- Foreword

- What are the Sustainable Development Goals and why are they important?

- Why are the SDGs important for Jersey’s financial and related professional services industry?

- How do Jersey’s financed economic activities contribute to the SDGs?

- Opportunities for Jersey and the call to action

- The call to action

Foreword

I am delighted to share Jersey Finance’s view on the role and opportunity that international finance centres (IFCs) such as ours have in accelerating the pace and scale of the financing of global sustainable development objectives, namely the achievement of the United Nations (UN) Sustainable Development Goals (SDGs/’the Goals’).

Launched in 2015, the SDGs have forged a common language between governments and business, and have become a focus for sustainable investment. Together, the 17 Goals represent the cornerstones of global society and planetary systems upon which we all depend, now and for future generations.

We know that achieving the Goals by the target date of 2030 is a significant challenge. Progress has been hampered by economic headwinds, the Covid-19 pandemic, and geopolitical forces. Urgent action is required both politically and, critically, by the private sector through new collaborations and innovations in technology, resources and knowledge. The financing gap for achievement of the SDGs is significant, most recently estimated by the UN in 2023 to be $4 trillion per year. The vast majority of this will need to be privately funded and, if done right, also represents a significant investment opportunity. We can already see breakthroughs in technology and unprecedented levels of investment in key sectors, such as in renewable energy, although as yet unevenly globally distributed.

Jersey, as one of the world’s most stable and successful IFCs, recognises that it has a responsibility to leverage its expertise and capital to support the transition to an environmentally and socially sustainable global economy. As set out in our original Jersey for Good strategy three years ago, our vision, by 2030, is to be recognised by our clients, key stakeholders and other partners as the leading sustainable international finance centre in the markets we serve.

Our view in Jersey, as a member of the UN Financial Centres for Sustainability (FC4S) Network, is that there is a key role for jurisdictions such as ours to play in financing the achievement of the SDGs.

We already have some compelling examples of this, from sustainable and transition funds through to impact-led private wealth management, as illustrated through our Sustainable Finance Awards, now in their second year. And, more broadly, our reputation as a stable jurisdiction with strong governance is key to upholding SDG 16 – Peace, Justice and Strong Institutions and SDG 17 – Partnerships for the Goals.

But we need to do more. Across Jersey’s four industry pillars of private wealth, funds, banking and capital markets, we can take more opportunities to engage our clients and to put capital to work for positive SDG impact and transition finance. We can be at the forefront of testing and of scaling innovative new financing solutions on issues ranging from nature restoration to financial inclusion. We can continue to grow our supporting professional services and sustainable finance technology solutions. And we can continue to place sustainability at the heart of how we run our corporate businesses, and how we provide finance for Jersey’s own island sustainable development.

All of this starts with increasing awareness, understanding and dialogue. This report sets out some of the key considerations for those operating in and engaging with Jersey as an IFC. It sets out why the SDGs are important for the finance industry, it shares insights about Jersey’s financed economic activities and the SDGs, and we hope that it inspires action that shifts further finance for positive change.

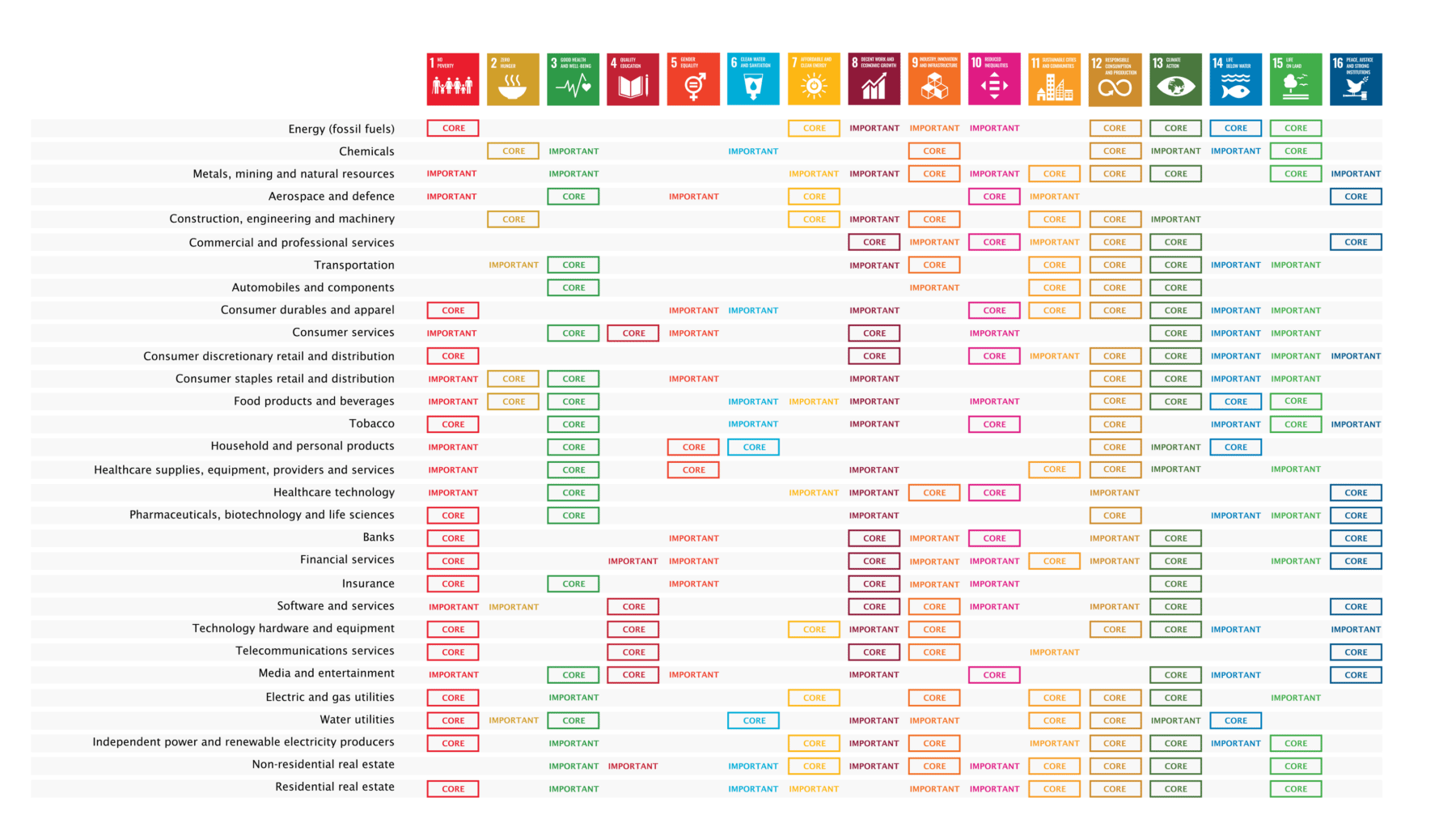

Combined with our recently launched SDG Alignment Tool, which provides entry-level mapping of SDG impacts and suggested actions across different industry sectors and job roles, we hope that this report inspires conversations and actions across Jersey’s finance industry, clients, and key stakeholders, and beyond.

Together we can finance a better world.

Joe Moynihan

1. What are the Sustainable Development Goals and why are they important?

This section provides an overview of the UN Sustainable Development Goals and the role of business in achieving them.

Sustainable development and the UN SDGs

The concept of sustainable development is defined as meeting the needs of the present without compromising the ability of future generations to meet their own needs. It requires the integration of economic, social and environmental pillars and, in a business context, a ‘triple bottom line’ beyond financial performance alone.

In 2015, 193 (UN) member states committed to a shared global vision of 17 SDGs. These act as an urgent call to action to address a range of economic, social and environmental challenges by 2030. They are designed to form a blueprint for people and the planet, now and into the future, underpinned by 169 indicators and targets to help define progress.

Since their launch, the SDGs have provided a comprehensive framework for sustainable development, and a common language between governments and businesses to focus resources and investment.

The SDGs are not optional nice-to-haves. They are the cornerstones of global society and the planetary systems upon which we depend, now and for future generations. Ignore them, and we are setting ourselves up for irrelevance at best – and extinction at worst.

Figure 1: The UN Sustainable Development Goals

Intersectionality of the Goals

The SDGs are intricately interconnected, with multiple relationships between the various goals and targets. In this way they recognise and reflect the complexity of the world’s problems and the systems thinking that is required to solve them.

For example, we cannot take climate action (SDG 13) without solving clean energy (SDG 7), nature (SDG 15), decent work and economic growth (SDG 8) and more. Similarly, achieving gender equality (SDG 5) is closely linked to both poverty eradication (SDG 1) and quality education (SDG 4). Climate action is also essential for clean water and sanitation (SDG 6) and good health and well-being (SDG 3) because it exacerbates water scarcity and health risks.

Recognising and leveraging this intersectionality is essential for creating effective and sustainable solutions that leave no one behind. Or, to put it another way, poverty, inequality, environmental degradation and social injustice are all symptoms of the need for large-scale economic and social systems change.

Progress to date and the transformation opportunity

2023 marked the half-way point towards the 2030 target date for achievement of the SDGs.

The UN’s 2023 stocktake1 showed that progress towards more than 50% of targets is weak, and has stalled or reversed on another 30%. This is largely attributed to the impacts of the climate crisis, war in Ukraine and in the Middle East, a weak global economy and the lingering effects of the COVID-19 pandemic, all of which have hindered progress.

