Our Vision and Strategy for Sustainable Finance

By 2030, Jersey will be recognised by its clients, key stakeholders and other partners as the leading sustainable international finance centre in the markets it serves.

Find relevant resources such as practical guidance, technical factsheets, thought leadership and training opportunities. You can filter by resource type and by Sustainable Finance topics including Sustainability & CSR, Climate & Net Zero, Regulation & Policy and more.

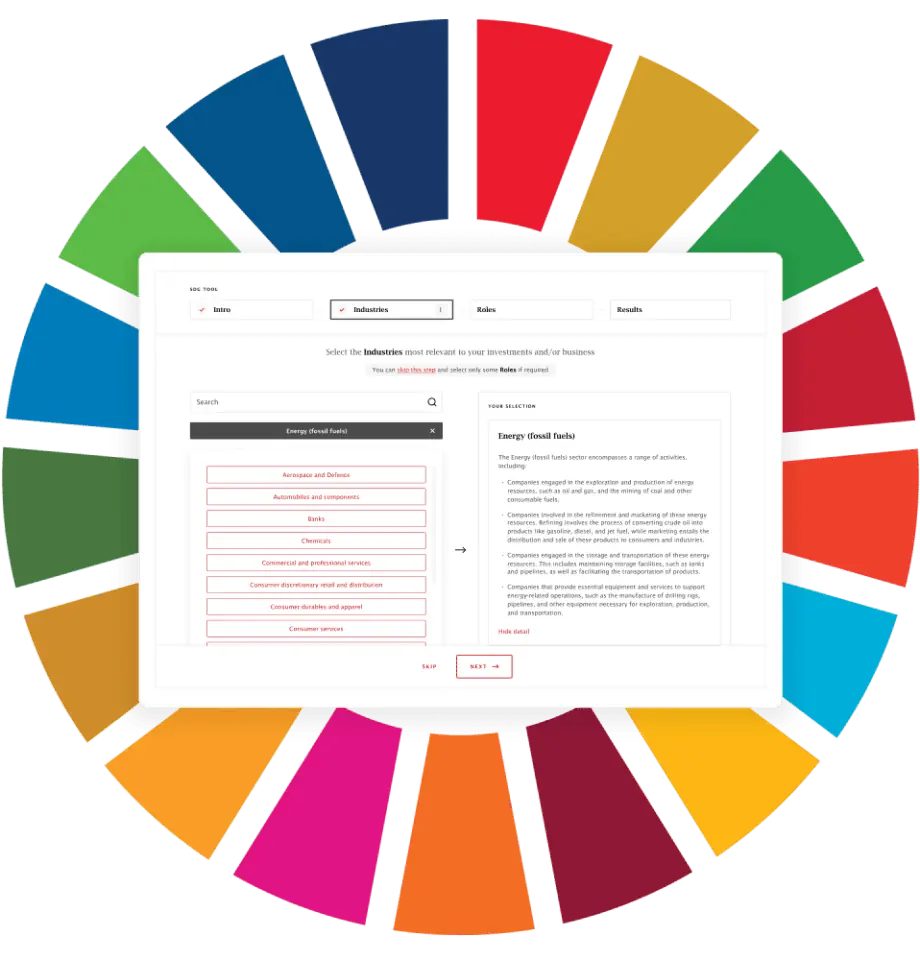

Discover the impact of investments and financial activities on the sustainable development goals (SDGs) with this SDG Alignment Tool, commissioned by us for our Members.

The tool offers practical learning opportunities and a simple way for you to analyse which SDGs are the most relevant according to either your role in your organisation, or your clients’ investment assets.

