net asset value of regulated funds under administration

of funds investing in alternatives

formed since their launch in 2017

The industry has a net asset value of £457.8 billion (as at September 2023) and a total of 638 regulated collective investment funds established. Currently, figures for the increasingly popular Jersey Private Fund are not included, meaning the actual net -asset value figure is much higher.

Key Facts

Jersey has attracted a significant number of venture capital, private equity, mezzanine, real estate, infrastructure and hedge funds. For example, the total net asset value of alternative investment funds under administration in Jersey stands at £440 billion (US$559 bn at 30 June 2023, converted at exchange rate of 0.82).

Providing significant flexibility for investor needs, Jersey continues to improve laws and regulations in order to provide better choices for investors. Some key facts include:

- The net asset value of regulated funds under administration stood at £440 billion as at the end of Q3 2023 (Source: JFSC, December 2023)

- Alternative asset classes represent 87% of total funds business in Jersey, with private equity and venture capital representing 40% of the alternative asset classes (Source: JFSC, June 2023).

- Significant money is being raised from a wide range of EU countries. Jersey has seen an annual increase in fund managers using Jersey to market funds into Europe to 200 Jersey-registered alternative managers marketing 369 funds (Source: JFSC, March 2022)

Why Jersey for Funds

With its political and fiscal stability and a no change outlook from a regulatory, legal or economic perspective, Jersey is a destination of choice for fund managers choosing where to locate either their funds or management company. Click a segment of our ‘wheel’ to explore the key drivers behind fund managers selecting Jersey.

AIFMD

Jersey has a legal, tax and regulatory framework, which supports the continued functioning of the Jersey fund management and services industry under the Alternative Investment Fund Managers Directive.

Jersey was the first ‘third country’ to offer a fully compliant opt-in regime under AIFMD, meaning that Jersey will be able to offer a passporting option under AIFMD as soon as it becomes available to third country managers.

A Jersey manager can establish different Jersey funds to access:

- The EU through National Private Placement Regimes (NPPRs); and

- The ‘rest of the world’ through business as usual

You can find out more on where investors in Jersey funds are currently based in the KPMG report, ‘Analysis of the Jersey Alternative Funds Sector Investor Base’.

NPPRs

Jersey has a fully flexible funds regime and, unlike other jurisdictions, offers easy and cost-effective access to EU investors via marketing within the EU through National Private Placement Regimes (NPPRs). As Jersey is not an EU Member State, it is not subject to the scope of the Alternative Investment Fund Managers Directive (AIFMD) when targeting investors outside the EU.

To see how well NPPRs are being used in Jersey, see our video below or view our interactive map showing which EU countries we work with.

Find out more about the Jersey regime by reading our factsheet.

With more than 13,700 highly skilled and experienced finance industry professionals, over 2,000 of which are employed in fund management and legal services, Jersey offers an exceptionally large pool of expertise, including a wealth of professional non-executive directors with extensive knowledge of funds across a variety of asset classes.

Jersey is also able to offer clients access to a wealth of expertise from Jersey service providers, including fund administrators, banks, custodians, depositories, accountants, tax advisers and legal professionals, who have the knowledge and international connections to deliver perfectly tailored products and specialist vehicles, whatever the investment objectives.

A range of national and international financial services firms are based in Jersey. Visit our Business Directory for a list of firms operating in Jersey or to search for a specific organisation.

The international regulatory and legislative landscape is changing all the time. Jersey’s funds regime reacts with agility, offering managers a full spectrum of regulatory options. Lawyers work closely with counterparts in all of the world’s major centres, including London, the US, China, India and the GCC, to deliver structured products and specialist vehicles that meet a whole range of financial and investment objectives.

Jersey fund vehicles may be approved in as little as 48 hours by the regulator, the Jersey Financial Services Commission (JFSC), which is responsible for the regulation, support and development of the finance industry.

The funds industry is constantly evolving, and Jersey’s fund administration firms and legal professionals are at the forefront of a range of emerging trends. Take alternative investments such as venture capital, private equity, real estate and hedge funds for example. Jersey has worked hard to develop expertise in these areas, as well as with funds in cutting-edge asset classes like mezzanine and infrastructure.

