Family Offices

Around the world, family offices are growing in number. Jersey is custodian to £1.3 trillion of wealth – the total value of assets held in Jersey. A family office is increasingly becoming the organisation of choice for very wealthy families because it can be tailored to meet individual needs. As one of the world’s leading international finance centres, with a robust regulatory framework, a stable political and economic environment and a forward-thinking approach, Jersey is well-placed to be part of that growth. Here you will learn about:

- What a family office is and how it is structured;

- Reasons why people choose to set up a family office;

- Why people choose Jersey to set up a family office;

- The benefits of a family office; and

- Other services a family office may need

What is a family office?

There isn’t one clear definition explaining what a family office is, because in the same way that every family is different, every family office is different. Family offices vary depending on the needs and wishes of the families establishing them. Generally, the term ‘family office’ is used to describe an organisation dedicated to holding and managing the wealth of a family.

A single family office would operate on behalf of just one family, and a multiple family office would look after the needs of a small number of different families. Usually a family office will be owned by, or on behalf of the family using its services. The cost of establishing and running a family office is high, and because of this they will generally be used by very wealthy families.

Family offices can have a number of different functions. From managing the family’s wealth for the present and future generations, to assisting the family with more day to day tasks such as travel arrangements and personal shopping. These tasks are often referred to as ‘concierge’ services. A family office can also be used to manage the family’s philanthropic activities.

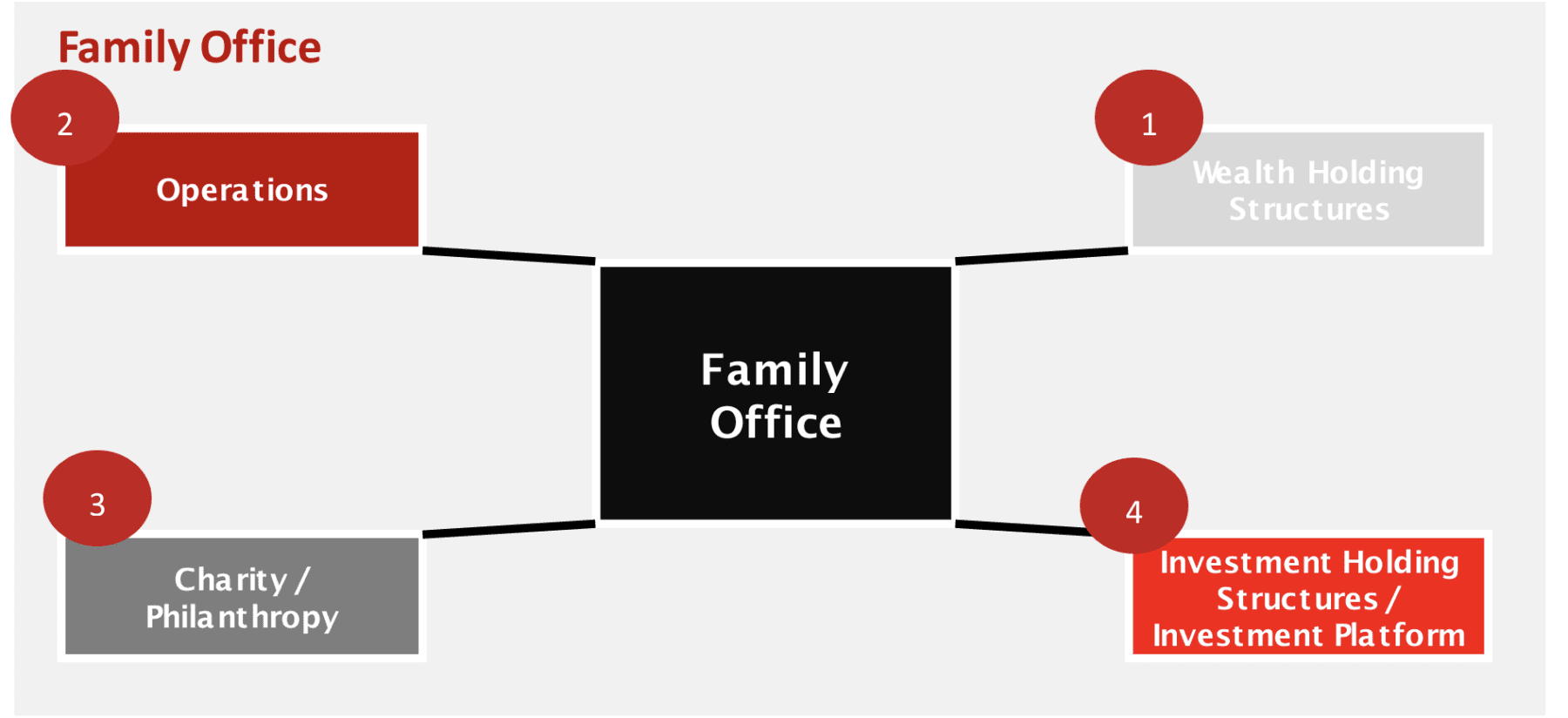

Most family office structures comprise of three or four key parts.

