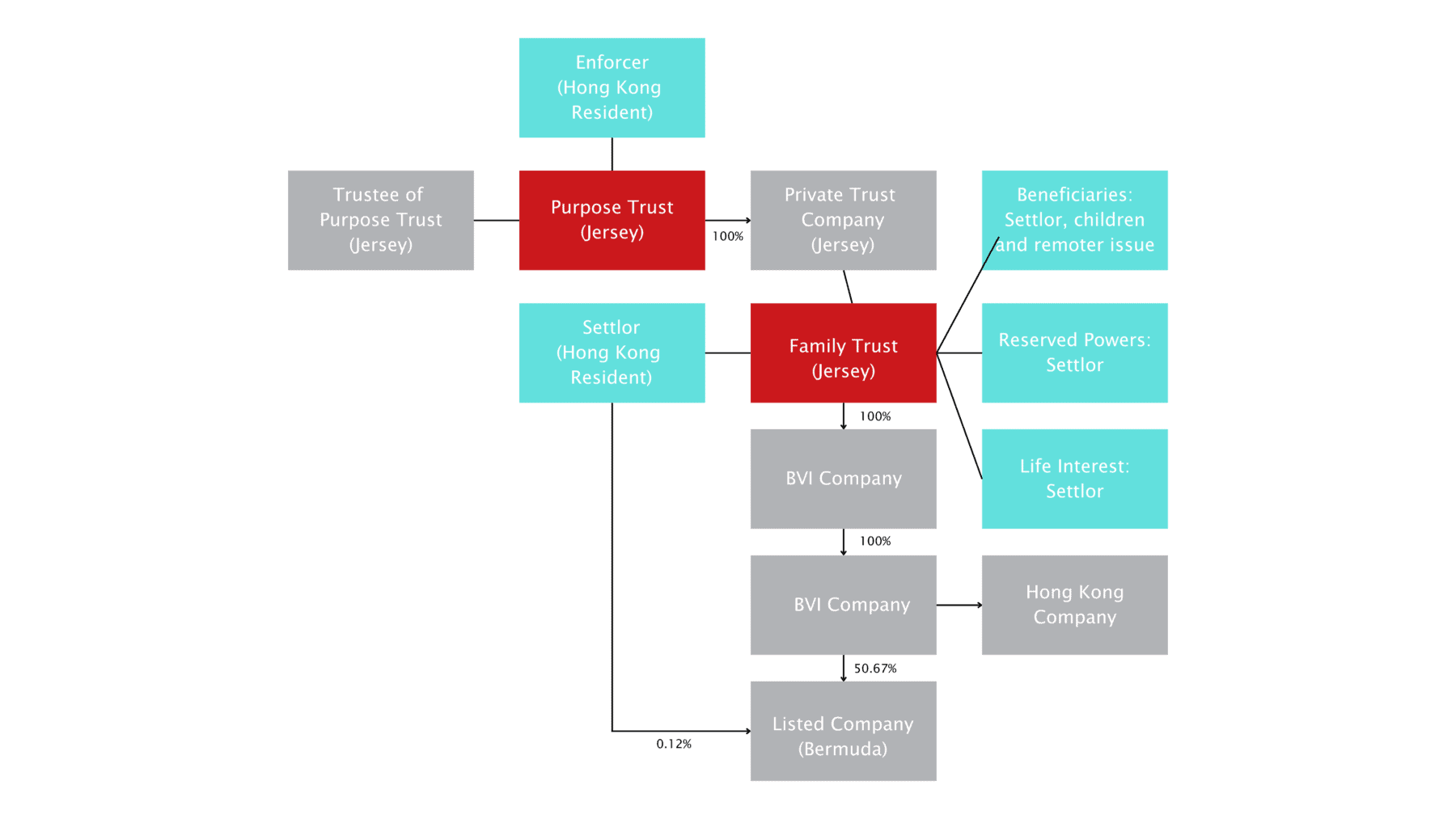

Case Study 1: Purpose Trusts, PTCs and Discretionary Trust Structures

Praxis were approached by a Hong Kong-based law firm in relation to the formation of a private trust company (PTC) structure, in accordance with advice from a Jersey-based law firm, for one of their long-standing clients (the Client).