However, transformation is possible and indeed inevitable in key markets and sectors that are critical for success in achieving the SDGs. There remains significant opportunity and potential through a combination of political will and use of available technologies, resources and knowledge. The 2023 UN Global Sustainable Development Report2 sets out progress on scientific and technology breakthroughs, tipping points and opportunities for investment in the solutions we need to achieve the SDGs. We only need to look at the UN’s Breakthrough Agenda on accelerating clean technology transitions in key sectors to see what can be achieved.

The role of business in achieving the Goals

The SDGs have become a common language and focus for investment between governments and businesses in the countries in which they operate. The actions of business can either positively or negatively influence achievement of the Goals. Indeed, in 2019, a PwC study found that 72% of global companies mentioned the SDGs in their reporting publications. Since then, stakeholder expectations have placed increased pressure on businesses to assess their impacts and to better understand their contributions to the Goals – good or bad – and seek to optimise their business strategy for positive impact.

The concepts of ‘inside-out’ and ‘outside-in’ are often used to describe how organisations approach sustainability and their contribution to sustainable development:

- An ‘outside-in’ approach to sustainability focusses on how changes in the environment and society could impact an organisation’s operations and performance. Examples include the effects on a business from the physical risks of climate change, such as increasing temperatures or rising sea levels, or transition risks, such as regulatory compliance costs or opportunities to move into new products or markets, on factors like profitability and asset values. The concept of ‘ESG’ is useful for the management of such environmental, social and governance factors.

- An ‘inside-out’ approach, however, is the inverse: where a business looks at how its operations and activities impact the wider environment and society. Examples of such considerations include carbon emissions, water and waste effluents, and societal impacts of conducted activities, including employment, gender diversity and inclusion. The SDGs are often used by organisations to monitor and manage their ‘inside out’ impacts in particular.

Materiality is a concept that has historically been employed in financial accounting, but in a sustainability context relates to the significance of an activity, impact or risk, and the degree to which they might influence the decisions of stakeholders. ‘Double materiality’ goes further to acknowledge that a company’s sustainability performance covers not only the ‘outside-in’ sustainability risks and opportunities that are material to a company’s financial performance, but also ‘inside-out’ impacts arising from its operations and activities on the wider world.

Sustainability disclosure frameworks and regulations

The quest for consistent and comparable ways to assess and manage sustainability risks, opportunities and impacts has given rise to a plethora of voluntary and regulatory sustainability disclosure and reporting frameworks and standards around the world. Underpinning them all is a desire to bring the quality and reliability of sustainability information up to par with financial information, in order to better inform markets, investors, consumers and other stakeholders, in order to drive change.

The SDGs are not intended or required solely as a disclosure framework in their own right, but rather as a driver for transformation, collaboration and investment. They inform and align to the core of a number of internationally recognised disclosure frameworks, guiding collective action towards achieving the Goals.

Examples of how the SDGs underpin some of the most widely-recognised disclosure frameworks include:

Table 1: Relationships between established international sustainability disclosure frameworks and the SDGs

| Standard/ Framework | Inside out | Outside in | Relationship with the SDGs |

| Global Reporting Initiative (GRI) | ✔ | Asks organisations to measure and disclose their impact on the economy, environment, and society, aligning with various SDG targets. | |

| UN Global Compact | ✔ | Encourages businesses to align their operations and strategies with ten universal principles in the areas of human rights, labour, environment, and anti-corruption; many of which align with SDG targets. | |

| Task Force for Climate Related Financial Disclosures (TCFD) | ✔ | In encouraging organisations to better manage climate-related risks and opportunities (outside in), TCFD promotes behavioural changes that align with the targets of SDG 13 – Climate Action (inside out). | |

| Task Force for Nature Related Financial Disclosures (TNFD) | ✔ | ✔ | Requires businesses to consider nature-related risks and opportunities, and also impacts and dependencies. This drives better business consideration of the targets of SDG 14 – Life Below Water and SDG 15 – Life on Land. |

| International Sustainability Standards Board (ISSB) | ✔ | IFRS S1 (sustainability) and S2 (climate) are now available for country adoption, with further accounting standards expected to follow. Internationally-consistent sustainability reporting standards will help organisations and investors track and compare their contributions. | |

| EU Sustainable Finance Disclosure Regulation (SFDR) | ✔ | SFDR requires financial market participants to describe any impacts of investment decisions that result in a negative effect on sustainability factors in a Principal Adverse Impact (PAI) statement, which can be aligned with SDG targets. | |

| EU Corporate Sustainability Reporting Directive (CSRD) | ✔ | ✔ | The ‘double materiality’ approach of CSRD requires an organisation to consider their actual or potential impact on people and the environment. It therefore not only enhances transparency in reporting, but also promotes sustainable business practices that align with the targets of the SDGs. |

| UK Sustainability Disclosure Requirements (SDR) | ✔ | Expected to closely follow ISSB standards. | |

| US SEC Climate Disclosure Rule | ✔ | Requirements to report greenhouse gas emissions, environmental risks, and measures taken in response, allow organisations to track progress against the targets of SDG 13 – Climate Action. |

The sustainability disclosure framework and standards landscape is complex and continues to evolve at pace, with jurisdictions around the world increasing their regulatory expectations. Two points are clear:

- Expectations are increasing for businesses to both manage the risks and opportunities arising from sustainability considerations on their operations and performance, and to consider the impacts of and contributions to sustainable development arising from their operations and activities. Being able to articulate SDG alignment is increasingly critical.

- IFCs such as Jersey have a key role to play, and need to both ensure that their jurisdictions are not overly exposed to sustainability risks, and to support and enable the financing of sustainable development, assuming continued access to markets and equivalence in any sustainability disclosure regimes.

This all begins with greater awareness and understanding, and this is explored further in the next section.

2. Why are the SDGs important for Jersey’s financial and related professional services industry?

Achieving the SDGs requires significant financing and investment, the vast majority of which will be through private capital. Put simply, the SDGs will not be achieved without significant realignment and redeployment of capital, whilst the finance industry also needs to understand and align with the SDGs to manage risk and remain relevant. This section sets out the size of the financing gap and the growth of sustainable finance. It then provides an overview of Jersey’s role and approach to date as an IFC.

Financing sustainable development

In 2014, the UN originally estimated that meeting the SDG targets by 2030 required at least $2.5 trillion of investment annually3. This was updated to $4 trillion per year in 2023.

Challenges in financing poverty reduction, education, decent work and climate action do not stem from a shortage of capital. The world’s total wealth, estimated at $463 trillion, could address the SDG financing needs if even less than 1% of it could be monetised. Funds need to be redirected to the right causes, and the remainder also needs to be realigned to avoid further harm to people and the planet. Achieving the 2030 Goals demands that all finance is sustainable, guided by the SDG framework. The finance industry needs to both:

- Ensure that all financed economic activities help to move the Goals forward, and avoid financing economic activities that contribute to their regression

- Unlock financing at scale for impact investing and innovative financial solutions, in the broadest sense, to finance the economic activities, the nature-based solutions, the technology innovations, the financial inclusion solutions and the industry transformations that society needs, including in emerging markets and developing economies

Mobilising finance for sustainable development has become a global policy priority; with governments and development finance institutions acutely aware that public funds alone are insufficient and that business and investor buy-in is key. Approximately 70% of investment is expected to be privately financed. Therefore, a key objective is to de-risk the enabling environment and provide incentives for private sector capital.

The process of taking due account of environmental, social and governance (ESG) considerations in investment decision-making has matured considerably in recent years, and flows of capital to achieve social and environmental goals, longer-term and sustainable activities, have significantly increased. For example, even after taking account of recent economic headwinds, PwC research suggests that up to 28% of global funds will be ESG-oriented by 20264, whilst the GIIN estimates the worldwide impact investing market is now over $1 trillion5.

Consider the role of the global finance industry in financing climate action, for example. Innovative new technologies need access to low-cost capital and expertise to scale up; high-emitting industries need capital and support to decarbonise, and low-carbon infrastructure needs financing and insurance to deploy. All of this requires technologies at all stages of financial maturity, involving all types of capital, from venture capital through to private equity, institutional investors and insurers. Whether it be mobilising capital to scale climate solutions; financing firms to transition to net zero; being active stewards to drive wider economy decarbonisation; accelerating the managed phase out of high emitting assets; or developing the data and methodologies required to make informed investment decisions, the industry’s contribution is on a scale that would have been deemed unimaginable only a few years ago.

The finance industry contributes more to the SDGs than to its capital and expertise for implementation. The industry can also enable:

- Global collaboration: As described above, the SDGs are global and require systemic change. Finance is essential to facilitate cooperation and collaboration amongst stakeholders. Take, for example, the importance placed on climate finance in the annual UN Framework Convention on Climate Change Conference of Parties.

- Innovation and technology: The finance industry supports research, development and scaling across a range of sectors that are key to achieving sustainable development. In some sectors, there remains a mismatch between investment allocations and sustainable development potential. For example, climate tech venture capital investment is not yet allocated in line with the decarbonisation potential of technologies in some sectors6. This is a significant opportunity for the industry.

- Financial inclusion: Resources must be allocated in ways that support the financial inclusion of marginalised and vulnerable populations, helping to lift them out of poverty. Some 1.4 billion people in the world remain unbanked. The role of the finance industry in providing banking and financial services is key.

- New financing solutions: Financing the SDGs requires bringing actors together in new ways to evolve new forms of financing. These range from blended public-private finance solutions, through to new market mechanisms. An example is how the corporate bond market has evolved into a range of green, sustainable and social bonds over the last decade. More recently, we are seeing new mechanisms such as carbon and nature credit markets, climate adaptation finance and insurance products. The finance industry needs to be at the forefront of this evolution.