Example of a Family Office Structure

1. Wealth holding structures

First, a family will set up an overarching structure to hold their wealth. This may include trusts, foundations, companies or all three. Often these structures will be organised so different trusts, foundations or companies hold different types of assets. For example, the family business might be held in one trust, real estate (houses, holiday homes, investment properties and so on) might be held in another trust, boats in another, aircrafts in another, and so on. There may also be different structures held for the benefit of different individual family members or for branches of the family.

Families with a family office will often use private trust companies to act as trustees of the trusts that hold the family’s wealth. A trustee is a person or firm that holds and administers assets for the benefit of a third party.

Case Study: Will Trust for Executors in Hong Kong

Walkers was instructed to provide Jersey legal advice by the executors of a wealthy businesswoman who died in Hong Kong. The executors wished to remain involved with the administration of the estate assets over the long term, since the beneficiaries themselves were still very young. Walkers therefore advised and assisted with the establishment of a PTC structure. The PTC acted as trustee of a new Jersey discretionary trust, and by doing so this enabled the executors, acting as directors of the PTC, to fulfil their objective.

Private trust companies are companies that are only set up to act as a trustee for trusts established by a specific family. They are often used because family members or their trusted advisors can sit on the board of the private trust company.

Because Jersey private trust companies do not provide services directly to the general public, they are not regulated by the Jersey Financial Services Commission. However, private trust companies must be administered by a regulated person. Private trust companies are usually ‘orphan entities’ meaning they are ownerless, so the shares are usually held by trustees of a purpose trust or a foundation.

In each case either the purpose trust or the foundation will not be held for the benefit of any person or people (beneficiaries); they are only set up to hold the shares in the private trust company

2. Operations

The operational part of the structure runs the family office. Typically, employees of the family office will administer the structures that hold the family’s wealth. Operations are usually run from one main jurisdiction, although they can have a presence in different jurisdictions depending on where family members live, where assets are located and what services the family office provides. An operational company usually employs family office staff and leases premises. They can also employ additional staff for the family or families, such as housekeepers, personal assistants or gardeners, for example.

Some family offices have in-house professional advisors such as lawyers, accountants, property managers, investment advisers and tax advisors working as part of the team. In other family offices, the in-house team is made up of generalist professionals whose job it is to retain, instruct and manage various external specialist professional advisors.

The number of employees and their expertise will vary depending on the value, type and complexity of the assets under management. For example, a family office for a family who owns a lot of art may employ a specialist art advisor.

3. Charity and Philanthropy

A family office usually includes structures for charitable or philanthropic purposes. Foundations or purpose trusts are well-suited for this because assets can be held for purposes rather than a person or people (beneficiaries).

In many cases, the assets dedicated to charitable or philanthropic purposes are very large. Depending on the size of the family office and the value of the assets designated for these purposes, this part of a family office structure can be significant. A dedicated in-house professional or outsourced advisory service would manage this part of the structure.

Case Study: Philanthropic Structures for a Family Client.

Affinity Private Wealth has a long-standing family client who chose Jersey to help them plan, invest for and deliver funding over a series of years from philanthropic structures, aiming to bring about a cure for an illness that kills hundreds of thousands of people annually. They also run structures which completely fund a range of philanthropic initiatives. These include a ‘Right to Read’ project in Rwanda; funding a ward, equipment and medical professionals in Bangladesh treating cleft sufferers; and support for a project in Cape Town giving disadvantaged young people a better future.

4. Investment Holding Structures or Investment platform

Some family offices have an in-house investment capability, meaning the family office has its own private investment vehicle. This is often referred to as an investment platform. Through this platform the family office can make its own investments directly, rather than placing assets with external investment managers. In these cases, investment decisions will be taken by an in-house investment committee. Where a family office has this capability, it will usually employ its own investment managers. Usually, this sort of investment vehicle would be regulated as a fund, protecting its investors. A fund is a pool of money from a number of investors which is then invested.

In the case of a single family office, because a family office’s investment vehicle is privately owned and there are no external investors, there is no need for regulation.

In the case of a multiple family office, any co-owned investment vehicle will usually require regulation. This type of vehicle is not a fully public fund because of the very small number of investors so ti would require less regulation than a fully public fund.

Reasons to set up a Family Office

If a family has a vast amount of wealth and a mix of assets, it may be more efficient for them to have a family office structure dedicated to meeting the family’s needs. A family office pulls together lots of structures and functions under one roof.

