Corporate sector business in Jersey

Jersey is a destination of choice for complex, cross border, multijurisdictional corporate business. Our corporate advisory, fiduciary and support services ecosystem provides the requisite expertise and experience built over six decades of supporting corporate transactions, across all asset classes, from across the globe.

At the heart of Jersey’s international appeal is its enduring political and economic stability. In this environment, we have developed an offering that balances product innovation alongside high standards of regulation, world class legislation and a depth and breadth of expertise. This sets Jersey apart from other jurisdictions.

Read on for a selection of case studies from our Member firms and how they support global corporate sector business.

- 1. International Savings Plans

- 2. A European Investment Platform

- 3. A Global Financial Institution

- 4. MS365 for a Banking Client

- 5. UK Real Estate Acquisition

- 6. EU Asset Manager

- 7. International Hospitality Business

- 8. A Family Office

- 9. Complex Fund Wind-Up

- 10. A Global Consortium

- 11. A Pan-African Group

- 12. Swiss Investment Bank

- 13. Residential Property Strategies

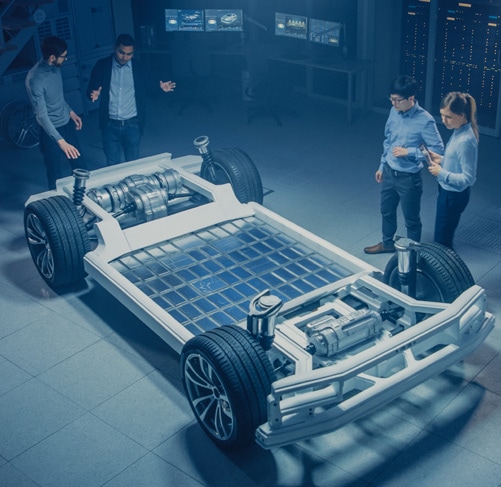

- 14. Propulsion Products Company

- 15. A Renewable Energy Company

- 16. Global Natural Resources Company

- 17. Jersey Companies on NYSE

- 18. Hedge Fund Joint Venture

- 19. Middle Eastern Investment Company

- 20. A Global Insurance Group

- 21. Multijurisdictional UHNW Client

- 22. US-Based Asset Manager

Corporate Sector Case Studies

Solution

Alexander Forbes Offshore and Standard Bank Offshore Trust Company Jersey Limited provided a savings plan to employers in the African continent who have staff deployed around the globe.

A unique International Savings Plan, positioned as an alternative to traditional pension plans for internationally mobile employees, offers the client a more flexible savings solution than a pension plan.

Working with a well-known multinational company in North America who wants to support employees working in countries across Africa, the funds will be invested in a range of Alexander Forbes Investment funds within a lifestyle strategy, with the employer able to select a suitable retirement date for members.

The savings plan will operate under a Master Trust domiciled in Jersey, which is an investment vehicle that collectively manages pooled investments.

Results

At retirement or on leaving the company, members receive the value of their savings plan account.

Contributions to the plan do not receive tax relief, however, there is no Jersey tax on the funds held in the members’ savings account and no tax is deducted on benefits paid.

On the death of the member, the Trustees are guided by the ‘Letter of Wishes’ provided by the member.

The savings plan complies with the requirements under Article 118D of the Income Tax (Jersey) Law 1961.

Visit Alexander Forbes to learn more about their range of solutions, or to speak with a key contact.

Key Contacts

Adrian Peacock Managing Director, Alexander Forbes Offshore

Timothy Townsend Senior Business Development Manager, Standard Bank

Jersey is a well trusted jurisdiction for investors and in this instance our seed investor is familiar with Jersey.

Productivity Media

The Challenge

The platform offers a range of alternative investment opportunities to the professional investor market. In a world of enhanced focus on environmental concerns, transactions on this platform aim to facilitate investor access to physical carbon credit exposure. A carbon credit is essentially a “permit” that allows its corporate holder to emit a certain amount of carbon dioxide or other greenhouse gases. Once received, investors benefit from the potential gain in value from trading such assets.