The UN recognises the urgency with which private finance must be further unlocked for sustainable development. The FC4S Network now brings together 40 leading financial centres, including Jersey, to share knowledge and resources on the pivotal role that financial centres play in steering the transition towards a sustainable future.

Drivers of growth in global sustainable finance markets

Beyond the above, there are a number of additional drivers of growth in global sustainable finance markets:

Drivers of growth in sustainable finance markets

Regulation

The global regulatory landscape continues to evolve at pace. The majority of leading finance centres now have some form of sustainable finance regulation in place or under development, or are finding ways to ensure the interoperability of their regulatory frameworks with leading practice – effectively raising the bar for good practice around the world. Key regulatory objectives include:

- Preventing greenwashing and the mis-selling of sustainable

products and services - Protecting financial markets from over-exposure to systemic

risks (e.g. climate) - Providing consistent and comparable finance-grade information to investors

- Preventing the financing of environmental crime / social harms

- Providing clarity on aligning sustainability objectives with fiduciary duty

- Reflecting externalities (e.g. cost of carbon) in the price of goods and services

- Redirecting capital to sustainable solutions

Investor demand

PwC’s 2023 Global Investor Survey found that 75% of investors surveyed wanted to see better reporting on the impact that a company has on the environment or society (inside out reporting)7 and 67% said they would increase their investment in companies that change their business conduct to have a beneficial impact on society or the environment. On the private wealth side, next generation successors and new private wealth generators are already shaping a direction of travel towards more sustainable investments8.

Performance

Over the last few years, ESG assets have outperformed conventional assets, supported by the premise that better governed businesses that are in step with the expectations of stakeholders are likely to outperform those that are not. Whilst it is true that economic conditions in 2022 have resulted in ESG outflows, this is not expected to be a long-term trend. Recent research shows that 9 out of 10 asset managers believe integrated ESG improves overall returns, and 60% of institutional investors report that ESG investing has already resulted in higher performance yields compared to non-ESG equivalents9.

Cost of capital

Taking action on environmental or social metrics and targets lowers the cost of capital through products such as Sustainability Linked Loans (SLLs), where performance against sustainability KPIs reduces interest or basis points ratchets. Conversely, the availability and cost of capital for activities that do significant harm to the environment is likely to rise as banks and investors align their portfolios with sustainable finance objectives and regulations.

Customer demand

As corporate sustainability objectives and targets move from ambition to action, businesses apply increased pressure through their value chain. Consumer demand is at an all-time high, with half of all global consumers now saying that a company’s sustainability performance influences their choice of products and services10.

Why should the finance industry align with the SDGs?

As described above, achievement of the SDGs needs finance, and the financial services industry. But it is also true to say that the global finance industry, including IFCs such as Jersey, needs the SDGs. The risks from inaction, or failure to take sufficient action, can be significant. Reasons include:

- Risk and reputation management: Financing adverse impacts on the SDGs, even if inadvertently, could have a significant reputational or financial risk. Over-exposure of portfolios to climate-related risk, nature-related risk and other SDG-related risks are systemic risks to the financial system. Responsible investors and jurisdictions are seeking to ensure these risks are understood, governed and, where appropriate, managed. Robust approaches to address greenwashing and mis-selling of products and services are also important.

- Value creation: Identifying financing opportunities which align with the SDGs create both profitable and impactful investments. Contribution to the sustainability transition has become a major driver of value creation, whether through business turnaround and transformation strategies, or investment in new products and markets. As described above, solving for the SDGs is driving new financing solutions, and there is an exciting opportunity for jurisdictions to grow and diversify their finance industries by attracting, incentivising and growing their sustainable finance clusters.

- Talent retention: The finance industry is relationships and expertise led. The industry needs to attract and retain talent. Employees want to work for companies that share their values, which increasingly means being environmentally and socially responsible. For example, a recent Channel Islands survey of workers found that 53% strongly or moderately agree their employer has a responsibility to take action to address climate change, although a third do not feel their employer is taking enough action11.

- NextGen readiness: The scale of intergenerational wealth transfers this decade is unprecedented, with estimates of up to $68 trillion shifting to adult children. This is already reshaping the financial services industry globally. Many of the younger generation want to make purpose-led investment decisions that align with their values. The private wealth industry needs to be able to talk the language of impact and SDG alignment in order to continue to best serve these clients.

In short, if IFCs such as Jersey fail to align with the sustainable transition, as articulated through the SDGs, those jurisdictions risk becoming uncompetitive and irrelevant in the long term.

Jersey’s actions and progress to date

Jersey, as one of the world’s most stable and successful IFCs, recognises it has a responsibility to leverage its expertise and capital to support the transition to an environmentally and socially sustainable global economy. As set out in our original Jersey for Good strategy three years ago, our vision, by 2030, is to be recognised by our clients, key stakeholders and other partners as the leading sustainable international finance centre in the markets we serve.

There has been much progress since the launch, with a focus on continued upskilling, support and promotion of the Island’s sustainable finance practitioners, products and services. As a member of the UN Financial Centres for Sustainability (FC4S) Network, the Island has benefited from collaborations and knowledge-sharing with other centres around the world, together with biannual jurisdictional assessments of Jersey’s own progress against best practice regarding sustainable finance institutional foundations, the regulatory environment and market infrastructure.

Key features of Jersey as an IFC, that position the Island well for continued growth and development of its role in sustainable finance, include:

- For funds, Jersey offers managers and investors unparalleled access and speed-to-market for their structures, with skills and expertise to support their sustainable investment, compliance and disclosure needs. Jersey also has anti-greenwashing legislation to address mislabelling risk of sustainable finance products and services; albeit without prescribing templates for disclosures – providing flexibility and allowing funds to meet their obligations using existing templates (such as those required under the EU’s Sustainable Finance Disclosure Regulation).

- For capital markets, Jersey provides unparalleled access to businesses looking to list on TISE Sustainable, which is headquartered in the Channel Islands. The sustainable market segment of The International Stock Exchange (TISE), TISE Sustainable, is Europe’s most comprehensive; enabling the flow of capital into investments that promote environmental, social or sustainable activities. With direct access to the segment, which currently supports more than £14 billion of listings for environmental, social and transition initiatives, Jersey offers an attractive platform for sustainable capital markets.

- A key foundation of Jersey’s finance offering is the provision of a tax neutral environment for international business. Jersey has been independently assessed to demonstrate a high level of compliance with international initiatives and standards designed to prevent tax evasion.

- The Island’s tax neutrality plays a key role in the attractiveness of the Island as a facilitator of capital towards “good”. In the funds space, Jersey is often used to establish vehicles that pool contributions from investors across the world, with the local tax environment allowing returns on investments to be distributed with investors only paying tax to their home taxation authority. The tax environment is therefore a further incentive in the promotion of Jersey as a centre through which capital can be directed towards sustainable solutions in an effective and tax transparent manner.

- Political stability, a talented local workforce of substance, a sophisticated legal system, modern corporate laws and a well-regulated environment for investment to continue to make the Island a popular destination for a variety of international clients.

Alignment with and contribution to specific SDGs depends on the underlying economic activities financed through Jersey; this is something we explore in the next section. However, it is also important to note that Jersey as a jurisdiction, by the very nature of its role as a responsible IFC, contributes positively as follows:

SDG 16 – Peace, Justice and Strong Institutions

The objective of SDG 16 is to promote peaceful and inclusive societies for sustainable development; to provide access to justice for all; and to build effective, accountable and inclusive institutions at all levels.

Corruption, human rights abuses, bribery, tax evasion and conflict all undermine inclusive and peaceful societies. Sustainable development depends on building more effective access to justice and institutions that contribute to transparent rule of law and protection of human rights – and with this, the role of the IFC in promoting responsible business and as a conduit of capital for sustainable development becomes even more apparent. There are three dimensions to SDG 16:

- Strong institutions set out to establish effectiveness, accountability and transparency, which secure fundamental legal human rights.

- Justice tackles issues of corruption and bribery that would threaten such institutions and ensures equal access to justice.

- Peace is key to eliminating all forms of violence, in particular against vulnerable groups, promoting the resolution of conflict through dialogue, negotiation and diplomacy.

Jersey’s finance industry and its supporting frameworks promote responsible and just business behaviours throughout the value chain. Jersey’s strong regulatory framework, designed to bring clarity and transparency to financial markets, sets it apart from other IFCs; and its robust legal framework provides vital support to our finance industry, ensuring that activities are not only flexible and attractive but are conducted fairly and with integrity. Furthermore, while the Island often works closely with the UK, it has retained domestic autonomy for centuries and has its own democratically-elected parliament which brings stability and independence. IFCs such as Jersey play a pivotal role in the advancement of SDG 16.

SDG 17 – Partnerships for the Goals

The objective of SDG 17 is to strengthen the means of implementation and revitalise the global partnership for sustainable development. Its targets include strengthening domestic resource mobilisation through international support, mobilising additional financial resources for developing countries, and for developed countries to implement their development assistance commitments; all with a view to enhancing global macroeconomic stability.

IFCs such as Jersey contribute to SDG 17 primarily through the mobilisation of resources. In acting as a conduit for international investment, IFCs serve as important hubs for global finance, which helps direct capital from across the globe towards projects and initiatives that promote sustainable development. Their function as intermediaries helps to facilitate partnerships between businesses from different countries, fostering collaborative economic growth.

Jersey’s finance industry is supported by a diverse pool of financial professionals, experts and consultants. These individuals share knowledge and best practices related to sustainable development with local governments and businesses, promoting capacity building and learning. In addition, one of the targets of SDG 17 is to provide access to financial services to all. IFCs play a key role in achieving this target through their often disproportionately significant contributions to the funding of financial services products and technologies, particularly fintech solutions, which improve financial inclusion.