Wealthy families could choose to engage a trust company business to manage a trust or a foundation on their behalf. But that trust company business would have other clients and would not be dedicated to that family only. Further, a trust company business would not ordinarily provide the wider ‘concierge’ type services mentioned above. Family offices are expensive, so the family’s assets need to be substantial for it to be cost effective.

Why set up a Family Office in Jersey?

Jersey is an attractive place to form a family office because of the experience and expertise offered by our highly skilled service providers and our mature and well-regulated business environment.

Jersey is proud to offer a robust, modern and sophisticated legal framework, enabling it to lead the way in delivering private client services, vital to the health of the finance industry worldwide.

More and more family offices are being established on the Island because of Jersey’s excellent reputation. In fact, Jersey has £400 billion in trusts established by private individuals and Jersey is custodian to £1.3 trillion of wealth (Capital Economics 2016).

Crestbridge has created a substantial family office structure involving numerous Jersey trusts, a number of private trust companies and overlying purpose trusts, property and asset holding vehicles and an operating company. The structure, for a high profile Gulf based family, was established to give oversight of the family’s overseas assets and for estate planning purposes. Holding real estate around the world and significant investment portfolios/private equity investment, the family office structure requires Crestbridge to administer structures in multiple jurisdictions. It is currently valued at more than US$2 billion.

An ultra high net worth family living in South Africa opted to establish a family office in Jersey a few years ago. They chose Jersey for its robust regulation, highly qualified workforce, reputation as the pre-eminent offshore centre and ease of access from the UK.

The family business spans across more than a dozen African countries and it was important that the proceeds of that business were invested in a stable, low risk environment with a wealth manager who understood their environment within which the family and the business operated.

Standard Bank is the family’s primary wealth manager and supports the client’s business requirements.

Learn more about our latest family office events, podcasts, articles, publications and more.

Benefits of a Family Office

Family office structures provide a family with many benefits.

Flexibility

Family office structures can be tailored to a family’s particular needs and wishes. They are carefully constructed and maintained bespoke structures. They take into consideration the degree of control a family wishes to have over its wealth, any taxation and succession issues, family dynamics and any risk issues, such as the physical security of family members and data security.

Privacy

Family offices provide a high degree of privacy. They are administered by a small number of employees who are likely to have been hand-picked by the family.

Participation

Family offices can give family members the opportunity to be more involved in their structures than they might be if their wealth was managed in various separate structures. Members of the family can be directors of private trust companies, council members of foundations and can be employed by the operational companies. This means that family members can take an active part in the administration of their assets if they wish.

Ethos or beliefs

Families can instil a strong sense of their personal ethos into a family office. Many families also establish bodies such as family councils. These bodies are usually made up of certain key family members, such as the oldest generation along with trusted professional advisors. They are often headed by the most senior family member, the generator of the family wealth, or the matriarch or patriarch. Employees of the family office work with the family council to guide and administer the family’s assets.

Families can draft documents such as family charters for employees of the family office. Family charters set out the family ethos and the wishes of the family.

Charters set out, for example, whether the structure should be dynastic (i.e. to benefit all future generations of the family in age order); how to distribute the family wealth; what the family wishes to do with particular assets, such as a family business; what the family’s wishes are in respect of philanthropy and how the family would like assets to be handed down over generations.

Control

A family retains a high degree of control over its structures in a family office scenario. For example, the constitutional documents of the operational companies and private trust companies can set out that family members have the power to make certain key decisions.

Families setting up family offices can also easily select and make changes to the personnel who administer the structure. Because the family are their only clients, family office personnel are likely to be more aware of and responsive to family needs and make quick decisions.

A multi-family office costs less to run than a single family office, but the level of privacy, the ability to tailor activities and the freedom to make changes is reduced because the other families’ wishes needs to be taken into account.

Other Services a Family Office May Need

Banking, trust and fund or investment services

A family office can service banking, trust and fund or investment needs. It can also coordinate all of these services externally for the family or families.

Private banking or wealth management

A family office can offer a more comprehensive tailored service than a private bank. A family office can provide a banker, trustee, investment manager, tax advisor, lawyer, property manager and accountant, philanthropy advisor and more.

A private bank is a commercial operation with more than one client and personnel would not be in the sole service of one family. While a private banker can co-ordinate most of the required activities within their own organisation, or use their teams to do this, it is unlikely all of a family’s needs could be met this way. Even if a private bank could coordinate these services, a family office would probably provide a more cost efficient way of achieving this.

Family offices are a way to manage private wealth. Jersey has 60 years of expertise delivering private wealth management from trusts and estate, future succession planning, to popular foundation structures.

Understanding the world of private wealth can be complex. We’ve produced a series of explainers to make things clear.