Solution

Using a multi-jurisdictional capital markets structure, Apex incorporated a range of corporate and financial services entities across Jersey, Ireland and Luxembourg; with Jersey being popular for its proximity, reputation, tax neutrality – and for being outside of the EU. Jersey forms a key domicile of choice within this multijurisdictional platform solution.

Results

Apex provided clear and expert services for the client including: the full capital markets spectrum of note issuance, register maintenance and SPV administration activity, through to banking and cash management, pricing and valuation work, as well as more bespoke custody processes and EU authorised representative services.

Visit Apex to learn more about their range of solutions, or to speak with a key contact.

One of the reasons we like Jersey so much is that it's embraced ESG in a really rational and flexible manner. And also Jersey funds, other than notification only funds, are eligible to be marketed into the European Union.

General Counsel & Chief Compliance Officer, Bruderman Brothers

The Challenge

The financial institution decided to restructure its operations. One aspect of this involved the closure of its Jersey office, which had historically provided a range of management and governance services to the institution’s onshore management company. The main implication of this decision was that the institution would need to appoint a regulated entity to manage the activities previously undertaken by its Jersey office in order to meet its regulatory and substance requirements.

Solution

As a regulated entity, the Aztec Group was well placed to support by establishing and operating a management company for the institution and thereby helping it meet its Jersey legal and regulatory requirements. The services typically delivered under this scenario are referred to as Manager of Managed Entity services and generally include the provision of directors, company secretarial, administrative support and accounting services. The provision of services can also extend to supporting investment managers who wish to relocate senior executives to Jersey.

Results

By entrusting local regulatory and substance matters to an experienced local provider, the institution has been able to better manage its cost base, while a more simplified and streamlined operating model has enabled it to focus on core investment management activities.

Visit Aztec Group to learn more about their range of solutions, or to speak with a key contact.

The Challenge

The client was concerned that both their legal and compliance teams would not have the skills to be able to run regulatory monitoring or investigations effectively on the new platform and that MS365 might not support the capabilities they require. A key concern was that they would be unable to access information on third party systems.

Solution

BDO assisted the client with a series of workshops delivered across five jurisdictions, initially running demonstration workshops on the capabilities of the E5 Compliance Center tool set, how it can connect to third party applications and in particular how thematic compliance reviews may be performed. Subsequently, use cases and requirements were gathered from the client’s legal and compliance teams and specific training was run in both a sandbox environment and the client’s live tenant. The BDO Jersey team provided both the advice and expertise for this solution.

Results

The banking client benefitted from BDO’s knowledge and experience of regulation and legal investigations combined with Microsoft technical knowledge. BDO’s pragmatic and practical advice helped the client remain compliant with monitoring obligations and respond to legal and data protection matters across their jurisdictions. While performing the engagement, future improvements to monitoring processes, technical architecture and configuration were identified to provide further efficiency and reduce costs for the business.

Visit BDO to learn more about their range of solutions, or to speak with a key contact.

We chose Jersey as a preferred IFC because our trusted advisers recommended it. Our lawyer spoke highly of the solutions, services and professionals on the Island. Other administrators, lawyers and bankers to whom we spoke made a similar recommendation. The community of professionals who support the business of international clients is broad and well established.

A Dubai-based family office

Solution

Bedell Cristin provided legal advice on a multi-million.pound acquisition which demonstrated both the effectiveness of collaboration between jurisdictions and also the key role of Jersey’s court system.

The team from Bedell Cristin led by partners Bruce Scott, Sara Johns and Edward Drummond advised Atlantic Leaf Properties, a Jersey company investing in UK real estate, on its £152 million acquisition by funds managed by Apollo Global Management Inc.

Before the acquisition Atlantic Leaf’s shares were listed on the Johannesburg Stock Exchange and the Stock Exchange of Mauritius.

