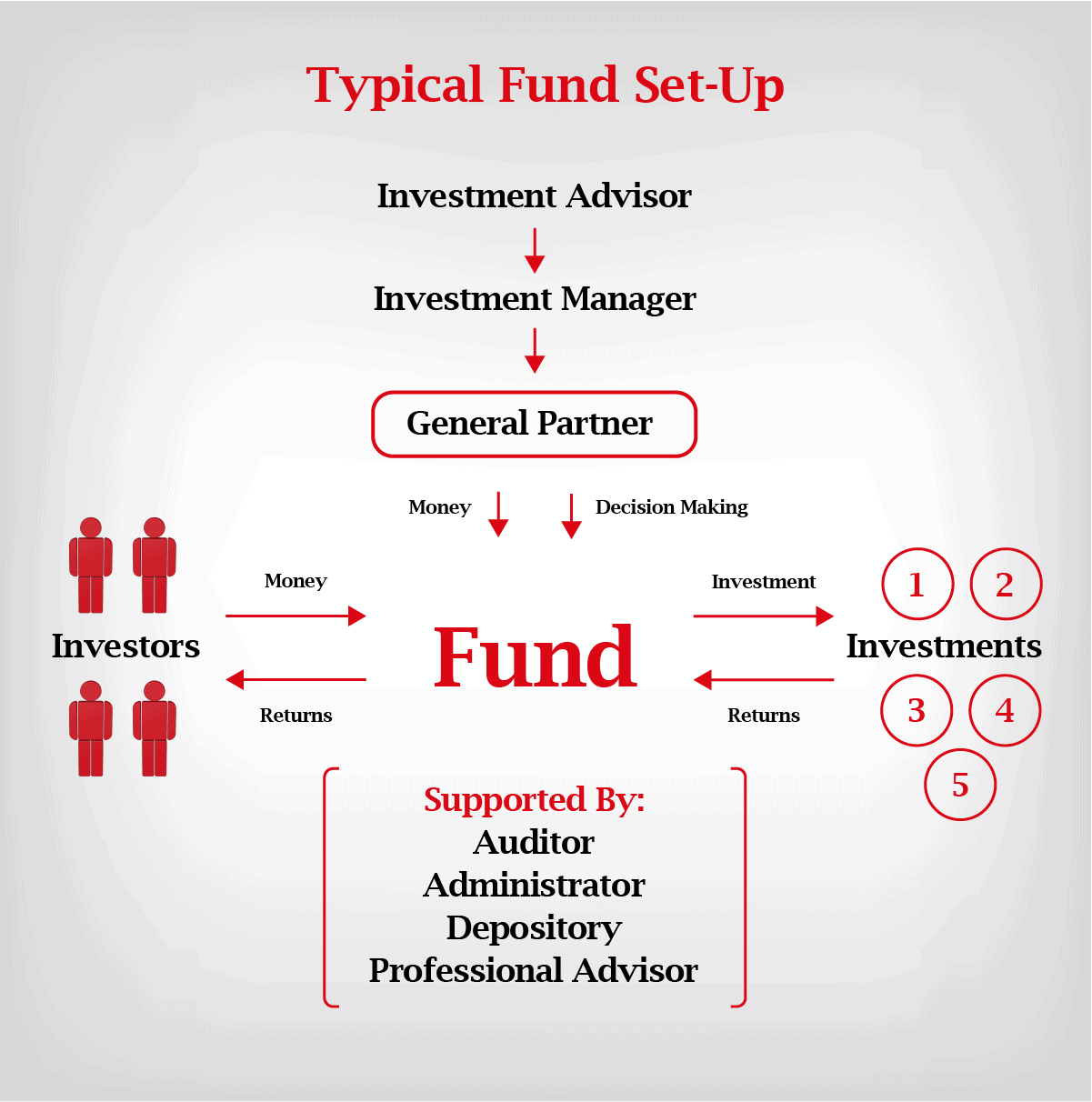

Roles and responsibilities within funds

There are many different roles, functions and responsibilities associated with funds, with these roles varying according to how the fund is put together.

What different roles, functions and responsibilities are associated with funds?

There are many different roles, functions and responsibilities associated with funds. This example describes a typical private equity fund, operating in Jersey as a limited partnership under the expert fund regime.

You can get a detailed description of each of these roles in the downloads.

How do the different roles interact with each other?

This example describes a typical private equity fund, operating in Jersey as a limited partnership under the expert fund regime.

- Promoter, often London-based, has an investment idea.

- Promoter consults with legal and tax advisors, who recommends using Jersey.

- Jersey legal advisors appointed.

- Administrator appointed and an auditor, if setting up an expert fund.

- Fund established by the general partner, typically a company licensed as a fund services business, and an initial limited partner – usually a company ran by the administrator – which exits once investors are brought onboard.

- General partner’s directors and the fund approved by the JFSC.

- Fund launches following a board meeting to officially engage the promoter, administrator and auditor.

- Fund ready to accept investors and start making investments.

You can get a detailed description of each of these roles in the downloads.

What does a fund administrator do?

What fund administration businesses do is entirely up to the fund manager. The role may require only a limited number of services or be much more comprehensive in nature. It’s also not unusual for the arrangement to evolve and grow in scope over time, as the fund manager becomes more comfortable with outsourcing and the level of trust between the two parties develops.

Typically, a fund administration business will support fund managers with the following activities. You can get a detailed description of each of these activities in our downloads:

- Fund establishment

- Investor onboarding

- Ongoing investor support

- Administration

- Accounting

- Governance

Why Jersey for funds?

Jersey is home to 844 regulated collective investment funds (as at December 2019). Here we’ve summarised what makes Jersey so popular:

- Jersey offers a wide range of investment vehicles and fund regulatory options to provide funds and fund managers the right structure.

- Jersey is a centre of excellence for alternative investment funds.

- Alternative investment classes include hedge, real estate and private equity.

- Jersey is well understood by investors.

- Our Island offers investors tax neutrality, substance, a strong legal framework and appropriate regulation.

- Jersey has more than 13,700 skilled finance workers from fund administrators to depositaries, lawyers and non-executive directors and can offer significant depth of experience across the alternative asset classes.

- There are more than 130 fund managers on the Island, offering risk and portfolio management expertise.

- At the end of December 2019, the net asset value (NAV) – i.e. the value of a fund’s assets less the amount of its liabilities, such as loans and debts – of regulated funds under administration in Jersey was £345.7bn.