The Client requiring the structure is a Hong Kong national, who still resides in Hong Kong. His wealth originates from family business, which was started by his father over 70 years ago. The business was subsequently listed some 30 years ago, with the family still holding c.51% today.

The structure, as per the below, will see the shares in the listed business held by a British Virgin Islands double company structure which will in turn be owned by the Jersey PTC structure. The board of directors of the PTC will be the Client, his close family members, and Praxis, as professional services providers (a requirement of Jersey regulation). This board composition gives the client and his family a degree of control in the decisions of the trustee. However, anyone taking on the role of trustee must be aware of their fiduciary duties in this respect. The Client will reserve the power to direct investments in the discretionary trust (the Family Trust), with a life interest to the Client and his wife (as co-Settlors).

The benefit of reserving the power of investment in the Family Trust is to give the Client control of when to sell or acquire shares in the listed business. This is a business that has been created over a significant period of time, is the majority of the family wealth, and the Settlor will likely feel that the trustees do not have the requisite degree of understanding of the business, and the environment it operates in, to give advice in terms of the timing of future sales and acquisitions of company shares. Therefore, the Client will relieve the trustees of this duty, in accordance with the terms of the reserved powers clause in the trust instrument.

In addition to the reservation of investment powers, the Client and his with, as co-Settlors, have created a life interest in the Family Trust, which will provide them with an income during their lifetime.

Chinese Translation

通过泽西岛律师与香港律师的沟通和建议,Praxis收到来自香港本土间律所关于私人信托公司(PTC)针对其客户的架构设立请求。 委托人来自于香港并在香港居住生活,大部分财富来源于70多年前委托人父亲起家的家族生意,大约在30年前已经成功上市,至今家族仍旧掌控51%的股权。 架构如图中所示,上市公司由两层BVI公司架构控股,并在最上层由泽西岛私人信托公司作为受托人持有此下层架构。私人信托公司的董事会包括委托人本人,家人成员,以及Praxis (根据泽西岛规定PTC董事会成员应包括泽西岛专业服务机构)。董事会的参与令委托人和其家族能够拥有部分程度的决策权参与受托人作出的决定,当然任何担任/参与受托人角色都务必明确他们的信托责任和义务。在此全权裁定信托架构中,委托人还保留针资产的投资权利,并与太太享有信托的终身利益权益。 保留此家庭信托中的投资权利主要优势是提供了委托人可随时买卖其上市公司股权的灵活性,家族产业通过跨世纪的积累和沉淀,委托人更熟悉和了解产业本身,所在的市场环境,以及公司未来的市场前景发展,所以委托人更愿意保留此权利,同时也明白信托契约中关于保留权利的条款诠释。 除了针对投资权利的保留以外,委托人和其太太(作为共同委托人角色)也在家庭信托层面设立的终身利益的权益信托,确保他们未来生活的收入保障。