Results

The transaction was implemented by means of a scheme of arrangement approved by the Royal Court of Jersey; the published judgment illustrated the sophistication and forward-thinking approach of the Court in dealing with issues affecting Jersey and beyond.

Advisers from several jurisdictions including Bedell Cristin worked together to ensure all international aspects of the transaction were concluded successfully, with Atlantic Leaf now listed on The International Stock Exchange.

Headquartered in Jersey and with offices worldwide, award-winning law firm Bedell Cristin is recognised for its “encyclopaedic knowledge of transactional work”. The firm’s experienced Jersey corporate team consistently advises on cross-border mergers and acquisitions, capital markets transactions, global restructurings and multi-partner joint ventures.

Visit Bedell Cristin to learn more about their range of solutions, or to speak with a key contact.

From our experience to date, Jersey is a great jurisdiction for the investment management industry. A fast, efficient and commercially-minded financial environment, with a strong regulator, that is going from strength to strength.

Systematica

Solution

BKS provided director, management, administration, statutory, nominee and compliance services the client’s special purposes vehicles (SPVs) in Jersey, working in partnership with their Luxembourg managers (six companies in each location).

The SPVs invested in commercial real estate (warehouse logistics, office and hotels) through French, German, and UK subsidiary holding companies, also Guernsey Property Trusts.

BKS worked with professional service firms providing audit, tax, accounting and legal services in managing the overall structure. Work involved:

- Dealing with all aspects of real estate management – purchases, sales, leases, lease extensions, property agents and insurance.

- Ensuring compliance with tax advice for management and control, quorum and economic substance purposes.

- Preparing reviewing and approving budgets, forecasts, quarterly management accounts, consolidated reporting packages and jurisdictional tax returns.

- Managing and calculating inter-co loans and interest computations.

- Managing shareholder returns through distributions and redemptions of shares following successful real estate exits.

Results

The tax efficient structuring involved assisting the SPVs in managing their European cross-border financing, holding and operating companies.

Visit BKS Family Office to learn more about their range of solutions, or to speak with a key contact.

The Challenge

The creditors wanted to: (a) take control of the group as it exited from a restructuring plan implemented under Part 26A of the UK Companies Act 2006; (b) reduce the group’s overall indebtedness; and (c) provide a new working capital loan facility.

Solution

Carey Olsen advised in respect of the establishment of a Jersey holding structure through which the creditors could take control. They also provided advice which included: an analysis of Jersey rules in respect of prospectuses/offering documents; advising on recognition of the restructuring plan in Jersey; consideration of various orphan structures; advising on bespoke constitutional documents; reviewing and inputting into the English law plan documents; and, advising on the reconstitution of the group’s existing indebtedness and the provision of new money facilities.

Results

The transaction reduced the group’s indebtedness by c.£1 billion. This is one of many similar restructurings carried out by Carey Olsen in conjunction with onshore counsel, reflecting a continuing trend that started before the Covid-19 pandemic. The choice of Jersey for incorporation of the new holding company reflects the continued usefulness of Jersey’s flexible corporate law and tax neutral environment in sectors outside traditional real estate/PE acquisition structures, which remain strong notwithstanding Covid-19.

Visit Carey Olsen to learn more about their range of solutions, or to speak with a key contact.

Equiom (Jersey) were well positioned to provide a full service to the two Jersey companies within the family structure, on a split board basis, due to vast experience and expertise in the local and UK property market.

Equiom were able to remediate historic administration including bringing the financial statements up to date which earned the client’s confidence in Equiom’s ability and the services on offer.

Results

Equiom’s relationship with the family has grown from strength to strength building their trust and, over time, Equiom (Jersey)’s advisors were asked to provide full services for two further companies and limited services/ad hoc administration to six others within the group with total assets under management (AUM) exceeding £150 million.

AUM within the structure include Jersey and Swiss commercial property, UK and EU based residential property, cash, a modest investment portfolio set up to provide diversification; and, Equiom is in the process of identifying further commercial property investment opportunities in Jersey which will be held via a separate Jersey Special Purpose Vehicle.