Jersey remains focused on developing its funds regime and on providing innovative solutions. Recently introduced, the Jersey Private Fund consolidates and streamlines Jersey’s private fund offering, enabling funds with up to 50 investors to take advantage of a fast-track authorisation process and lighter ongoing regulatory requirements. A new, manager-led, Jersey Alternative Investment Fund is also in the pipeline.

Jersey has been at the forefront of funds services for more than 50 years. In that time, the jurisdiction’s track record in the structuring, management and administration of fund vehicles has given it a world-class reputation, serving primarily institutional, specialist and expert investors.

The International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development (OECD) and the European Union (EU) have all endorsed Jersey as a top international finance centre. A major report published by MONEYVAL underlines Jersey’s ability to combat financial crime through a sophisticated system of capturing ownership information about entities and structures in the jurisdiction.

Jersey’s reputation as an international finance centre (IFC) of excellence has been endorsed by independent bodies and institutions of the highest standards – see our Awards and Accolades. Our reputation as a quality IFC supports our work in a range of markets around the world, building better futures for global partners and investors.

Fund managers are putting substance at the heart of the decisions they make.

When it comes to substance, Jersey offers certainty. In March 2019, Jersey was assessed as a cooperative jurisdiction by EU finance ministers regarding the business taxation initiative from the EU Code of Conduct Group (COCG). Although funds are not subject to the substance requirements, where there is a Jersey resident company in the structure, such a company would be required to meet the criteria.

Jersey’s appeal as a jurisdiction of substance is evident not only through the presence of more than 120 fund promoters doing business on the Island, but through the number of high-profile manager relocations in recent years.

See our Jersey: Certainty and Substance factsheet for more information

Jersey is a tax neutral jurisdiction for international business. This makes Jersey’s funds solutions far less complex than in other jurisdictions in that it offers:

a simple tax neutral regime – operational flexibility, with less complexity

no necessity for complex tax structuring

This simplified system means that, while the fund does not pay tax, investors from various countries with their individual tax systems will all pay the correct amount to their respective governments. Other onshore jurisdictions can offer a comparable arrangement, but require significantly more red tape, and ultimately cost, to orchestrate.

Jersey’s own democratically elected Parliament and judicial system provides us with stability and independence.

Jersey has never been part of the EU, but has excellent, long-standing bilateral relationships with the EU’s Member States and established European market access arrangements for its asset management industry. These will not be impacted by the major initiatives impacting the industry, most notably, Brexit.

The majority of Jersey’s funds have a large base of UK investors, and the British Government has already stated that the relationship between the UK and Jersey will not be impacted by Brexit.

Therefore, Jersey also provides a ‘no change’ solution for access to UK investors. This unique position sets Jersey apart.

Discover more about Jersey’s Constitution.

Jersey offers a wide range of fund types and structures and has substantial experience of the full spectrum of fund strategies and asset classes.

Our Funds Work

Jersey's Contribution to Global Value Chains

Research from the Centre for Economics and Business Research (Cebr) found that Jersey’s funds’ sector supported a scale of economic activity in line with the total GDP of Bahrain in 2020. £225.9 bn of capital was serviced by the sector, supporting £29.3 bn of global GDP via Global Value Chains