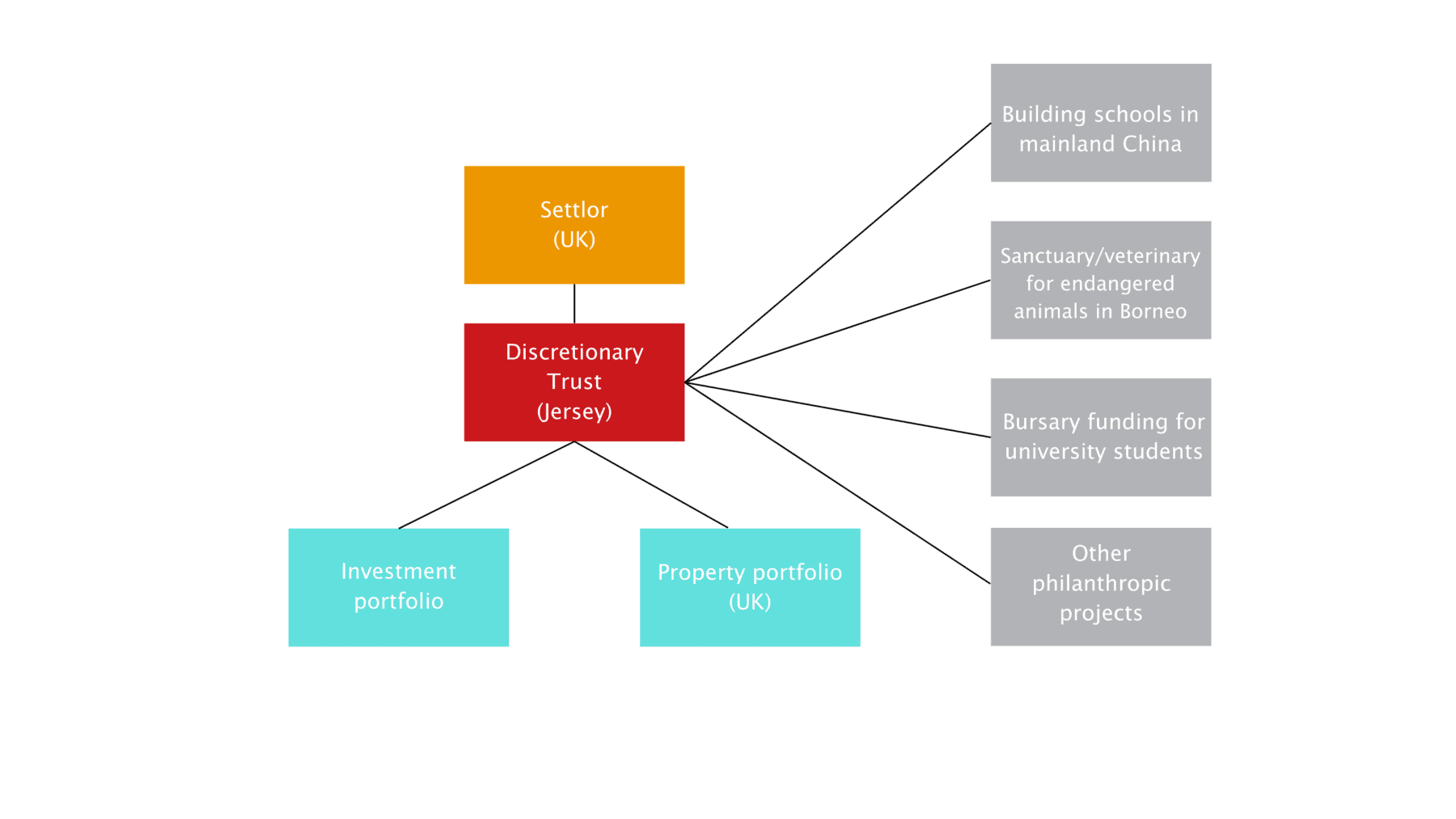

Case Study 2: Philanthropic Trusts

The client was a wealthy UK individual, who inherited significant assets when his father, who lived and generated his wealth in Hong Kong, passed away. The client set up a Jersey discretionary trust (the Trust) for Philanthropic purposes to support worthy causes in the Asia region and give back to the region where the wealth originated. In order to fund the charitable projects, the Trustees placed funds in an investment portfolio, as well as owning a property portfolio in the UK, which generated income which could be donated annually.

Each year, the Trustees would set aside an amount for the projects and would consider requests from worthy causes for funding. As part of the consideration process, the trustees would review the requests and, where required, visit the organisation, or project, that required funding. This enabled the trustees to properly assess the needs of each project, but also help from a due diligence and authenticity perspective.