Visit Equiom to learn more about their range of solutions, or to speak with a key contact.

Key Contact

Steve Le Seelleur Managing Director, Equiom

The Challenge

A contentious legal battle, coordinated in Jersey, for control of the assets, spread internationally. Extensive forensic accounting was required to gather assets prior to their sale. Involving numerous jurisdictions, work was carried out in Bermuda, France, Luxembourg, Switzerland and Russia.

Solution

Grant Thornton’s appointment as a restructuring advisor meant that asset recovery specialists were needed to demonstrate strong expertise. Services provided to the client included:

- Project management – to coordinate many advisors, stakeholders and company directors.

- International insolvency knowledge – to realise assets in many jurisdictions, understanding differing winding up procedures. Working with local company directors, financial regulators and FIUs.

- Legal knowledge – a number of legal systems were involved requiring instruction of local lawyers.

- Negotiation skills – a complex settlement to release various assets was then negotiated, requiring persons who were difficult to access but were critical to the outcome.

- Asset recovery skills – corporate intelligence and forensic accounting to trace and recover assets and individuals through a complex web of companies.

- Hostile security protection – to ensure the integrity of the project, security was obtained to protect our personnel, premises and company records against attack.

Results

Following an intense period of four years, the assignment was successfully concluded.

Visit Grant Thornton to learn more about their range of solutions, or to speak with a key contact.

Solution

HSBC’s Commercial Banking (CMB) team in Jersey, are globally connected through the bank’s unique network in 64 countries and territories in geographical regions such as Europe, Asia, North America, Latin America, the Middle East and North Africa.

In 2020, the Jersey CMB team managed a US$20.7 billion deal, one of the year’s largest global infrastructure transactions.

HSBC acted as the senior mandated lead arranger, sole hedge structuring and market risk execution bank and joint hedging coordinator, on the associated hedging of US$8 billion acquisition bridge financing for a global consortium.

HSBC Global teams involved in the deal included: real assets and structured finance, corporate risk solutions, private capital group, global banking and corporate banking coverage, sector coverage, loan syndications and debt capital markets.

As part of this deal, HSBC provided end-to-end risk management and structuring expertise that protected the investors’ equity returns.

Results

The deal demonstrates HSBC’s unique ability to connect people and businesses across jurisdictions while also highlighting HSBC’s strength in risk solutions and expertise in providing bespoke long-term private capital structures.

Visit HSBC to learn more about their range of solutions, or to speak with a key contact.

The Challenge

The client was undertaking a group reorganisation, the main aspect of which was the establishment of a new group holding company in a jurisdiction with highly qualified professionals, economic and political stability and operating in the same time zone as London, where its head office is located.

Solution

ICECAP worked closely with the client and their lawyers to gather all the necessary due diligence to establish the Jersey holding company and undertake the necessary administrative tasks under the reorganisation plan and subsequent rights issue. This involved liaising with a number of different stakeholders across numerous jurisdictions throughout Europe and Africa.

Results

The reorganisation was successful with ICECAP providing ongoing support through the provision of director, company secretarial and administration services. ICECAP have also established a number of Jersey company subsidiaries to support the group’s growth across the African continent.

Visit ICECAP to learn more about their range of solutions, or to speak with a key contact.

The Challenge

To provide an innovative corporate structure involving Jersey incorporated cell companies, delivering two distinct features for the client’s investment arrangement:

- The ability to either co-invest with others in a single asset; or

- The ability to create their own vehicle, as sole investor, and hold a variety of underlying investments.

Key requirements were the ability for investors to select individual investments and to segregate the liabilities of each investment. Management and control were to be retained by the client and investors were to receive economic rights only.

Solution

IQ-EQ worked closely with lawyers and admin teams to create an innovative structure using an incorporated cell company and a series of incorporated cells. As the underlying private equity and real estate investments were located across Continental Europe, additional holding companies located in the same jurisdiction as each investment were established and held by each incorporated cell. Since each incorporated cell either had a single investor or a single asset, the main characteristics of a fund (being pooling of cash and risk-spreading) did not apply to any of the incorporated cells.