Get startedWork

Featured

Work

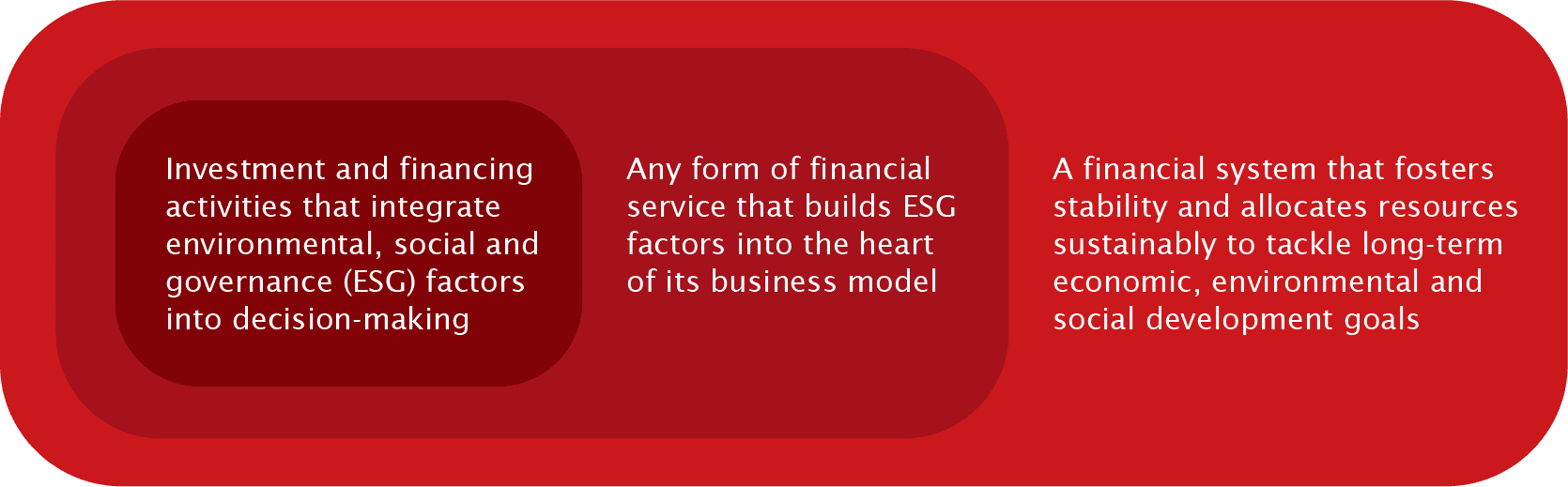

What is Sustainable Finance?

The process of taking environmental, social and governance (ESG) considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects.

In the EU’s policy context, it is understood as “finance to support economic growth while reducing pressures on the environment and taking into account social and governance aspects.”

A system-wide view:

Sustainable Finance is Part of Everything We Do

The global financial system is changing. Powered by a range of global mega-trends – ranging from societal pressures to increased regulatory intervention in support of global policy commitments, such as the decarbonisation of our economy – sustainable finance, is experiencing strong growth.

Globally, ESG assets are predicted to exceed US$100 trillion by 2028 and US$150 trillion by 2034 (Deutsche Bank and GSIA). This shift in private capital towards activities that support a sustainable future is essential if we are to tackle the world’s most pressing issues.

As a leading IFC, Jersey has been active in this area for some time, and with a new sustainable finance strategy to catalyse action we are well placed to support the embedding of sustainable finance across all the different sectors of our financial services offering.

As intergenerational wealth transfers drive demand for investment strategies that focus on purpose and impact as well as transparency and profitability, private wealth is playing a vital role in supporting the global shift towards sustainable finance.

Fund managers are increasingly focussed on sustainable investment principles bringing their products, domiciliation choices and choice of service providers in line with sustainable investing criteria, as a way of enhancing returns, managing risk and differentiating their offering. There are clear opportunities for Jersey to support them with innovative solutions such as data-driven reporting to meet the increasing demand for ESG disclosure from investors and regulators.

Jersey’s banks are also embracing sustainable finance by expanding their range of sustainable lending products and embedding global standards such as the Principles for Responsible Banking (PRB) into their business models.

The inclusion of ESG factors in mainstream investment planning has accelerated significantly in recent years, with asset owners and managers adopting a range of approaches that are broadly described as responsible investing.

With a thriving fintech sector, Jersey is in a strong position to capitalise on advances in digital technology that can be used to scale up ESG data solutions and drive developments in sustainable finance.

Our corporate service providers continue to develop new ways to support Jersey’s transition to sustainability – from standardising ESG reporting to helping clients list on forward-thinking stock exchanges like TISE Sustainable.

Our legal and professional service providers continue to develop new services in this space – whether in terms of assurance, regulatory compliance, or supporting clients to list on innovative sustainable exchanges like TISE Sustainable.

To ensure that our sustainable finance credentials are built on trust and integrity, Jersey introduced a new, proportionate disclosure framework to mitigate the risk of greenwashing in 2021.

Put simply, we are certain that we have the solid foundations with which to support businesses and investors with their sustainable finance goals.

ESG Investing Spectrum

At the core of sustainable finance, ESG investing allows for consideration of environmental, social and governance factors, alongside financial factors in the investment decision-making process.

The ESG investing spectrum ranges from negative screening (where the primary focus is to achieve a financial return, while also making a positive impact) to impact investing (where the primary focus is to achieve a positive impact, while also making a financial return).