Leading by example

Sustainable finance IFCs are only credible if they themselves operate in a sustainable manner from a sustainable location; and with this in mind, the Government of Jersey has made a domestic commitment to reach net zero by 2050. On a practical level, the grid carbon intensity of the Island’s electricity system benefits from low carbon electricity from France and is already roughly only one tenth of the UK’s current supply. More broadly, the Island’s economic development strategy has a twin focus on sustainability and technology, and how these intersect. And the recently launched £20m Impact Jersey technology accelerator fund is using public finance to pump-prime new collaborations and private finance of technology solutions for the Island’s sustainable development challenges.

The Island has committed to ensuring it has the high-quality infrastructure needed to service the increasing demand for sustainable finance products, and there is a growing community of skilled ESG professionals on the Island – evidenced by the formation in 2023 of the Jersey Association of Sustainability Practitioners (JASP).

The Island’s supporting infrastructure, including corporate services, technology and education, will be pivotal to the Island’s success in building further mechanisms to increase sustainable finance allocations and assess SDG alignment and impacts.

Jersey as an IFC has recognised that awareness of, and engagement with, the SDGs is more likely to have alignment with the direction of travel of emerging global policies. As a leading sustainable IFC, Jersey has recognised how vital it is to clearly set out its ambition, remove barriers and use all its influence, expertise and processes to play its part.

3. How do Jersey’s financed economic activities contribute to the SDGs?

As one of the world’s most stable and successful IFCs with over £1.3 trillion of assets from largely non-resident investors flowing to economies around the world, Jersey plays a specific role as a hub of expertise and conduit of capital. The UN FC4S’s 2023 State of Play Report is clear that jurisdictions need to underpin their commitments to sustainable finance with accelerated efforts to identify and grow attractive and viable investment opportunities aligned to the SDGs.

In this section of the report, we take a deeper dive (to the extent data is available) into how the four pillars of Jersey’s finance industry – Funds, Banking, Private Wealth and Capital Markets – drive capital towards achievement of the SDGs. Understanding these contributions is increasingly important as Jersey looks to not only ensure activities align with progress against the SDGs, but also that activities financed through the Island do not cause or enable significant harm.

The following analysis sets out some of the connections between the Island’s exposure to the financing of activities in certain sectors, defined using Global Industry Classification Standards12 (GICS), and the SDGs that are most impacted by activities conducted within those sectors. In addition, links between the Island’s professional and corporate services sector, its industry bodies and its other enablers are considered for SDG-alignment. To summarise the key findings from this analysis:

SDG alignment highlights from an initial analysis

Funds

Over 88% of AuM in the Island’s Funds industry was found to align with SDG 12 – Responsible Consumption and Production, based on analysis of the sectors and activities of underlying portfolio companies invested in. The Funds industry was also found to play a pivotal role in the financing of activities that impact SDG 13 – Climate Action.

Banking

From a review of financed activities, 9 of the top 10 Banks in Jersey were found to have recorded a positive contribution towards both SDG 4 – Quality Education and SDG 7 – Clean and Affordable Energy.

Private Wealth

In the Private Wealth space, qualitative analysis suggests there is strong correlation between investment decision-making and alignment with the targets of SDG 8 – Decent Work and Economic Growth.

Capital Markets

By incentivising businesses to improve resource efficiency and reduce waste generation in order to benefit from both lower operating costs and reduced environmental impacts, Capital Markets were found to have strong positive alignment with SDG 12 – Responsible Consumption and Production. Over 75% of Jersey-domiciled entities listed on TISE were found to have significant opportunity to influence SDG 15 – Life on Land – primarily through exposure to the Real Estate and Financial sectors. Understanding the impact of such allocations will be fundamental to solving the ongoing nature and biodiversity crisis.

We recognise this is only a partial analysis based on limited data to date, however, it does provide some positive insights into where Jersey can most readily influence the SDGs, and also highlight where there could be opportunities for improvement, or indeed for further analysis should data become available.

Further details of the analysis performed, together with findings, is set out for each pillar below.

Funds

AuM of ESG-oriented13 funds reached 14% of total global fund AuM in 2021, and it is projected to rise to at least 21%, and potentially as much as 28% by 202614. Even in the USA, which has seen some different politics to Europe with regards to sustainable investing, a recent survey found that 81% of US institutional investors plan to increase allocations to ESG products over the next two years – almost on par with Europe (83.6%). Applying growth projections to Jersey’s funds industry, it is estimated that Jersey-based ESG-oriented AuM could grow to some $160 billion by 2026.

Jersey’s funds industry offers managers and investors unparalleled access and speed-to-market for their structures, with skills and expertise to support their sustainable investment, compliance and disclosure needs. Jersey has long-recognised the importance of enabling access to and ensuring equivalence between international markets and is well positioned as an enabling platform, facilitating access to products that meet a variety of investor sustainability preferences.

A Jersey base supports a strategic multi-jurisdictional approach, and the Island’s agile and skilled financial services industry is well-placed to provide support. This approach has allowed the Island to service a growing number of funds that operate in line with internationally-recognised ESG principles:

- As of June 2022, more than 729 Jersey-domiciled funds are managed by UN Principles for Responsible Investing (UN PRI) signatories, with an AuM of over USD 257 billion15.

- As of June 2022, 60% of assets in Jersey regulated funds are managed under responsible investment policies aligned with the UN PRI16.

Contribution of Jersey’s funds sector to the SDGs

The economic activities financed by over one third of Jersey’s regulated funds were assessed for this report, with underlying portfolio investments assigned to one of thirty GICS-aligned categories in order to align them to the relevant Sustainable Development Goals. The sample reviewed included private equity, venture capital, real estate, equities, Exchange Traded Commodities (ETCs), private debt and alternatives; with the industry found to have exposure across the entire GICS spectrum from investment in energy and materials through to technology, communications and real estate.

Private equity and venture capital

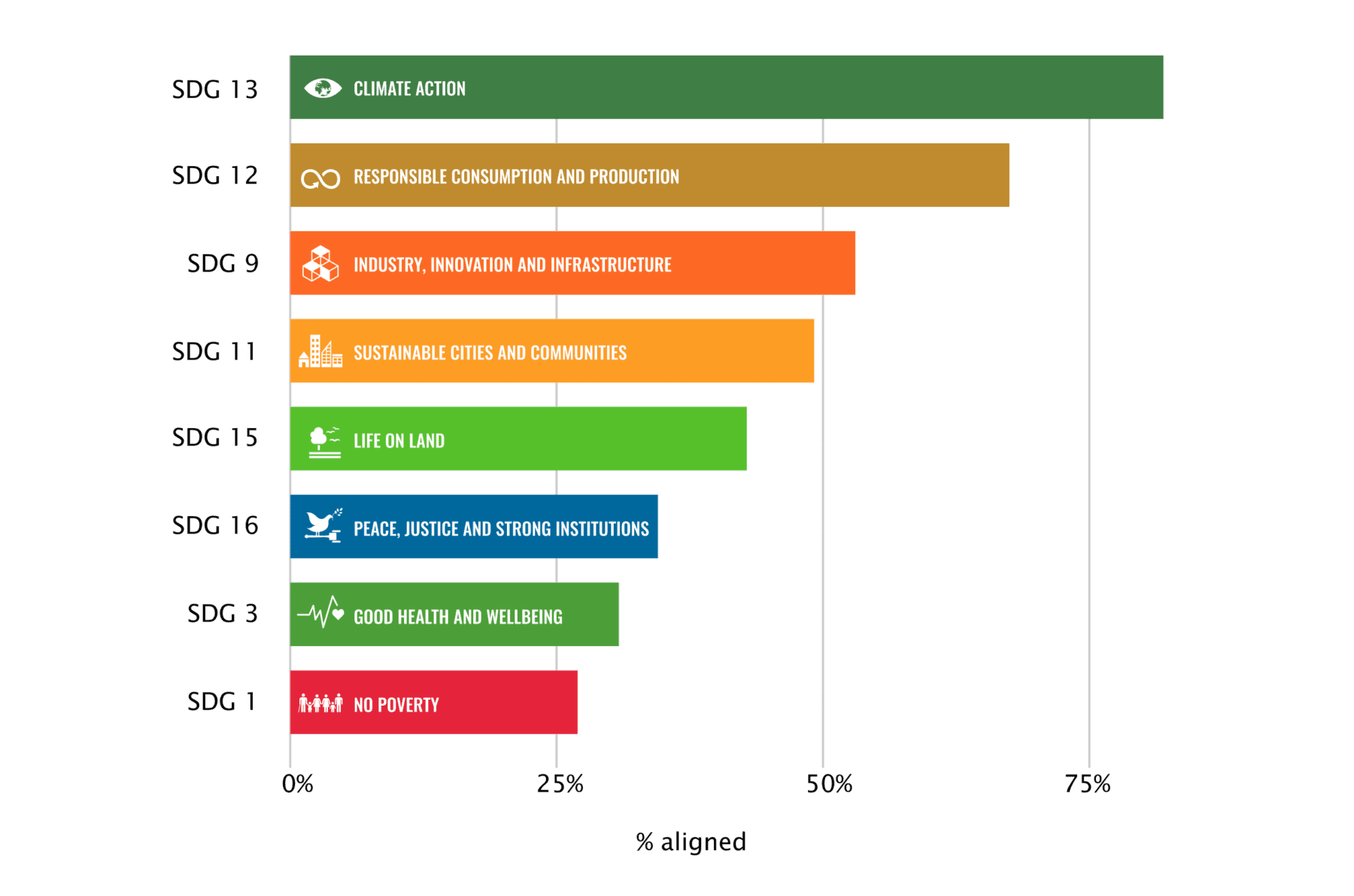

Analysis for this report found that Jersey’s funds industry has the greatest alignment with SDG 12 – Responsible Consumption and Production; with over 88% of fund investments reviewed found to contribute toward this Goal. Private equity and venture capital funds were identified as being particularly aligned with this Goal, likely driven by the longer-term investment horizons of these sectors when compared to public markets; allowing investors to support portfolio companies in making sustainable changes that may take time to yield results. This aligns with SDG 12’s focus on responsible and sustainable practices over the long run.