Results

Using a bespoke corporate structure IQ-EQ were able to utilise Jersey’s flexible company law and COBO regime – without the requirement for fund regulation.

Visit IQ-EQ to learn more about their range of solutions, or to speak with a key contact.

The Challenge

Through regular contact with a dedicated client manager, it was identified that the clients’ investment strategy had changed and required assistance from Kleinwort Hambros. The client felt it was prudent to take a longer-term view of property markets and to diversify their non-property holdings into more traditional investments.

Solution

By working with the client’s tax and legal advisors Kleinwort Hambros, was able to convert the short-term property debt into longer term buy-to-let mortgages and release equity from the properties, in order to provide the initial capital to fund a discretionary portfolio mandate. The client matched the amount of the released equity from their own resources in order to increase the size of the investment pool.

The discretionary mandate was then constructed in accordance with the clients’ risk profile. In order to further increase the portfolio, an element of debt was introduced by way of a loan, which was secured against the lending value attributed to the portfolio.

The expert advice from the Jersey-based team was vital to the positive outcomes of this solution.

Results

A restructured property debt provided the client with maximum flexibility to consider market opportunities with a longer-term approach, the added benefit of income from the properties and capacity to drive much needed diversification into more traditional liquid investments.

Visit Kleinwort Hambros to learn more about their range of solutions, or to speak with a key contact.

BorgWarner Inc. in relation to its acquisition of Delphi Technologies PLC, a Jersey company listed on the New York Stock Exchange, focussed on developing propulsion products and systems across combustion, hybrid and electric vehicles. The all-stock transaction valued Delphi at around US$3.3 billion and combined two major auto parts makers.

The Challenge

Advising in respect of a US-listed target acquired using a Jersey scheme of arrangement for the first time.

Solution

Mourant has seen a number of landmark moments in the corporate sector over the past eight decades. The Lawyer’s 2020 Offshore Law Firm of the Year is still breaking new ground.

The transaction for this client was implemented by a Jersey court sanctioned scheme of arrangement.

Mourant provided Jersey legal advice on all aspects of the acquisition, working alongside New York Counsel.

Results

This is just one of a number of schemes of arrangement the Mourant corporate team has advised on. Other recent examples include the largest ever outbound M&A deal by a Japanese company, the takeover of Shire plc by Takeda Pharmaceutical Company Ltd. That deal was worth US$62 billion confirming Mourant’s position as expert advisers on significant cross border corporate matters.

Visit Mourant to learn more about their range of solutions, or to speak with a key contact.

Key Contact

James Hill Partner, Mourant

The Challenge

Unlike conventional battery technologies, vanadium flow batteries do not degrade with continued charge and discharge cycling, allowing them to deliver durable, low-cost storage over decades of service.

These batteries are ideal for providing accessible energy ‘on-demand’ from renewable sources, replacing traditional storage systems, many of which use rare, expensive minerals or have disposal problems.

Solution

Oak Group provides a wide range of Jersey corporate administration services for clients producing renewable energy solutions around the world. In April 2020, Jersey company redT energy plc completed a complex merger with US business Avalon Battery Corporation to create Invinity, recognised as a leading producer of vanadium flow batteries. The newly merged entity was a Jersey registered holding company.

Based on many years of relevant experience, Oak has supported Invinity Energy Systems plc and its predecessor throughout life as a listed company. Solar energy generation especially has suffered from a shortage of durable and portable storage. Invinity seeks to fill that gap while producing investable project returns and Oak is proud to support them in reducing energy wastage and carbon emissions.

Results

Following a successful fund raise on AIM, the company has significantly accelerated its rollout. Although active across all key international energy storage markets, Invinity decided to retain its Jersey corporate residence.

Visit Oak to learn more about their range of solutions, or to speak with a key contact.

