Private wealth is a key sector of the finance market in Jersey. Put simply, it’s how people and families manage their wealth.

Jersey offers a number of services for private wealth clients from around the world. Here you will find simple explanations for some of the services.

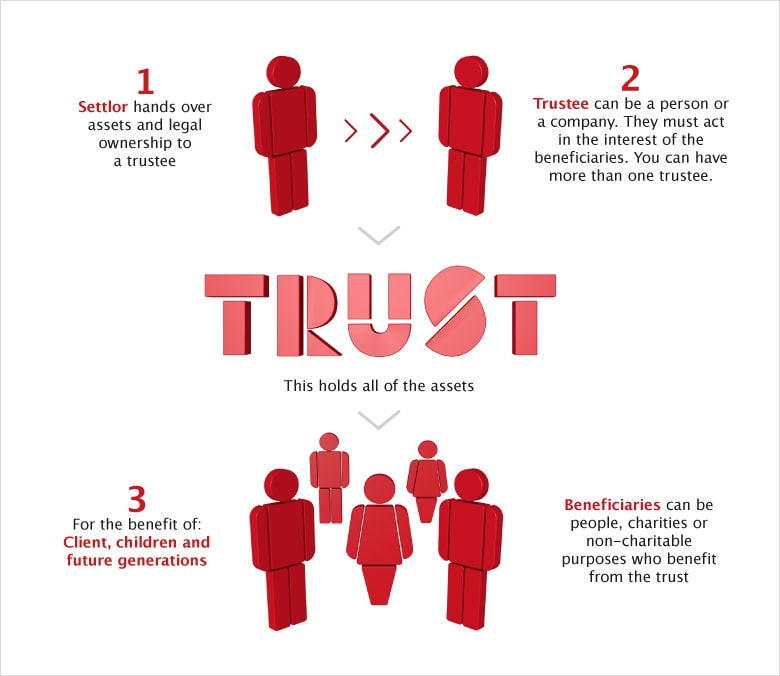

Trusts

Did you know Jersey is responsible for an estimated £400 billion worth of assets for private individuals and families from around the world? Here you can read more about trusts or download a detailed explanation

What are trusts?

A trust is created when a person (settlor) gives assets to another person (trustee) to hold for the benefit of a third person or people (beneficiary/beneficiaries). The settlor can also be a beneficiary.

A trust is a legal way to hold and protect your assets for the future.

A document called the trust deed is the set of rules for the operation of the trust. It sets out who the beneficiaries are, who the trustees are and how the trust will be administered.

How do trusts work?

Trusts can hold assets, and the people responsible for them (trustees) can invest and borrow money and operate businesses on behalf of a trust.

After you set up your trust, you hand over legal ownership to a trustee.

The assets get valued at the time they are added to the trust. Once the assets are in the trust, any increase in their value belongs to the trust.

Why set up a trust?

To avoid forced heirship rules

Some countries have forced heirship rules which means the law decides who inherits the trust’s assets. If a settlor from a country with forced heirship rules sets up a trust in Jersey, the settlor can decide who inherits the trust’s assets. They can also decide who should take over as settlor if they leave.

To protect assets

Jersey’s economy and political environment are stable. Because of our clear statutory framework and supporting case law, Jersey is seen as a safe place. It is also a place where assets may continue to grow, free of foreign law interference. This is attractive to non-Jersey settlors who live in countries which may not offer the same stability, security or investment opportunities.

Privacy and confidentiality

Under Jersey law, we do not have a register for trusts and there is no requirement to make it public when a trust is set up in Jersey. Because of this, a beneficiary may not be aware they are a beneficiary. If they are a minor, under 18 years of age, this is particularly helpful because it protects them and allows them to carve out their own path before receiving any money from the trust or come of age.

Tax benefits

If none of the beneficiaries of a Jersey trust live in Jersey, then the trust does not have to pay tax on its foreign income. It will only need to pay tax on any Jersey income (except interest received on a Jersey deposit bank account). So, the trust fund can grow without weighty tax obligations.

If a trustee does not live in Jersey, the trust fund may be subject to tax in that jurisdiction. So, it may be better to have a Jersey-based trustee, not only for tax purposes but also because they will be familiar with Jersey law. If a settlor does not have English as a first language, it could also be best to use a Jersey-based trustee because the language of the trust will be in English.

If a beneficiary does not live in Jersey and receives a distribution, they may be liable to tax in their own jurisdiction. If a beneficiary moves to Jersey however, the trust’s entire income may become subject to tax.

Real life examples

Protecting wealth for future generations

A divorcee set up a trust to protect the wealth generated from her family business in Jersey. The trust was to benefit her, her children, her grandchildren, great-grandchildren and so forth. The trust had a letter of wishes which set out the divorcee’s wishes for the trust during her lifetime and what should happen with it on her death. It also set out her wish that spouses (or spouses of her children, grandchildren and so on) could not be added as beneficiaries to the trust. It also recommended beneficiaries should discuss pre-nuptial agreements with the trustees before getting married.