Work

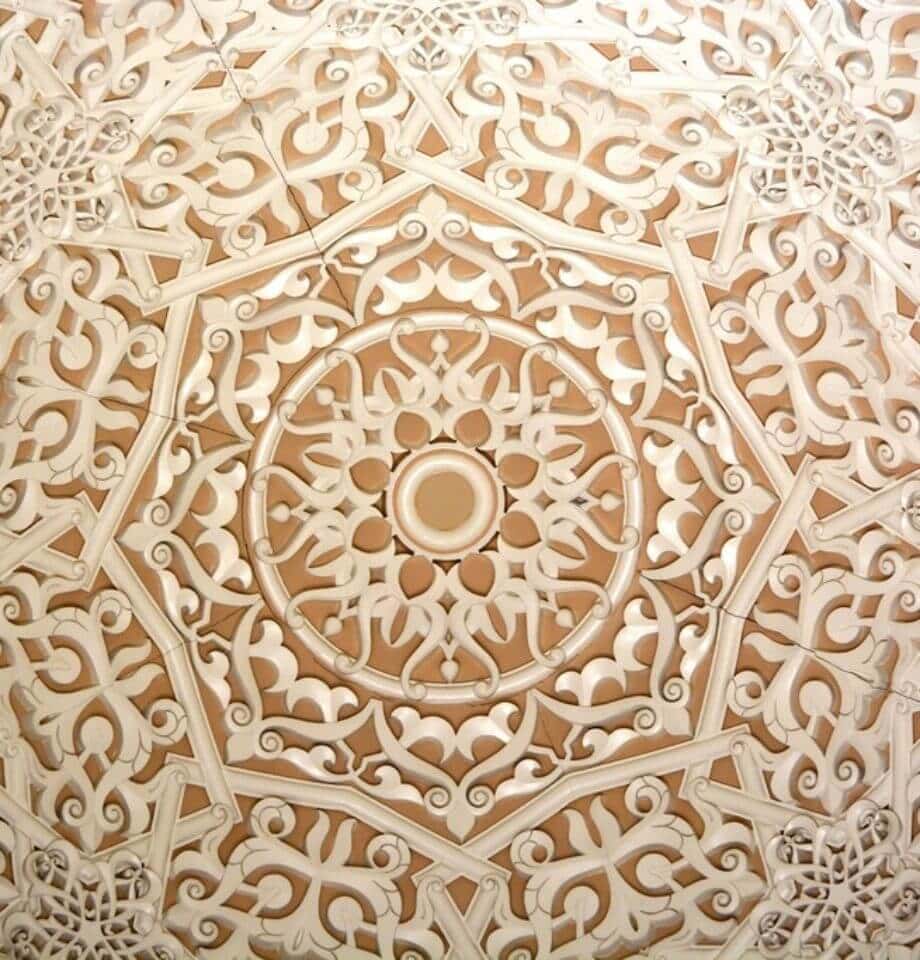

Islamic Finance

Jersey’s funds sector is a leader in Shariah-compliant asset management. The jurisdiction is a preferred domicile for developed asset classes, such as real estate, private equity, commodity, and equity, for Shariah-compliant fund mandates.

Discover MoreThe Future of Funds

Through a combination of investor appetite, regulatory demands and government pressure to steer capital towards a sustainable future, environmental, social and governance (ESG) criteria are expected to play an increasing role in driving decisions such as asset allocation and fund domiciliation. ESG factors are also influencing the way funds finance themselves, with greater recourse to sustainability linked lending (SSL).

Along with a widening variety of funds managed in accordance global ESG frameworks such as the Principle for Responsible Investment, tackling issues ranging from urban regeneration to infrastructure development, we’ve also seen the emergence of a number of large Jersey-based alternative fund structures that have been deploying much-needed capital into specific projects that support the transition away from fossil fuels The common theme is that these funds not only have the usual financial return targets but also aim to consider their impact on the world.

Jersey is ideally placed to support managers marketing on a cross-border basis in complying with emerging sustainability requirements, including the EU Sustainable Finance Disclosure Regulation (SFDR).

With a set of pragmatic and workable anti-greenwashing rules, the Jersey Financial Services Commission has laid the right foundations for Jersey’s fund industry to support the scaling up of sustainable investing.

Discover moreSustainability and Funds Resources

Video

5 October 2021

Funds Videos

Careers in Funds

If you are interested in a career in banking, here are some resources you may find useful:

We’ve made it simple to understand what a fund is, how funds work and why investors would choose to use a fund to invest their money. In it, we explain how funds bring together multiple investors who invest their money together, and why Jersey specialises in ‘alternative investment’ funds compared to more conventional funds that invest in stocks and shares, and cash.

The financial services industry in Jersey has an excellent reputation internationally and is a leading player in private wealth, funds, banking and capital markets. Jersey’s highly-skilled workforce, world-class products and services, and high regulation standards make it one of the most respected financial services centres in the world.

Some career opportunities may include but are not limited to: Financial Analysts, Trader, Portfolio Manager, Fund Manager, Fund Services Manager, Fund Administrator.