The Challenge

The client had a significant number of employee share awards due to vest and Ocorian worked with them to explore ways in which they could meet their commitment in a cost-effective manner.

Solution

Having evaluated a number of options, Ocorian’s advisors entered into a structured share purchase whereby Ocorian as trustee of the trust purchased the shares over a 30-month period with the aim of ensuring the trust had sufficient shares to satisfy the awards vesting at the end of the award period.

The employee share trust, administered in Jersey, allows the shares that are purchased to be held in trust free of any capital gains tax which is beneficial to a UK plc trying to manage its future share award commitments. An irrevocable trading plan was put in place and the company had the plan approved at board level. Ocorian were not bound by close periods and executed the trading plan in an orderly manner ensuring not to affect the market.

Results

This trading plan was very successful as the price on the date of vesting was significantly higher than the weighted average price the trustees achieved through the structured purchase plan. This led to a cost saving of over £140 million for Ocorian’s client.

The treasury department and CFO of the company were very happy with the outcome and have rolled over the program again to now prepare for the next scheduled release.

Listed companies can significantly benefit from proactive management of their employee incentive arrangements and this is just one such example of how a Jersey Employee Share Trust can be beneficial.

Visit Ocorian to learn more about their range of solutions, or to speak with a key contact.

Solutions

Working closely alongside Latham & Watkins LLP in the US and London, Ogier’s Corporate team advised on the Jersey legal and regulatory aspects of both transactions and listings.

Clarivate continued in 2020 to undertake a US$6.8 billion combination with CPA Global, one of the world’s largest Intellectual Property management and technology solutions firms with its head office in Jersey. Multiple Ogier teams assisted on the landmark transaction, including corporate, employment, pensions, property and competition.

Ogier advised Atotech Limited on its US$498 million IPO on the NYSE in February 2021. To celebrate, Atotech CEO Geoff Wild was invited to virtually ring the Opening Bell of the exchange, which values the company at US$3.7 billion.

Results

“The growing number of Jersey companies admitted to trading on the New York Stock Exchange (NYSE) illustrates the jurisdiction’s acceptance and an understanding of the benefits of using Jersey vehicles, in particular where the businesses also have connections to the UK,” says Ogier Partner Richard Daggett, whose long-time client Clarivate plc listed on the NYSE in 2019.

Lead Partner on the Atotech deal, Raulin Amy said: “This transaction involved a complex reorganisation pre-IPO and having the support of our corporate administration team, Ogier Global, to provide a seamless service was invaluable”. Ogier Global provided input on both the IPO and pre-IPO restructuring.

Richard Daggett added: “It’s great to see Jersey carving a reputation for itself beyond the UK. Jersey companies are viewed as stable and flexible platforms for acting as holding companies, whether listed or unlisted”.

Visit Ogier to learn more about their range of solutions, or to speak with a key contact.

Key Contacts

Richard Daggett Partner, Ogier

Raulin Amy Partner, Ogier

Solution

The Corporate Services Team at PraxisIFM was approached by one of the senior team at the hedge fund. Following a series of discussions with the potential client we worked with them and their advisors to implement the most suitable solution.

PraxisIFM in Jersey established a holding company acting as a joint venture between the parties, which entered into a development agreement with a large independent charitable foundation in the healthcare sector.

Results

Over a 10 to 15-year period there will be seven development phases of a large mixed-use scheme in Central London. Each phase will be held by a specific subsidiary structure which will sit under the joint venture vehicle and include a Jersey Property Unit Trust and two Jersey companies with the asset being held by a UK LLP.

The team at PraxisIFM in Jersey provides the client with real estate management work supporting strategic decisions, has carried out tax compliance and VAT returns, as well as administration, director, co sec and accounting services. The Group’s London office provides director and registered office services to a number of the client entities.

Visit PraxisIFM to learn more about their range of solutions, or to speak with a key contact.

The Challenge

Providing an appropriate structure for the client to enable both individual and corporate investors, situated in a variety of regions and countries across the world, to have the opportunity to collectively invest in growing businesses operating in a number of markets.