Focussed support for a disabled son

A father wished to provide for his adult son who had learning disabilities. Due to this disability, the son was unable to work and generate sufficient income to allow him to live in a property of his own. His disabilities also meant he needed the assistance of a full time live-in carer for life.

The father wished to put funds in a trust for his son’s sole benefit during his son’s lifetime. If the son died, the trustees would be free to benefit any of the settlor’s nieces and nephews at their discretion. He set up a life interest trust, supplemented by a letter of wishes explaining his reasons for creating the trust. This ensured the trustees were fully aware of the purpose of the trust and would act in the best interests of the son during his lifetime.

The money made from the trust’s investments paid for the son’s general living expenses, medical costs, a property for him to live in with a carer and alterations to the property.

While the son can manage a weekly budget, he was vulnerable. His father did not want people to take advantage of his son, especially if they learnt of his family wealth. Having wealth in a trust and managed by trustees meant that when the father (the settlor) dies, his son would be looked after and all his needs met. This gave the father peace of mind.

Forward-thinking parents

A husband and wife put a substantial sum into a trust to provide for their children. While the children were under the age of 35, any income generated by the trust was to be used to pay for school fees and general living expenses. When the children turn 35 years old, they would be entitled to their share of the trust, along with any income that had not yet been added. The children would receive their share outright. The parents felt 35 was a suitable age for the children to receive their share; if the children received the money at a younger age then this may have discouraged them from making a living for themselves.

Foundations

In 2009, Jersey launched a financial product called a Jersey Foundation. Since then, more than 350 Jersey Foundations have been set up. Here you will get an overview of Jersey foundations or download a detailed explanation.

What are foundations?

Foundations help people or corporate bodies manage their wealth by holding assets; foundations are asset-holding vehicles.

They combine some of the best features of a company with some of the best features of trusts.

Foundations hold assets for the benefit of:

- beneficiaries

- named people (such as individuals or corporate bodies)

- a non-charitable purpose,

- a charitable purpose; or

- a mixture of both charitable and non-charitable purposes.

How do foundations work?

Foundations work according to terms set out in their constitutional documents. There are two parts to this document: a public charter and a private set of regulations.

You can see the public charter on the registry section of the Jersey Financial Services Commission’s (JFSC) website. The private set of regulations is usually a longer list of details including who makes the decisions, who the beneficiaries are and who has the power to add and remove beneficiaries, among other things.

Foundations have a lot of positive features, including:

- It can hold assets in its own name and can sue and be sued in its own name, like a company it does not issue shares so it cannot be owned.

- It does not issue shares so it cannot be owned.

- It can last indefinitely or for a fixed period or can come to an end activated by a particular event, for example on the death of a founder.

- It can directly hold any asset, other than immoveable property in Jersey.

- It may not direct commercial trade, for example running a shop, unless it is incidental to its objectives (such as raising money for a charity).

Why set up a foundation?

Foundations are used:

- For private family benefit. Foundations can act as a private wealth holding vehicle with its own rules for making decisions on how it distributes money, invests money and manages property it holds. Commonly held assets in such foundations are private companies, property, bank accounts, art, private aircraft and yachts.

- To act as charitable bodies. They can collect donations and perform charitable work in any part of the world.

- For non-charitable purposes. A typical example is a foundation acting as the owner of the shares in a private trustee company. This means ownership and control belongs to the Foundation, not a person.

Real life examples

Private family benefit

An entrepreneur chose to set up a foundation in Jersey which is expected to have over US $500 million available for charities supporting education and the environment. The founder was attracted by the stability of Jersey’s Foundations Law and the ability for the wider family to have meaningful engagement in the process over the long term.

Protecting the rainforest

A foundation set up to protect the rainforest in South America bought tracts of the rainforest to prevent them from being deforested and commercially exploited. The founders of this foundation were motivated by a desire to help preserve an oxygen lung for the planet.

Multi-asset structuring across countries

An ultra high net worth individual in the United Arab Emirates has assets including real estate, private equity stakes and financial assets. His assets span many different jurisdictions. Keen to retain an element of control, he set up a private trust company owned by a Jersey foundation with his trusted advisers acting as council members of the foundation, as well as directors of the private trust company.

Understanding how family offices work can be complex. We’ve produced a series of explainers to make things clear.

Identifying Ultimate Beneficial Owners and Person’s with Significant Control

An ultimate beneficial owner (UBO) of a company is the person, or people, who ultimately control and benefit from a company’s activity. In Jersey, the Jersey Financial Services Commission collects and maintains information on beneficial ownership and control of Jersey incorporated companies.

The UK has kept a register of individuals (PSCs) or legal entities (RRLEs) that have significant control over companies since 6 April 2016.

To see what the process is for identifying company ownership in Jersey and in the UK , download the Put Simply Identifying Company Ownership: UBOs and PSCs Flowchart.