Notably, 78% of all private equity and venture capital investments reviewed were found to contribute significantly towards SDG 13 – Climate Action. This is unsurprising given the pivotal role of private investment in delivering on climate ambitions – both from a mitigation and an adaptation perspective. According to the International Renewable Energy Agency, to keep average global temperature rises to below two degrees Celsius, investment in energy systems alone would need to reach $110 trillion by 205017. Many of the technologies required to tackle climate change are emerging, requiring capital at the seed and venture stages in order to successfully scale. Due to longer holding periods and active ownership models, private equity and venture capital are uniquely placed to drive the financing of climate solutions and seize the opportunities that exist to create real financial value through longer-term investments.

Jersey-domiciled private equity and venture capital funds also finance a significant volume of activity that impacts the targets of SDG 3 – Good Health and Well-being – driven by the fact that of all the GICS sectors, Healthcare was found to be the one most invested into by Jersey’s private equity and venture capital funds at 15.8% exposure. Identified investments span healthcare supplies, equipment, providers and supporting services; healthcare technologies; and pharmaceuticals, biotechnologies and life sciences. This aligns with broader investment trends: globally, healthcare private equity buyouts have exceeded £157 billion since 2021, with significant activity specifically in healthcare technology and technology-enabled businesses where investment themes focus on enhancing clinical, operational and financial workflows. These investments were also identified as having a strong positive impact on related SDGs, including SDG 8 – Decent Work and Economic Growth through the impact that improved technology and equipment has on the safety of healthcare workers such as pharmacists and care providers.

Figure 2: Jersey’s private equity and venture capital: AuM SDG alignment

Real estate funds

Monterey Insight values Jersey’s real estate funds sector at £69.7 billion AuM as at 31 December 2022; accounting for c. 16% of all Jersey regulated funds by AuM. In addition, analysis of equities funds also identified significant exposure to investments in real assets, bringing the total percentage of all real estate identified through the analysis performed for this report to 20% of all investments reviewed.

SDG 11 – Sustainable Cities and Communities is the SDG with the strongest relationship with the real estate sector. This Goal centres on making cities and human settlements more inclusive, safe, resilient and sustainable through targets such as access to affordable housing, safeguarding cultural heritage and providing universal access to safe and accessible public spaces. With over half of the global population currently residing in urban areas, a figure projected to increase to 70% by 2050, the significant role the real estate sector plays in achieving SDG 11’s targets is clear. Initiatives such as investing in infrastructure that is environmentally sustainable and inclusive, encouraging green building concepts, enhancing connectivity through well-planned transport networks, and fostering inclusivity through barrier-free designs are all essential to successful sustainable development.

Of the real assets analysed for this report, 92.2% were found to be non-residential – spanning industrial, commercial and retail assets – with only 7.8% found to be residential assets. The heavy weighting of industrial real estate over residential means that the sector’s SDG alignment is more significant across SDGs such as SDG 9 – Industry, Innovation and Infrastructure, than across others that relate more so to residential property – such as SDG 1 – Zero Poverty.

Globally the built environment accounts 40% of energy consumption and 33% of all carbon emissions originating in human activity18. As a result, there is little doubt as to the critical role the real estate sector plays in decarbonisation and in achieving SDG 13 – Climate Action – both as a culprit and a catalyst for change. The sector is already adopting climate change adaptation measures that will improve resilience against the negative impacts of our changing climate, and there are further opportunities for the sector to decarbonise, from construction materials and methods, through to operational use and the eventual repurposing of assets. More broadly, the real estate sector plays a key role in place-making and the wider climate readiness of business and society.

Intrinsically linked with the real estate sector’s impact on climate is its impact on nature and biodiversity, and therefore SDG 15 – Life on Land. For this sector in particular, nature’s ecosystem services enable the conditions necessary for maintaining the value of assets, and a recent PwC report found that at least 35% of the economic value generated by the sector’s upstream supply chain and direct operations is moderately or highly dependent on nature19.

The sector also has significant impact on nature. Developments often involve land use changes that can impact ecosystems and biodiversity, and choices made around land use, including the conservation of existing natural habitats and the integration of green spaces in development projects, can substantially influence the achievement of the targets set under SDG 15.

Banking

Banks play a key role in allocating finance for the functioning of the economy. As a result, they can contribute to channelling private capital towards the transition to a sustainable, resource-efficient and fair economy. Such financial institutions provide finance to all sectors of the economy; funding business, private investment, home ownership, education, and almost all basic human needs. It has therefore become a business imperative for banks to understand the impact of their financing decisions and the associated risks – and in doing so, they play a pivotal role in financing sustainable development on a global scale in three key ways:

- Protection from risk: Climate, and other sustainability risks, are often described as systemic risks to the banking system. Exposure to stranded assets, i.e. those that are rendered economically unviable by the transition to a more sustainable economy, could deplete collateral value on a bank’s balance sheet. Assets and activities in the energy and transportation sectors are most often cited as being at risk of obsolescence; however, the issue is broader. For example, a 2022 report by Planet Tracker and CDP estimated that as a result of depleted and contaminated water supplies, US$13.5 billion is already stranded and over US$2 billion is at risk on major infrastructure projects20. As a result, banks have a responsibility to their customers and to financial markets to ensure that assets secured and activities financed are viable in a post-transition world.

- Transition planning and financing: Banks are a unique and essential enabler in the global system to accelerate a just transition towards a net zero, climate-resilient economy, aligned to the achievement of the SDGs. Climate transition plans, which are now required for UK banks and are increasingly prevalent globally, drive banks to reduce their financed emissions, manage climate risks and opportunities, help clients build climate resilience, and use their levers to enable the economy-wide transition, including financing the growth of green alternatives. This in turn means that banks are proactively seeking ways to finance the sustainable transition of sectors and markets, in order to deliver on their plans.

- Offering sustainable banking products: Global sustainable lending activity has grown significantly in recent years, driven largely by increasing adoption of sustainability-linked loans which have terms contractually tied to the sustainability performance of borrowers. 90% were sustainability-linked loans, while green loans, whose proceeds are earmarked for financing sustainable projects, make up a smaller segment of this market.

A recent report found that revenues from sustainable trade finance and cash management products are expected to grow by up to 20% annually, reaching a total of US$28 billion to US$35 billion in 202521. At present, demand for sustainable global transaction banking products far exceeds supply, with only 10% of demand being met22.

Contribution of Jersey’s banking sector to the SDGs

Analysis of the SDG alignment of Jersey’s banking sector for this report covered the 10 largest international banks with a Jersey presence. Banks in IFCs are typically branches of international institutions; specifically, Jersey’s banks are predominantly branches of UK structures.