Sustainable Finance Case Studies

Sustainable Finance Resources

Latest Sustainable Finance News

Our News

25 March 2024Our Members' Work

We have compiled this section of the website to make it easier for you to find useful resources such as practical guidance, technical factsheets, thought leadership and training opportunities that are relevant to Jersey’s sustainable finance vision. If you would like us to add something, please feel free to drop us a line.

Articles

1 March 2024In order to take sustainable finance to the required scale and collectively achieve $1 trillion Moonshot target, the UNDP Sustainable Finance Hub launched the SDG Finance Academy. It is a free and open tool to all users, informed by collaborative efforts across the UNDP’s Global Policy Network in areas critical for achieving the SDGs. It offers 10 self-paced courses in vital areas of sustainable finance – critical for leveraging the financing needed to achieve the SDGs.

This is a unique opportunity for Fintechs to become leaders in sustainability and make their business impact orientated. The programme consists of five modules delivered over ten weeks, and will equip participants with the knowledge base required to develop solid sustainability strategies to lead their organisations in the field.

Understand climate change and how to reduce your carbon footprint at this Carbon Literacy Project accredited training for business, driving positivity and action towards reducing carbon emissions

This course was developed in collaboration with finance industry professionals, leading experts and education specialists. It is the first course to be offered a budget - appropriate, self-taught, introduction to Sustainable Finance, suitable for all levels of competence and across all sectors of finance, and specifically tailored to the needs of International Finance Centres, such as Jersey.

Jersey Finance is pleased to partner with CISI to offer our Members discounted access to the CISI Sustainable and Responsible Investment Professional Assessment. This course is designed to give professionals from across different financial services areas and functions a solid grounding in the concepts and terminology that are key to meeting client requirements in a changing world.

The Asian Development Bank Institute offers a range of tuition-free training courses across a sustainable finance topics such as the circular economy, climate change and sovereign risk, and green investments in renewable energy.

Designed for professionals seeking to upskill themselves in climate change risk, the University of Cambridge Business and Climate Change: Towards Net Zero Emissions online short course gives you a holistic business understanding of how best to mitigate the business risks of climate change and oversee a low carbon transition. Gain the knowledge and skills to combat climate change in your context, and learn to build a business model that is resilient and profitable in the low carbon, resource-efficient economy of the 21st century. By decarbonising your business, you’ll enhance the resilience of your organisation, and unlock new opportunities for growth and innovation both now and into the future.

Designed for all professionals in the finance sector, the University of Cambridge Sustainable Finance online short course offers insight into the role of finance in creating a more sustainable and resilient global economy. Over eight weeks, you’ll learn about the pressures and trends affecting the current financial system and investigate the strategic business implications of these social and environmental challenges. You’ll also discover how sustainable finance can open up exciting new opportunities and strategically drive long-term business returns.

This course is designed to address the growing need and prevalence of sustainability practices in business – giving you the tools to pioneer meaningful change throughout your organisation. Upon completion of the course, you will gain access to the CISL global alumni network, consisting of nearly 27,000 like-minded business leaders around the world.

The Master's helps to develop leaders who can respond effectively to the economic, social and environmental challenges facing the world and lead others to achieve positive change. The Master of Studies (MSt) in Sustainability Leadership is a full Master’s degree, delivered part time for working professionals. It is part of the University of Cambridge Institute for Sustainability Leadership's (CISL) mission to empower individuals and organisations to take leadership to tackle critical global challenges.

On the Sustainable Real Estate: Creating a Better Built Environment online short course, you’ll learn how to find opportunities within sustainability challenges in the built environment. The course addresses and analyses the ecological, social, and governance aspects of real estate. With this overview of industry trends and risks, you’ll examine how sustainable real estate can contribute to a more resilient and inclusive society, and positively impact communities. This course is for professionals who want to understand the sustainability challenges facing the real estate sector, and want the knowledge and insights to implement resilient measures to address these challenges.

This course gives a strong introductory understanding of key ESG issues that all employees working within Financial Services firms and business professionals generally should understand.

Environment, Social & Corporate Governance (ESG) initiatives will have a major part in defining our business strategies for the future. This course considers how these considerations might be built into the fabric of an organisation using the United Nations 17 Sustainable Development Goals as a structure.

This introductory course aims to develop an understanding of the key ESG factors that impact company performance, as well as the methodologies for integration of ESG into the investment analysis process.

This one hour course considers the development of the requirements for companies to report sustainability information in their annual reports. It will examine current requirements, impending developments, and the likely direction of travel.