Solution

R&H Trust Co (Jersey) Limited (RHTC) worked closely with a leading firm of advisors and agreed that a Jersey Limited Partnership and General Partner would be the most suitable structure with Jersey the choice of jurisdiction given its tax neutrality and high level of regulation. RHTC’s sector expertise, coupled with its strong accounting and administrative background, has allowed the seamless creation of multiple Jersey Limited Partnerships and subsequent implementation of effective investments in many international companies.

Results

Working closely with the client and leveraging off our extensive experience in assisting clients in the Middle East, RHTC has ensured that expectations and requirements continue to be met. With the number of investments increasing and additional investors being attracted to participate, RHTC look forward to further developing this structure to support the needs of the client and the investors.

Visit R&H Trust Co (Jersey) Limited to learn more about their range of solutions, or to speak with a key contact.

The Challenge

Sanne’s client required the restructuring of multi-jurisdictional entities in 2020, when litigation proceedings commenced from investors in connection with the sale of its stake in a company which was sold as part of an Initial Public Offering. The value of the asset had been deemed to be overvalued by the investors and the group company provided insurance for one Dutch and two Luxembourg companies party to the litigation.

Solution

After obtaining external tax, legal and structuring advice, Sanne created an orphaned ownership structure of the entities party to litigation proceedings and established a Jersey Charitable Trust as the ultimate beneficial owner of the Dutch and Luxembourg companies. Any residual funds are to be paid to charity, and to enable the wind-up of the structure and for final distributions to be made by the trust, the insurance group company provides insurance cover against any adverse determination in the litigation over the five-year period.

Results

As a leader in global corporate and trustee services for multinational businesses, Sanne supported the restructuring process through the provision of full corporate and directorship services across the multi-jurisdictional entities as well as acting as trustee for the newly established Jersey Charitable Trust.

Visit Sanne to learn more about their range of solutions, or to speak with a key contact.

The Challenge

The client held a mortgage and cash holdings and wanted to sell a business in India to increase the cash holdings to purchase a property in London.

Solution

Standard Chartered provided expert investment advice to the client, offering a bespoke solution to meet the wealthy client’s financial requirements by working closely with its team in India and the UAE, adhering to detailed laws and regulations across countries.

Additionally, the bespoke solution provided family succession planning support for the client to safely pass on future wealth to the client’s children.

Results

Through its geographical reach and breadth of expertise, Standard Chartered catered for the client’s diverse needs under complex cross-border conditions.

Standard Chartered in Jersey upholds the Island’s reputation as one of the most developed and well-regulated offshore financial centres in the world through its global footprint and wide range of offshore products and services on offer. This includes banking services, credit, investment opportunities and treasury solutions, underpinned by the support of qualified relationship managers and client advisors.

Visit Standard Chartered to learn more about their range of solutions, or to speak with a key contact.

The Challenge

The client wished to establish a Jersey-resident structure to issue collateralised loan obligations (CLOs) marketed to sophisticated international investors. CLOs are securitisations of large, sub-investment grade corporate loans syndicated to a diverse investor base, which has the effect of reducing the cost of financing for corporations and providing loan market liquidity.

Pursuant to the Capital Requirements Regulation, which came into force in 2014, CLO managers were required to retain a 5% economic interest as “skin in the game” for the life of a securitisation transaction. This was in response to the economic crash of 2008-9 after which regulators concluded that the economic interests of managers and investors were not sufficiently aligned.

Solution

Alongside the issuer Special Purpose Vehicles, VG established a Jersey-based expert fund to invest in a US LLC which is responsible for originating and managing the CLOs in addition to retaining at least a 5% economic interest for the life of each transaction.

Results

The client favoured Jersey for this business due to its well-regulated, business friendly and politically stable environment. While US-based asset managers tend to use Cayman for CLOs and other debt capital markets transactions, Jersey remains a very attractive alternative with a strong expertise in this field.

Visit VG to learn more about their range of solutions, or to speak with a key contact.