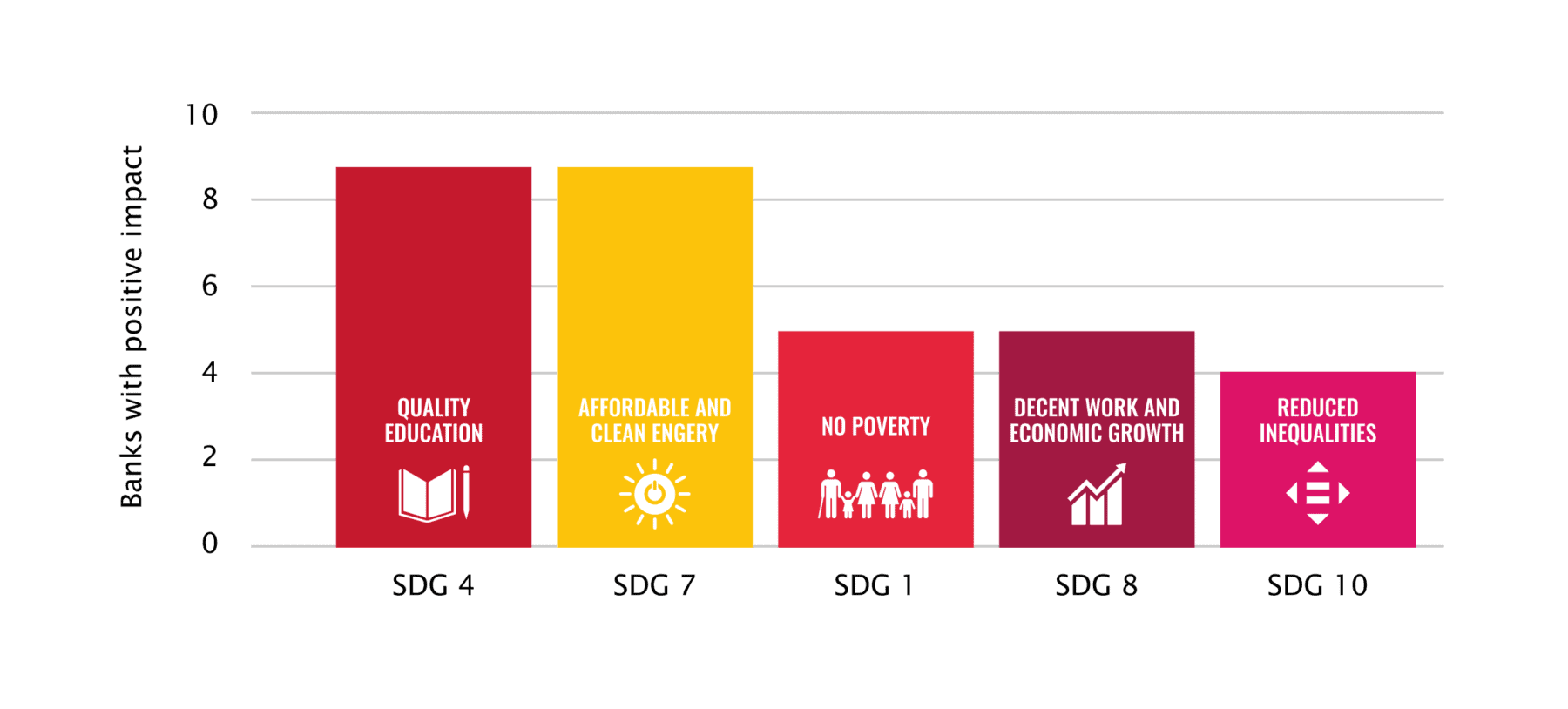

From analysis of the top 10 banks in Jersey, SDG 4 – Quality Education and SDG 7 – Clean and Affordable Energy were determined to be those for which the sector has the greatest positive impact through the activities financed – with nine out of the 10 local banks reviewed having a recorded positive contribution against both Goals.

SDG 4 – Quality Education has specific targets and indicators related to access to education, quality of education, and the promotion of lifelong learning opportunities. Some of the ways that Jersey’s banking sector positively contributes to this SDG are through:

- The provision of financial support to educational institutions, students, and educational projects, including offering student loans, scholarships and grants to help increase access to education.

- Financing the construction and maintenance of educational infrastructure and businesses, such as schools, libraries, ed-tech companies, textbook publishers and vocational training providers, to improve the quality and accessibility of education.

- Supporting financial literacy programmes which help individuals make informed financial decisions – which in turn also supports progress against SDG 1 – No Poverty.

- Offering responsible lending practices for education-related loans, ensuring that students are not burdened with excessive debt and can reasonably repay their loans after completing their education.

SDG 7 – Clean and Affordable Energy aims to ensure access to affordable, reliable, sustainable, and modern energy for all by 2030. The banking sector can contribute to SDG 7 in several ways, including:

- Providing financing and investment opportunities for renewable energy projects such as solar, wind, hydro, and geothermal power.

- Issuing green bonds and providing sustainable finance options that support energy-efficient and clean energy initiatives. These financial instruments can direct capital towards projects that align with SDG 7, helping to reduce greenhouse gas emissions and promote clean energy adoption.

- Energy efficiency loans: Banks offer loans and credit lines specifically designed for energy efficiency upgrades in homes, businesses, and industries. These loans can help individuals and organisations invest in energy-efficient technologies, reducing energy consumption and contributing to SDG 7 targets.

- Research and development funding: Banks allocate funding to research and development initiatives focused on advancing clean energy technologies. This support can lead to innovations that make clean energy sources more accessible and affordable.

SDG 1 – No Poverty, SDG 8 – Decent Work and Economic Growth and SDG 10 – Reduced Inequalities were also found to be positively aligned with underlying economic activities financed by Jersey’s largest banks:23

- SDG 1: A large portion of the world’s population lacks access to banking, typically overlapping with poverty. Banking can reduce costs compared to third-party payment options and short-term loans, as well as boosting business productivity. The sector also plays an important role in promoting financial inclusion by providing their services to low-income individuals and marginalised communities which in turn helps people save, invest, and build assets, which are essential for escaping poverty.

- SDG 8: Decent work and full employment are central to SDG 8. The financial services industry is a significant employer in many countries, offering a wide range of job opportunities, from banking and insurance to investment management and fintech. A healthy financial sector can contribute to job creation and help address unemployment issues.

- SDG 10: The banking sector plays a crucial role in contributing to SDG 10 through various mechanisms and practices that aim to promote economic and social equality, including designing affordable banking products tailored to the needs of low-income groups, facilitating access to credit and financial resources for small and medium-sized enterprises, and adhering to responsible lending practices such as responsible debt collection and ensuring loans granted are based on a borrower’s repayment ability.

SDG 17 – Partnerships for the Goals is also positively contributed to by the banking sector. In 2021 the UN-convened Net Zero Banking Alliance (UN NZBA), which brought together a global group of banks which currently represent c.40% of global banking assets, unified in their commitment to aligning their lending and investment portfolios with net zero emissions by 2050. In addition, the UN Principles for Responsible Banking (UN PRB) now has more than 300 signatory banks representing 45% of global banking assets, and drives action to align strategy, decision-making, lending and investment with the UN SDGs. Nine out of the 10 largest banks in Jersey are members of the UN NZBA and nine out of 10 are members of the UN PRB24.

“As a financial institution and a local employer, [we are] redefining our ESG strategy, governance framework, dedicated resource and product offering to increase our positive SDG impact.”

Figure 3: Jersey’s banking sector: positive alignment with SDGs

Case study:

HSBC Encourages Island Innovators to Embrace Global Climate Tech Funding Push

View case study ›Private Wealth

As of 2020, the estimated AuM of Jersey trusts and other asset-holding vehicles (encompassing both private and corporate clients) was £1.14 trillion. It is evident among industry participants that the ongoing intergenerational wealth transfer will continue to drive increased interest in sustainability preferences for Jersey’s private wealth clients and that SDG-aligned AuM in this sector will rise substantially in the coming years. Jersey needs to be ready to serve these clients, should the Island’s wealth management market double in line with global projections by 2026.

The Island has a robust, sophisticated and forward-thinking legal framework that allows it to lead the way in delivering private client services – from simple trusts and underlying company structures, to high-value and complex arrangements involving trusts, companies, limited partnerships and foundations. The stability and quality of Jersey’s trust law remains highly attractive to international private wealth clients, including those focussed on philanthropic and socially responsible wealth management in a tax neutral environment.

Contribution of Jersey’s private wealth sector to the SDGs

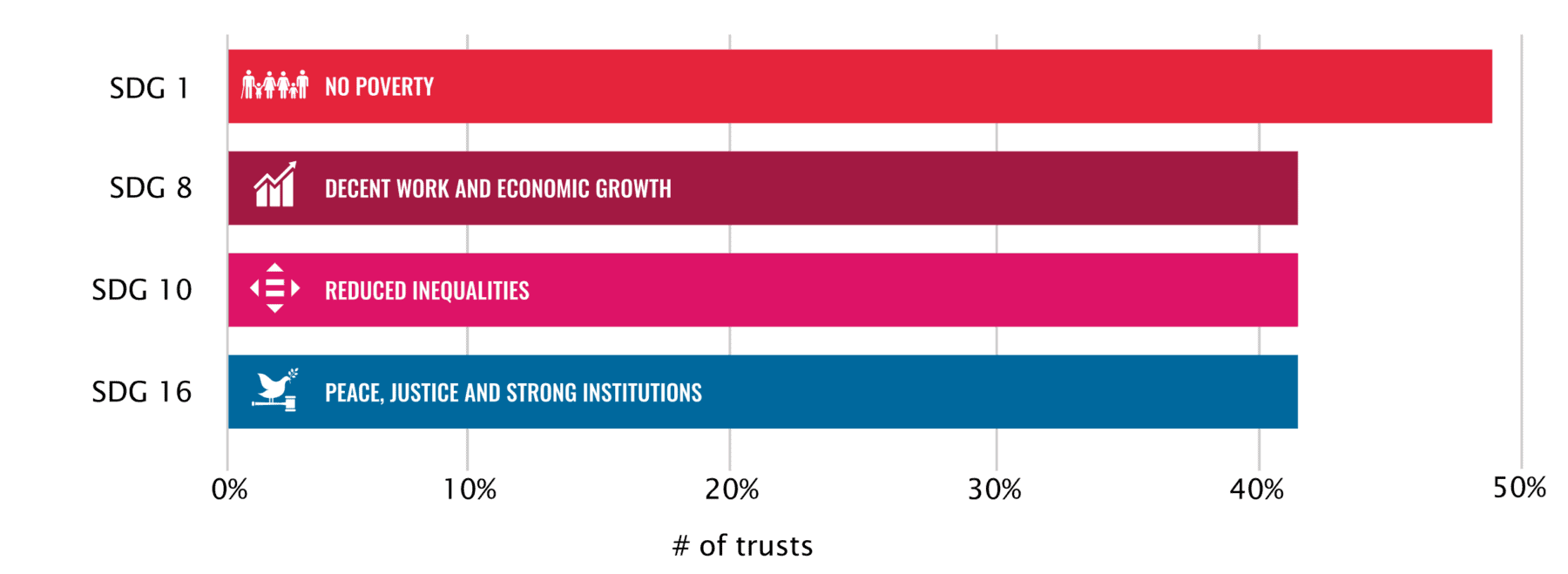

Analysis of Jersey trusts showed significant correlation between investments held and SDG 1 – No Poverty, with more than 50% of all Jersey trusts holding assets that contribute towards this Goal.

Further analysis of Jersey’s trusts showed that over 40% hold assets that contribute to:

- SDG 8 – Decent Work and Economic Growth, primarily via contributions from Employee Benefit Trusts, which have been considered in more detail below.

- SDG 10 – Reduced Inequalities, which includes targets such as improving the regulation and monitoring of global financial markets – where Jersey, as a world-leading IFC, stands out from peers; and

- SDG 16 – Peace, Justice and Strong Institutions which, as noted above, is part of Jersey’s core identity and its licence to operate.