Examples of the initiatives are as follows;

- bursary funding for students to study at university at the University of Hong Kong (receiving reports annually to ensure support could be continued);

- building of schools in mainland China (and providing further maintenance funding in subsequent years);

- establishing a sanctuary / veterinary for endangered animals in Borneo.

Chinese Translation

此案例中的委托人是英国的高净值客户,继承了他父亲在香港打拼的家族资产,为了反馈给家族财富起源的亚太地区,委托人决定设立以慈善为目的的泽西全权信托。在信托规划上,受托人不仅仅安排了投资组合,信托也拥有在英国的多处房产组合产生收益,以满足每年慈善捐赠的确定项目和其他慈善捐赠的款项请求。 受托人每年都会安排一笔资金用于已确认的慈善项目和考虑其他慈善捐赠,在择选过程中,受托人会审查这些项目,甚至包括慈善机构或者项目的拜访和考察,以确保其真实性的同时,也帮助受托人能够更全面仔细的了解每个项目的需求和妥善处理好合规的事宜。 慈善捐赠的形式有许多种,举例来说: - 香港某大学学生的助学金(每年需收到成绩报告确定继续捐赠); - 参与内地学校的建设(以及未来每年持续性的捐赠支持); - 参与在印尼建设濒临灭绝动物的避难所/兽医诊所。

