Profile

A large Middle Eastern family whose wealth is derived from multiple sources, including inheritance, interests in international family organisations, and personal ventures.

Objectives

The family were looking to create a harmonious structure that facilitated international co-investments in various sectors but also wanted a mechanism that allowed them to co-invest into conventional (non-Shari’a) funds with other conventional investors.

In addition to the Shari’a-compliant aspects, the structure had to align with global practices with respect to robust co-investment governance and strict Shari’a compliance. Jersey was also favoured as a jurisdiction due to its comprehensive legal framework applicable to this type of structuring.

Implementation

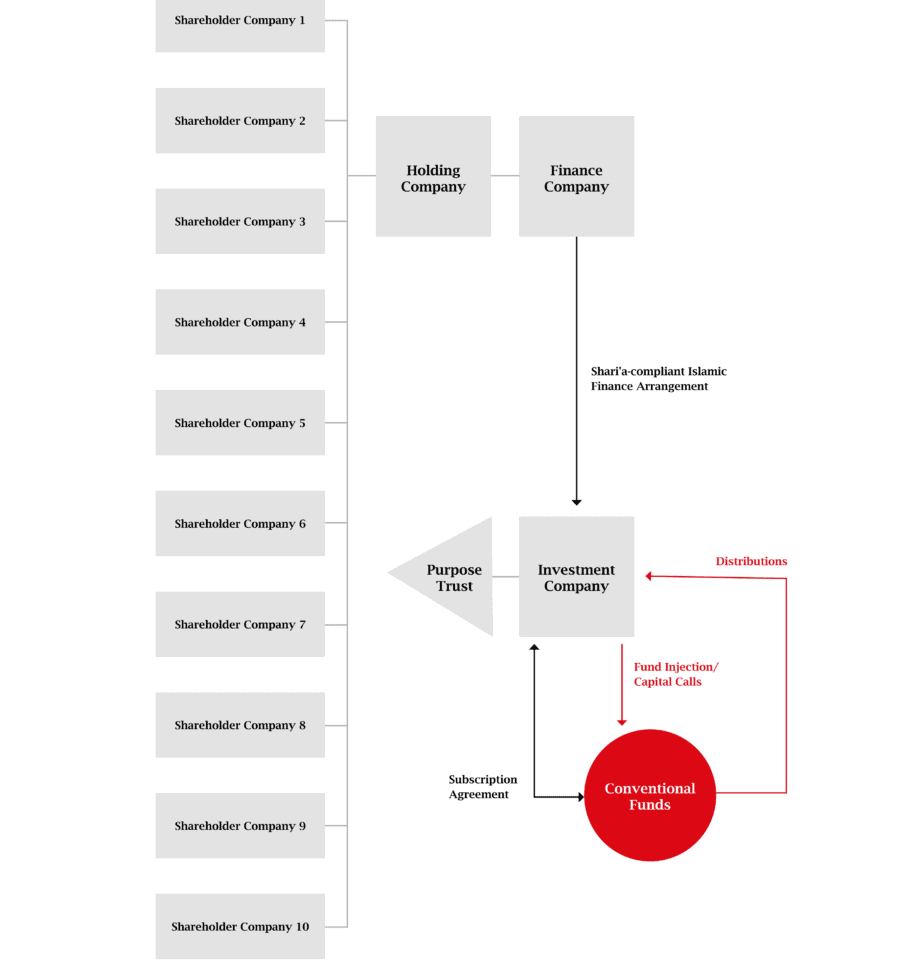

Crestbridge Family Office Services successfully implemented the professional advice prepared by two well-respected Middle East-based accounting and law firms. The structure included the establishment of 10 shareholder companies (one for each family branch), one family holding company, an underlying finance company and an orphaned investment company with a Shari’a-compliant Islamic finance arrangement blessed by the family’s Shari’a Committee.

In addition to this, the family required the adoption of a robust and bespoke shareholder’s agreement between them, which detailed the rights, responsibilities, communication and provided clear guidance for the family members as shareholders in relation to their interests in the structure.

To view the image in a larger format, please download the brochure.

Why This Worked for the Family

- United the family’s existing interdependent investment objectives while simultaneously providing a flexible platform for additional co-investments in a Shari’a-compliant manner.

- Determined long-term clarity on how the family branches interests inter-relate to one another with robust yet proportionate governance given that it is a family structure with pooled wealth.

- Delivered clear mechanisms on family exits, additional further capital, return on capital and succession of interest within the family branches.

Read all fourteen case studies.