Figure 4: Percentage of Jersey trusts correlated with specific SDGs

The role of Employee Benefit Trusts

13.5% of all Jersey trusts are Employee Benefit Trusts (EBTs)25, the purpose of which is to incentivise and reward employees. An EBT typically takes the form of a discretionary trust of which all the employees are beneficiaries, with companies benefitting from dedicated and motivated employees whose interests are aligned with those of their employer. There are a number of advantages of using a Jersey trust for an EBT, including:

- Assets held within an EBT are bankruptcy remote, meaning that should a company go bankrupt, the assets remain in the EBT to be used for the benefit of employees. Further, using a Jersey Trust as an EBT allows flexibility in the type of benefits that can be delivered, including both share-based and cash-based rewards; enabling them to be structured such that they best meet the needs of both the company and its employees. These advantages map to SDG 8 – Decent Work and Economic Growth, in creating a protected, incentivised workforce with a vested interest in the performance and success of their employer.

- EBTs typically have independent trustees who are required to act in the best interests of their beneficiaries, helping to avoid both real and perceived conflicts of interest. This aligns with the targets of SDG 16 – Peace, Justice and Strong Institutions, which promotes independence and governance that is free from bias in pursuit of equality.

Wealth management

Private wealth managers often focus on long-term financial planning and multi-year investment strategies in order to create sustained wealth for their clients. In very simplistic terms, the role of an investment manager is to make money for their clients in a manner that is consistent with their risk profile and investment requirements/ambitions. In constructing and managing the portfolio it is important that managers understand the client in terms of their own personal objectives – not just financially, but also ethically and morally.

Interviews with senior members of Jersey’s wealth management sector revealed consensus that the “best companies” from an investment perspective are often those who create diverse and equitable workplaces, knowing that this helps with recruitment, retention, productivity and competitiveness. Companies that promote decent work and have good growth prospects are often those that offer the best investment returns; with experienced wealth management teams understanding the landscape of both economic and cultural change and thereby actively investing in the companies that are best placed to operate successfully in tomorrow’s world. This demonstrates clear alignment with SDG 8 – Decent Work and Economic Growth; specifically its targets relating to supporting productive activities, decent work creation, creativity and innovation.

Therefore, while many wealth and investment managers do not as yet focus on direct pillars of sustainable investing (e.g. addressing climate change or environmental destruction), they do allocate capital in a manner that contributes towards a sustainable future, while restricting the flow of capital towards organisations that operate in an unsustainable manner.

“I do not believe it is merely a coincidence that the ultimate choices in our portfolios are often those companies that get high ratings in ‘the best companies to work for’ research, and favourable ESG classifications, even though these are not primary parameters we use to rate the suitability of an investment”

Capital markets

Jersey has the largest number of FTSE 100 and AIM companies outside of the UK and these, together with Jersey companies listed on global exchanges, collectively hold a market capitalisation of over £237 billion26.

Contribution of Jersey’s Capital Markets sector to the SDGs

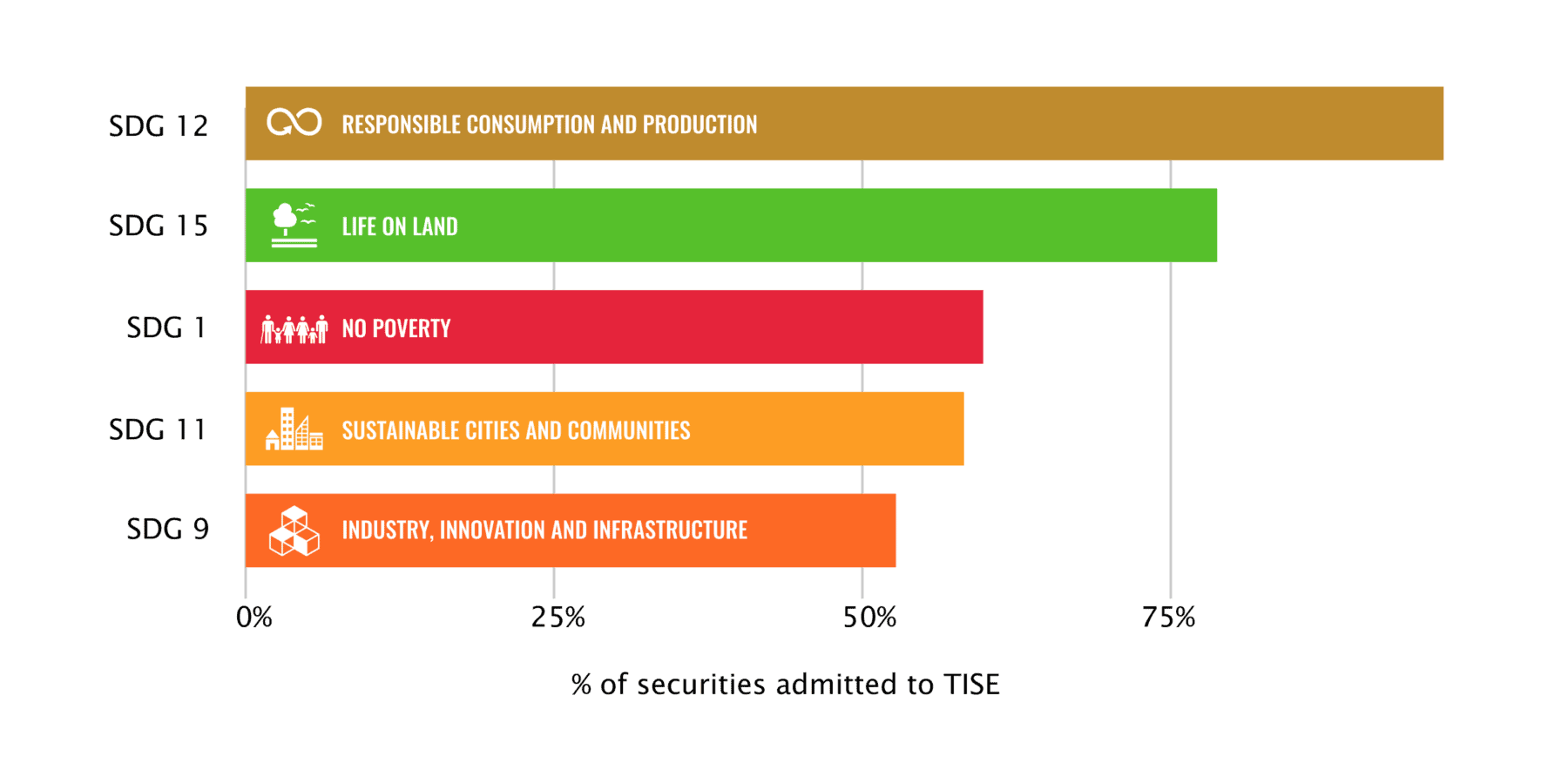

Part of the research undertaken for this report focussed primarily on Jersey-domiciled entities listed on TISE; being those where they were both listed on a local exchange and decision-making powers are on-Island. Further analysis of relevant case studies covered non-Jersey domiciled issuers, but where listing agents were based on-Island. Admissions to TISE Sustainable are predominantly from issuers of high yield bonds which come to list with the initial noteholders already secured. As such, they are not raising capital on TISE but are listing to meet investor expectations or mandated requirements. The combined market value of admissions to TISE Sustainable, together with listings on the main TISE Segment that have sustainable activities, are estimated to total more than £14 billion at the end of June 2023.

SDG 12 – Responsible Consumption and Production

SDG 12 – Responsible Consumption and Production is the SDG that is the most aligned with the activities of the Jersey-domiciled entities listed on TISE. Environmental, social and governance-related metrics have become increasingly important to investors, and capital markets play a crucial role in encouraging companies to incorporate sustainability considerations into both their operations and reporting and subsequently reward companies with strong sustainability performance. In addition, through mechanisms like carbon pricing and emissions trading, capital markets can incentivise businesses to improve resource efficiency and reduce waste generation; with companies that implement resource-efficient practices benefiting from lower operating costs and reduced environmental impacts.

“TISE, in conjunction with Jersey-based Listing Agents, is assisting a range of companies from across a variety of different sectors, including some major global brands, to undertake initiatives which contribute towards the pursuit of the UN SDGs.”

SDG 15 – Life on Land

Over 75% of all Jersey-domiciled entities listed on TISE were found to have significant opportunity to influence SDG 15 – Life on Land – primarily due to exposure to the Real Estate and Financial sectors. Both sectors have significant impact on nature and biodiversity – whether that be through real estate’s physical impact on the natural environment and those who inhabit it, or finance which will need to take a leading role in financing solutions to the nature crisis.

Approximately 1 million species are facing extinction within decades. Ecosystems have declined in size and condition by an average of 47% globally compared to estimated natural baselines. Dependencies on nature (i.e. the goods that we depend on natural resources for, such as food, fuel, medicine; and the services nature provides us such as climate regulation and water filtration) remain unpriced and are therefore economically invisible. Similarly, many of the impacts that businesses have on natural capital bear no measurable cost – such as water discharges and use of land.

But, despite the alarming risks that society faces from nature loss, the world continues to spend too little on conserving and restoring natural ecosystems. To date, public financing has shouldered the lion’s share of the responsibility for natural capital finance. However, public financing alone will fall far short of the required levels of investment needed to achieve a nature-positive future. In its recent State of Finance for Nature 202227 report, the United Nations Environment Programme estimated that the world spends US$154 billion per year on ‘nature-based solutions’ (actions to protect, conserve and restore natural ecosystems) – which is less than half the predicted funding needed in 2025 and one-third of the 2030 requirement.