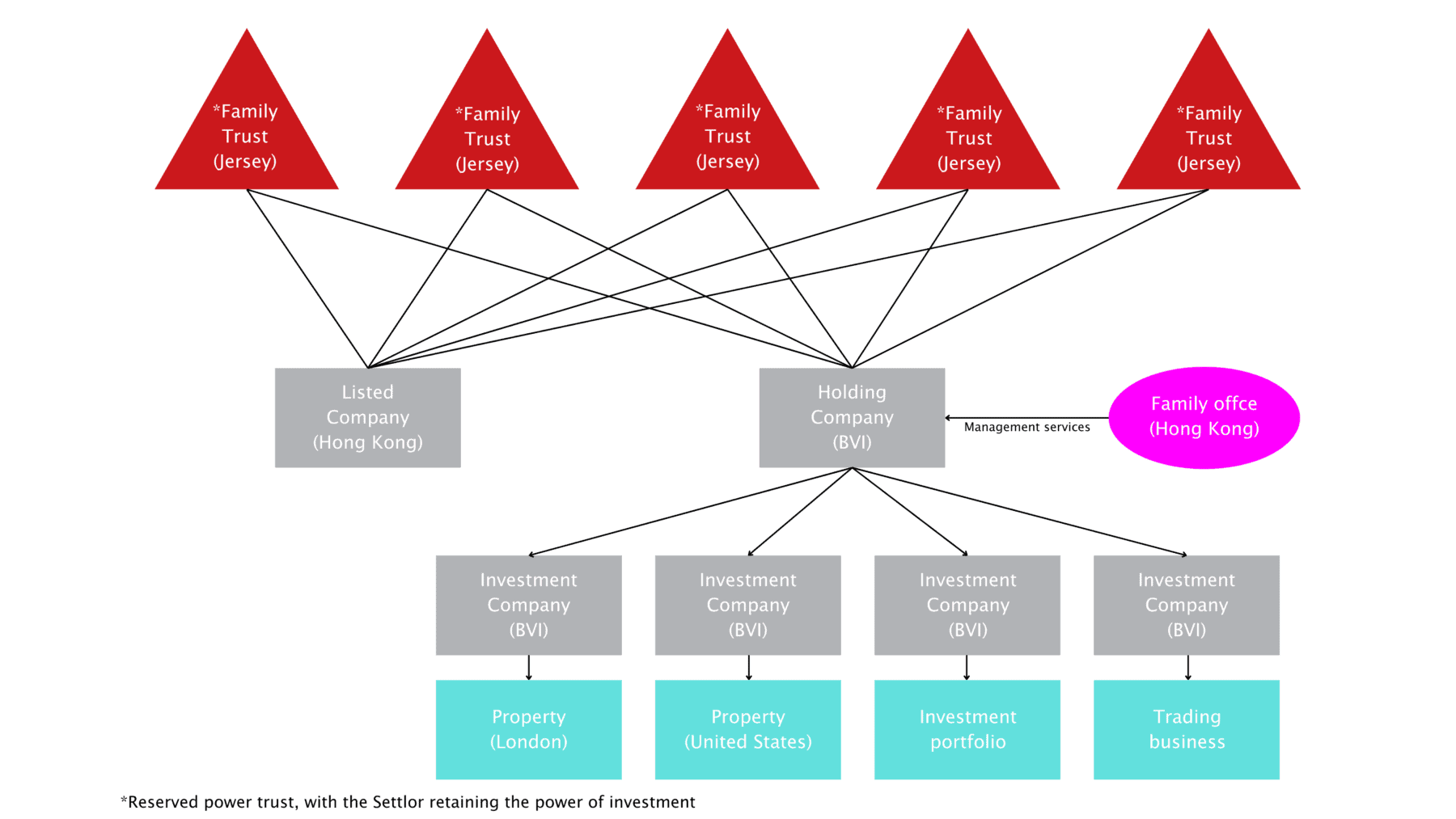

Case Study 3: Multi-Trust Structures

This structure was established for a wealthy Asian family who had grown their family business and subsequently listed it on the Hong Kong Stock Exchange. The family created a number of typical discretionary trusts, one for each branch of the family, to hold their respective interests in the listed entity. However, in order to preserve the principle ownership of the family business in the family there was one bespoke reservation of power included in the Deed, namely that the Trustees could not sell the shares in the family business without the prior consent of the matriarch of the family, as she wanted to have control over the timing of any sales of the listed shares and ensure that in the event of a rift in the family, the shares could not be sold to third parties.

In addition to the holding in the listed company, each trust also held an equal share in various non-listed BVI companies (via a BVI holding company). These companies were managed by the family office based in Hong Kong, and the investments held were diverse in nature and global in geographical reach.

The purpose of this structure was to keep the listed company primarily in the family for generations to come whilst allowing each branch to deal with the income from that holding as they saw fit. It provided a mechanism to keep control over the timing of the sale of any shares in the listed company, as this was clearly a business the family knew well, so they felt they were best placed to know when these corporate transactions should occur. Finally, it also meant that the investment experts in the family office were able to properly utilise their knowledge and skills to buy and sell a variety of global assets to fit with the investment objectives of the overlying trust structures.

Chinese Translation

这个架构是为一个来自亚洲的富豪家族设计搭建的,家族产业的发展从扩张到最终在香港上市。架构中设计了若干个常见的全权信托,为家族中的每个小家庭持有上市公司的相应股权。特别值得留意的是,为了整个公司产业能够把控在家族手里的原则,信托契约中特别约定权利的保留,即受托人不能在未经得家族族长同意前提下出售信托持有的上市公司股权,以确保家族万一出现分歧情况下公司股权不会出售给外界第三方。 除了持有上述上市公司以外,每个信托以一间BVI控股公司名义也同时持有若干间非上市的BVI公司股权。这些公司主要是由家族在香港的家族办公室打理配置全球多元化的投资。 整个架构的目的主要为了上市公司股权能够世代传承,并让家族后代在需要时支配信托分配的收入。在架构设计上不仅上市公司股权得以在家族掌控下把控买卖的时机,架构也同时让专业人士在家族办公室层面布局各项规划各类型和目的的投资产业和项目。

We are a highly experienced, forward thinking, owner-managed group, delivering a range of independent professional financial services to private individuals, families and international corporate clients. We have a refreshing approach to achieving the most effective solutions for our clients: close, personal service guiding an open and collaborative ideas-driven process. A unique way of building trust in our range of services.

discover more