Updated for 2023, the Certificate in Green and Sustainable Finance aims to develop the learner’s knowledge, understanding and ability to apply the key principles and core practice of green and sustainable finance. Specific aims are to increase the learner’s knowledge and understanding of: climate change and its impacts; climate risks and emerging environmental and sustainability risks; the evolution of green and sustainable products and services in the banking, investment and insurance sectors; and, increasing awareness of the role of the finance sector and finance professionals in supporting the transition to a low-carbon world.

Managing climate-related risks and supporting the transition to a low-carbon world are amongst our most significant global challenges. Central banks and financial regulators consider the identification, measurement and disclosure of these risks to be a priority. Recognising the strategic importance of this topic, the Chartered Body Alliance have developed their first joint qualification, the Certificate in Climate Risk.

The CFA UK Certificate in Climate and Investing is a Level 4 qualification which delivers the knowledge and skills required by investment professionals to understand climate as it relates to investing and how to integrate climate change considerations into the investment process. The first qualification in the UK designed specifically by investment practitioners for investment practitioners.

BPP offers the CFA Institute Certificate in ESG Investing, a course which gives you both practical application and technical knowledge in the fast-growing field of ESG investing — an opportunity to both accelerate progress and demonstrate purpose. The certificate and learning materials were developed by leading practitioners for practitioners, and have been recognized by the UN Principles for Responsible Investment (PRI), an independent body that seeks to encourage investors to use responsible investment to enhance returns and better manage business risks.

This two day training course from the Center for Sustainable Finance and Private Wealth is designed for professionals from private banks and family offices who advise clients, develop wealth management solutions and products as well as those responsible for moving forward wealth management divisions in the area of sustainable finance. The course draws on CSP’s learnings from 7 years of helping ultra high net worth individuals develop and implement sophisticated sustainable investment strategies with impact at their center.

Study the economics and finance of climate change. With this specialization, learners will gain a basic understanding of the science of climate change, which is a fundamental requirement for a good understanding of the pros and cons of different climate policies as well as a good understanding of the impact of climate change on companies and investment portfolios.

Principles of Sustainable Finance explains how the financial sector can be mobilized to counter this. Throughout this course, you will learn about the UN Sustainable Development Goals, how social and environmental factors should not be regarded as externalities, you will learn more about sustainable banking and asset management, about effective engagement, sustainable scenario analysis and long-term value creation. At the end of this course you will understand how sustainable finance can be used as a tool to steer the sustainability transition. This course is free to take, payment is only needed to obtain a completion certificate.

The GRI Sustainability Reporting Standards (GRI Standards) are the first and most widely adopted global standards for sustainability reporting. This course will introduce you to the sustainability reporting practice and to some key concepts of the GRI sustainability reporting Standards. The content is divided into 4 modules and will take learners through the sustainability challenges, explain what sustainable development is, and define the benefits of reporting. Additionally, you will be introduced to the story of the Global Reporting Initiative and to the main concepts of the GRI Standards such as the reporting principles, stakeholder engagement, impact and material topics.

The programme is designed for mid to senior level managers (5+ years of experience); tasked with or seeking to develop or implement sustainable business practices within their organisation, or aiming to update their management capabilities with new frameworks and perspectives.

This interactive and practice-oriented course, originally developed in 2018 and comprehensively updated in 2021, covers the basics of Sustainable Finance while providing several opportunities to dive deeper. The course covers sustainable finance instruments, methodologies and frameworks for integrating sustainability into financial decisions, key global sustainable finance initiatives, and sustainable finance regulations. It is designed for interested participants from governments, academia, the financial sector, businesses, and civil society.

This three-day Climate-related Financial Risk Programme at the University of Oxford is designed to equip individuals from financial institutions and regulators, government officials, and corporate strategists with the latest understanding of climate risks.

On this pioneering programme, you will develop a deep and broad understanding of the impact investment sector and understand how to make more targeted investment decisions.

The Introduction to Sustainable Finance Course provides public servants and third sector representatives with an understanding of the main concepts, theories, and issues in making sustainable investment decisions. The course will enable participants to explore developments in the field, and identify and activate levers of change. The course takes place over 10 weeks, with 20 to 25 hours of online learning and three live sessions from the Oxford faculty.

The Sustainable Finance Executive Programme at the University of Oxford provides an introduction to sustainable finance for professionals working across a range of sectors. Held over 5 days in Oxford, it equips participants with essential knowledge of the principles and concepts of sustainable finance, as well as an advanced understanding of the latest developments.

Through this course, anyone can learn to improve their organization's practice of impact measurement and management and align their ESG or impact activities and reporting with emerging global standards. Impact Measurement and Management for the SDGs is a collaboration between UNDP SDG Impact and the award-winning team at CASE at Duke University.