Recent analysis28 of 19 large, global stock exchanges found that more than half of the market value of listed companies is subject to nature-related risk due to each listed company’s either moderate or high dependence on nature somewhere in their value chain. Even in industries that had minimal identifiable dependencies in their own operations, high or moderate dependencies were often found in supply chains and in customer bases.

Because companies depend on nature, shareholders do too. The report also estimated shareholder nature dependencies for each of 19 major stock exchanges by calculating the dependence of the market value of listed companies. The overall nature dependence of these listings is close to that of the global economy, with just over half the company value – nearly US$45 trillion – exposed to financial risk through high or moderate nature dependence. Applying this to the market capitalisation of Jersey companies on international exchanges would result in over £87 billion of market capitalisation held by Jersey listed companies globally being either moderately or highly dependent on nature.

Figure 5: Securities admitted to TISE: % exposure by SDG

Enablers for sustainable finance

Corporate and professional services

The four pillars of Jersey’s finance industry – Funds, Capital Markets, Private Wealth, and Banking – are all underpinned by a thriving corporate and professional services industry which supports complex, cross-border multijurisdictional business activities. Jersey’s offshore corporate services ecosystem – including accounting, advisory, assurance, fiduciary and other enabling services – provides the requisite expertise and experience built over six decades of supporting corporate transactions, across all asset classes, from across the globe. Each of these roles plays a unique part in furthering the Island’s contributions to the SDGs.

“Many of our practitioners take part in shaping the responses of our jurisdictions to assist in sustainable investment and ESG initiatives in the finance industry through involvement in governmental, regulatory and industry groups.”

Industry associations, skills and education

As a highly regulated, forward-thinking jurisdiction, Jersey is home to a number of key industry trade associations and regulatory bodies who work closely with businesses, industry and government – very much in the spirit of SDG 17 – Partnerships for the Goals. One of the targets of SDG 17 is to enhance policy coherence for sustainable development, which Jersey’s industry bodies play a key role in the achievement of.

2023 also saw the launch of the Jersey Association of Sustainability Practitioners (JASP), which unites the Island’s sustainability professionals and experts to accelerate the pace and scale of sustainability action in Jersey.

Case study

Jersey is also home to the world’s first sustainable finance training course specifically designed for IFCs. Equilibrium Future’s Understanding Sustainable Finance course is designed for financial professionals including trustees, banks, asset managers and governments seeking to enhance their sustainable finance expertise. The course provides a comprehensive overview of sustainable finance risks and opportunities and is accessible to practitioners at all levels, from C-Suite executives to newly onboarded finance professionals. Jersey having such an offering, especially one that is specifically tailored to IFCs and their role in global financial markets, shows a commitment to the advancement of SDG 4 – Quality Education (“ensure equitable quality education and promote lifelong learning opportunities”) and of SDG 17 – Partnerships for the Goals (“strengthen the means of SDG implementation through sharing knowledge and expertise”).

Technology solutions

The agility of Jersey’s financial services sector, when combined with its high regulatory standards and fast-growing digital economy, has led to a growing and exciting array of digital start-ups on the Island – supported by one of the fastest broadband speeds in the world. As a result, Jersey is emerging as a centre of excellence for investment in sustainable finance tech solutions, operating at the interface of sustainable finance and digital technology. This is supporting the Island’s industry to better capture and analyse ESG and impact data and to provide a growing range of efficient and relevant regulatory disclosure and investor reporting solutions.

Case studies

These solutions are enabled by the depth of expertise held locally, as well as the useful testing ground for innovative ideas in our finance industry, with two strong examples:

- Innovest Advisory – An impact investment advisory firm helping clients to become more intentional about impact and embed it into their processes in order to achieve targeted social and environmental outcomes. This firm works with fund managers, asset owners, companies, international organisations and non-profits across a broad range of sectors, supporting the design of impact strategies and methodologies that credibly demonstrate to stakeholders an organisation’s impact and results; and

- Paragon +Impact – A global expert tech company specialising in digital impact analysis with a mission to reduce the complexity of ESG and sustainability reporting. They have created a cloud-based impact assessment tool, built upon global frameworks and delivering a robust impact grading methodology that is powerfully aligned to the SDGs and other ESG principles. They aim to shift the focus from simpler ESG risk reporting over to tangible impact reporting, ensuring better transparency over the results of a company’s activities, enabling informed decisions that focus foremost on the sustainability of the planet and its people, alongside sustainable economic growth.

4. Opportunities for Jersey and the call to action

The findings of this report clearly demonstrate that IFCs such as Jersey have a significant role to play in furthering the world’s achievement of the SDGs.

While the sections above set out some good progress to date, there is much more to do. This section outlines the evolution of the role going forward for Jersey as an IFC, the opportunities arising, and what actions are required to harness these. It is intended as a call to action for all those operating in and engaging with Jersey in the context of our aspiration to be the leading sustainable finance centre in the markets we serve by 2030.

The continued evolution of Jersey’s role as a leading sustainable IFC

Ensuring capital is directed to where it is needed most, and doing so quickly, securely and efficiently, is increasingly important. IFCs such as Jersey are well-equipped to do exactly this by financing sustainable development with the support of top-rated regulatory, compliance and governance frameworks.

Section 2 set out the key functions IFCs have in relation to SDG 16 – Peace, Justice and Strong Institutions and SDG 17 – Partnerships for the Goals in particular.

Beyond this, and as described above, Jersey needs to use its role as a conduit of capital and hub of expertise, building on success to date in order to accelerate pace and scale as follows:

- Play our part in unlocking financing at scale for achievement of the SDGs, including impact investing and collaborating to develop, test and scale innovative financing solutions.

- Encourage all economic activities that are financed through Jersey to be positively aligned to the SDGs, avoiding any further harm to people and planet.

- Ensure all our industry participants, including supporting professional services, have business strategies that are Goal-congruent.

- Support growth of sustainable finance with training, skills, technology, collaborative partnerships, incentives and proportionate regulation where appropriate to protect and promote Jersey as a leading sustainable finance jurisdiction.

- Continue to strengthen market data on financing of the SDGs and consider aspirational targets for example on size of AuM. Share case studies of sustainable finance solutions for the SDGs that are structured from Jersey and leverage Jersey’s strengths as an IFC.

How Jersey’s role in the international finance system supports this role

The benefits that Jersey presents as an IFC in terms of interoperability, efficiency and credibility are significant assets in furthering progress against the SDGs:

- Interoperability: Jersey has long-recognised the importance of enabling access to and ensuring equivalence between international markets and as a result it has become home to products that meet a broad variety of international investor preferences and appetites – including those that further the objectives of the SDGs. With a regulatory environment that recognises and enables the establishment of internationally adopted product labelling disclosure frameworks, financial products on the Island are not only able to take a strategic, multi-jurisdictional approach to compliance, but can also leverage opportunities for impact.

Jersey has also addressed the risk of mislabelling; with anti-greenwashing legislation introduced in 2021 which protects investors from the risk of financial products being mislabelled as having sustainable objectives. Under the legislation, funds promoted on the basis of making sustainable investments are required to disclose all material information on the fund’s sustainable investment objectives and strategy – including if and how these align with the SDGs, if they have been used as a basis for sustainable investment decisions.

- Efficiency: Jersey’s regulatory and tax regimes are entirely independent of the UK. This allows for a fully independent legislature, with a comprehensive framework of financial services and product laws and regulations; and an internationally-compliant and attractive personal and business tax regime. When combined, these result in a highly efficient platform for international investment and financing activities.

There are also efficiencies to be found from a regulatory compliance perspective. For example, there are already a significant number of EU SFDR Article 8 funds on the Island, having taken advantage of the National Private Placement Regime (NPPR) to market into the EU. Non-EU Alternative Investment Fund Managers (AIFMs), such as those in Jersey, are only in-scope of SFDR in respect of each product that they market, and are not considered to be in-scope themselves. This means that a Jersey-based AIFM is only required to make fund-level disclosures, whereas an EU-based AIFM would have to comply with a number of additional manager-level provisions.

In the private wealth sector, change is anticipated as wealth is transferred to a new generation of wealth holders with greater appetite for sustainable portfolio management strategies. As evidenced through a number of interviews with organisations operating in this sector, the local market has readily anticipated this increase in demand and is well-prepared for an increase in demand for sustainable products and strategies.

- Credibility: As set out in section 2, a sustainable IFC is only credible if the industry operates in a sustainable manner from a sustainable location, and in this regard the Island has its own sustainable economic development strategy and net zero by 2050 commitment, which the finance industry is committed to playing a full part in both operationally and through providing finance where appropriate.

More broadly the Island has committed to developing high-quality infrastructure and expertise to service the increasing demand for sustainable finance products. There is also a growing community of skilled sustainability professionals on the Island, including technical regulatory experts with multi-jurisdictional expertise.

Some leading sustainable finance opportunities aligned to the SDGs

What specific financing solutions might Jersey’s finance industry look to explore? Here are some examples of the most promising trends and opportunities for further innovation and scaling:

Transition financing

In order to achieve the SDGs there needs to be wholesale transformation of every sector of the economy – which means funding new technologies and disruptive products and services. There is significant value-creation potential for financial market participants who direct capital towards so-called “transition finance” opportunities. Transition finance focusses on financing the dynamic process of becoming sustainable, providing solutions for whole-of-economy decarbonisation, and decarbonising the most polluting and hard-to-abate industries. It also requires consideration of the wider social and environmental context and the context of a just transition, which leaves no-one behind.